Market liquidity decreased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 841 million shares, equivalent to a value of more than 27.4 trillion VND; the HNX-Index reached over 80.1 million shares, equivalent to a value of more than 1.8 trillion VND.

The VN-Index opened the afternoon session with continued selling pressure, despite buyers re-emerging, but the index couldn’t reclaim the reference level by the end of the session. In terms of impact, VCB, GAS, BID, and GVR were the most negatively influential stocks on the VN-Index, contributing to a 9.7-point decline. Conversely, VIC, VHM, VJC, and TCX maintained their gains, helping the index retain 12.4 points.

| Top 10 stocks most impacting the VN-Index on January 23, 2026 (measured in points) |

Similarly, the HNX-Index showed a rather pessimistic trend, with negative impacts from stocks like KSF (-5.86%), PVI (-3.54%), PVS (-4.38%), and IDC (-2.95%).

| Top 10 stocks most impacting the HNX-Index on January 23, 2026 (measured in points) |

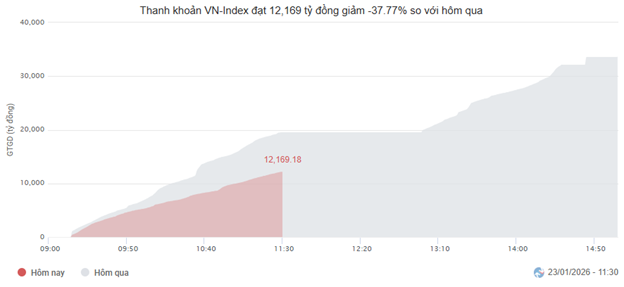

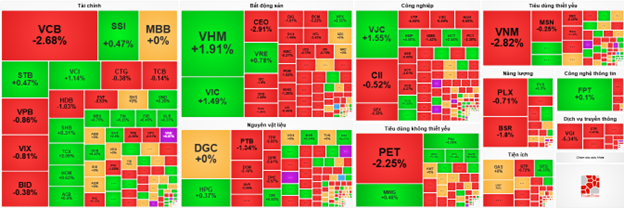

At the close, the market declined with red dominating most sectors. The communication services sector saw the sharpest decline at 9.94%, primarily driven by stocks such as VGI (-11.59%), CTR (-3.03%), FOX (-4.72%), MFS (-4.88%), and YEG (-3.47%). The energy and information technology sectors followed with declines of 5.17% and 2.5%, respectively. Notable selling pressure was observed in stocks like BSR (-6.98%), PLX (-3.36%), PVS (-3.73%), PVC (-7.53%), PVD (-5.15%), FPT (-2.42%), DLG (-6.76%), ELC (-0.79%), and CMG (-3.1%).

Conversely, the real estate sector recorded a strong gain of 0.87%, primarily driven by VHM (+1.66%), VIC (+2.67%), VRE (+1.73%), and HPX (+1.17%).

In terms of foreign trading, foreign investors continued to net sell over 207 billion VND on the HOSE, focusing on stocks like VCB (350.13 billion), VHM (169.26 billion), CTG (125.34 billion), and VPB (88.41 billion). On the HNX, foreign investors net bought over 6 billion VND, concentrating on IDC (79.7 billion), PVS (26.12 billion), VFS (1.7 billion), and VGS (1.06 billion).

| Foreign net buying and selling trends |

Morning Session: Fluctuations Around 1,880 Points

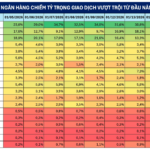

The market continued to fluctuate within a narrow range around the 1,880-point mark by the end of the morning session. At the midday break, the VN-Index decreased by 3.8 points (-0.2%), closing at 1,878.93 points; the HNX-Index fell by 0.78%, reaching 256.41 points. Market breadth favored sellers, with 406 stocks declining, 284 advancing, and 893 unchanged.

Market liquidity remained quite subdued this morning. The trading volume on the HOSE only reached over 363 million units, equivalent to a value of more than 12 trillion VND, down 37.77% from the previous session. The HNX recorded a volume of 42 million units, equivalent to over 854 billion VND, a decrease of 38.43% compared to the previous session.

Source: VietstockFinance

|

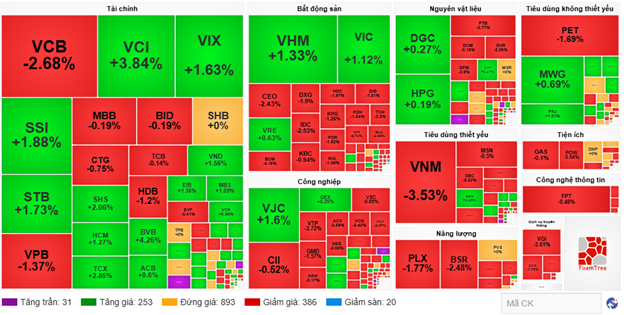

Among the top 10 stocks influencing the VN-Index, VIC had the most positive impact, contributing 3 points to the index. VHM and TCX also added over 2 points collectively. Conversely, VCB was the most negatively influential stock, subtracting 3.33 points from the index.

| Top 10 stocks most impacting the VN-Index in the morning session of January 23, 2026 (measured in points) |

Divergence continued to dominate, with most sectors fluctuating within a narrow range. The communication services sector temporarily lagged, declining sharply by 3.68%, primarily due to deep adjustments in stocks like VGI (-3.81%), FOX (-4.3%), CTR (-1.72%), YEG (-1.54%), FOC (-2.56%), TTN (-2.25%), and VTK (-5.3%).

Large-cap sectors such as industrials and financials exerted significant pressure on the index, with many stocks adjusting sharply, including ACV (-3.59%), MVN (-2.68%), VEA (-1.87%), HVN (-1.41%), GMD (-1.57%), PHP (-4.65%), and VTP (-3.72%); VCB (-2.68%), HDB (-1.2%), VPB (-1.37%), and BVH (-4.21%). However, there were still some standout performers attracting good demand, such as PVX hitting its ceiling, VJC (+1.6%), VGC (+2.1%), CTD (+1.33%); VCI (+3.84%), VIX (+1.63%), SSI (+1.88%), STB (+1.73%), SHS (+2.06%), and HCM (+1.27%).

Conversely, non-essential consumer goods and real estate maintained their upward momentum, but only due to the leadership of top-tier stocks like VPL (+1.09%), MWG (+0.69%), PNJ (+1.81%), HUT (+1.89%), and DWG (+1.67%); VIC (+1.12%), VHM (+1.33%), and VRE (+0.63%). The remainder of the stocks either remained at the reference price or adjusted deeply into the red.

Source: VietstockFinance

|

Foreign investors continued to net sell with a value of 740.03 billion VND across all three exchanges. Selling pressure was concentrated in VHM and VCB, with values of 169.57 billion and 149.51 billion, respectively. Meanwhile, STB led the net buying list with a value of only 42.84 billion VND.

| Top 10 stocks with the strongest foreign net buying and selling in the morning session of January 23, 2026 |

10:40 AM: Selling Pressure Increases, Vingroup Stocks Support the Index

Investor hesitation caused the main indices to fluctuate narrowly around the reference level. As of 10:35 AM, the VN-Index reversed, dropping slightly by 1.51 points to trade around 1,881.22 points. The HNX-Index decreased by 2.58 points, trading around 255.85 points.

The breadth of stocks in the VN30 basket showed a fairly balanced mix of green and red. On the selling side, VNM subtracted 2.65 points, VCB subtracted 0.84 points, VPB subtracted 0.5 points, and MBB subtracted 0.28 points from the index. Conversely, VIC, VHM, VJC, and LPB maintained strong gains, contributing over 7.9 points to the VN30-Index.

Source: VietstockFinance

|

The communication services sector continued to decline sharply, with most stocks in the red. Notably, VGI fell by 5.03%, CTR by 1.41%, FOX by 5.14%, and YEG by 0.77%.

The energy sector showed strong divergence, with red dominating in leading stocks such as BSR (-2.03%), PLX (-1.77%), PVD (-1.55%), PVC (-2.04%), and OIL (-3.87%).

In contrast, the real estate sector maintained its growth momentum, helping the index retain its gains. Buying pressure concentrated on large-cap stocks like VHM (+1.74%), VIC (+1.49%), and VRE (+0.63%). Meanwhile, most other stocks remained in a rather pessimistic red, including CEO, TIG, IDC, DXG, and HDC.

Compared to the opening, sellers gradually gained the upper hand, although the number of unchanged stocks still dominated (over 930). There were 241 advancing stocks (33 hitting ceilings) and 348 declining stocks (22 hitting floors).

Source: VietstockFinance

|

Market Open: Cautious Sentiment Prevails

After the previous session’s decline, the VN-Index opened with a surge of over 10 points, but low liquidity indicated prevailing cautious sentiment. However, there were positive contributions from a few sectors, including real estate, non-essential consumer goods, and healthcare.

Leading the recovery was the real estate sector, which experienced strong divergence, with green concentrated in large-cap stocks like VHM (+5.81%), VIC (+3.48%), and VRE (+3.14%).

Next was the non-essential consumer goods sector, with stocks like MWG, VPL, CSM, DRC, and TTF showing positive momentum.

In contrast, the communication services sector opened weakly and was the worst performer in the early session, with stocks like VGI, CTR, and FOX declining.

– 15:30, January 23, 2026

Vietstock Weekly 26-30/01/2026: Will the Tug-of-War Continue?

The VN-Index retraced after a five-week winning streak, yet its medium-term uptrend remains intact. The index’s proximity to the Bollinger Bands’ Upper Band and the MACD’s sustained upward trajectory post-buy signal reinforce this outlook. However, short-term volatility is likely to persist as the Stochastic Oscillator hovers in overbought territory.

Afternoon Technical Analysis 21/01: Short-Term Adjustment

The VN-Index experienced volatility, forming a candlestick with a long upper shadow, indicating significant short-term selling pressure. Meanwhile, the HNX-Index is undergoing a correction as the Stochastic Oscillator signals a return to selling momentum.

Stock Market Week 12-16/01/2026: Capital Rotation in Focus

The VN-Index rebounded in the final session of the week, capping off a volatile trading period marked by intense tug-of-war dynamics. Despite facing corrective pressures at elevated price levels, market breadth remained relatively balanced, supported by agile capital rotation across various stock groups. Moving forward, the VN-Index is likely to require additional time to absorb supply pressures and establish a new price equilibrium in the upcoming week.