Market liquidity increased compared to the previous session, with the order-matching trading volume of the VN-Index reaching over 998 million shares, equivalent to a value of more than 29.3 trillion VND; the HNX-Index reached over 90.4 million shares, equivalent to a value of more than 1.9 trillion VND.

The VN-Index opened the afternoon session with continued strong selling pressure and a lack of buyers, causing the index to plummet and close in pessimistic red. In terms of impact, VIC, VHM, MBB, and VJC were the most negatively influential stocks on the VN-Index, contributing to a 14.9-point decline. Conversely, GAS, BID, VCB, and GVR maintained their green status, helping the index retain over 10 points.

| Top 10 Stocks Impacting VN-Index on January 26, 2025 (in points) |

Similarly, the HNX-Index showed a rather pessimistic trend, with negative impacts from stocks like KSF (-3.56%), PVI (-4.33%), CEO (-6.19%), and HUT (-3.8%)…

| Top 10 Stocks Impacting HNX-Index on January 26, 2026 (in points) |

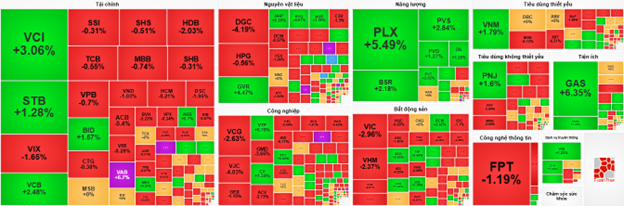

At the close, the market saw a significant decline with red dominating most sectors. The industrial sector experienced the sharpest drop at 4.37%, primarily due to stocks like VCG (-6.8%), VSC (-6.86%), GEX (-6.38%), ACV (-8.87%), and VJC (-5.99%). The real estate and information technology sectors followed with declines of 3.15% and 2.48%, respectively. Notable selling pressures were observed in stocks such as KBC (-6.89%), VHM (-2.94%), VIC (-3.33%), CEO (-6.19%), DXG (-4.25%), FPT (-2.48%), DLG (-4.83%), ELC (-2.4%), and CMG (-2.92%).

Conversely, the utility sector recorded a strong increase of 2.71%, primarily driven by GAS (+6.94%), POW (+0.72%), PVG (+4.48%), and BSA (+0.44%).

In terms of foreign trading, foreign investors turned net buyers with over 109 billion VND on the HOSE, focusing on stocks like BID (218.44 billion), VNM (185.87 billion), VCI (148.26 billion), and PLX (142.62 billion). On the HNX, foreign investors net bought over 61 billion VND, concentrating on IDC (76.07 billion), PVS (14.1 billion), MBS (3.84 billion), and TNG (3.83 billion).

| Foreign Net Buying and Selling Trends |

Morning Session: Red Continues to Spread

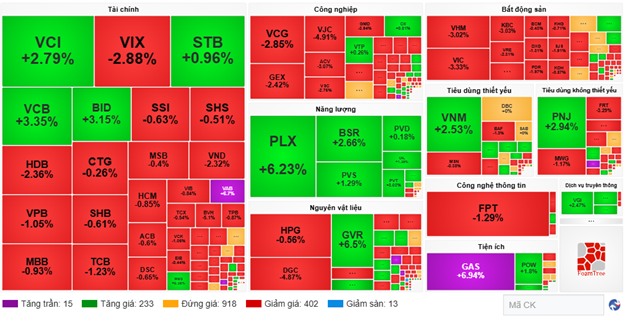

No significant recovery efforts were seen by the end of the morning session. At the midday break, the VN-Index fell by over 7 points (-0.41%), to 1,863.12 points; the HNX-Index dropped to 250.02 points, a sharp decline of 1.16%. Market breadth increasingly favored sellers with 415 declining stocks, 248 advancing stocks, and 918 unchanged stocks.

Among the top 10 stocks influencing the VN-Index, the duo VIC and VHM had the most negative impact, reducing the index by 12 points. Conversely, VCB, GAS, BID, and GVR were the bright spots, contributing a combined increase of nearly 13 points.

| Top 10 Stocks Impacting VN-Index in the Morning Session of January 26, 2025 (in points) |

In terms of sectors, real estate temporarily led the decline with a 2.74% drop as most stocks in the sector faced strong adjustment pressures, notably VIC (-3.33%), VHM (-3.02%), VRE (-2.31%), KSF (-5.04%), KBC (-3.03%), PDR (-1.97%), VPI (-1.83%), and SJS (-1.91%).

Following were the industrial and information technology sectors, both declining over 1% due to negative performances from stocks like ACV (-3.07%), VJC (-4.91%), HVN (-2.17%), GEE (-2.96%), VEA (-2.47%), GEX (-2.42%), GMD (-3.94%); FPT (-1.29%), CMG (-1.11%), ELC (-2%), and VEC (-3.03%).

Conversely, the energy and utility sectors led the market with a positive increase of 3.14%, driven by stocks attracting good demand such as BSR (+2.66%), PLX (+6.23%), PVS (+1.29%), OIL (+1.38%), PVT (+3.02%), PVC (+4.44%); POW (+1.8%), and GAS reaching its upper limit.

Source: VietstockFinance

|

Foreign investors continued to sell with a net value of 88.63 billion VND across all three exchanges. Selling pressure concentrated on two stocks: FPT and VHM, with values of 64.53 billion and 59.56 billion, respectively. Meanwhile, GAS led the net buying with a value of 127.6 billion VND.

| Top 10 Stocks with Strong Foreign Net Buying and Selling in the Morning Session of January 26, 2025 |

10:40 AM: Selling Pressure Continues to Increase

Pessimism continued to dominate large-cap stocks, causing major indices to decline. As of 10:30 AM, the VN-Index reversed and fell by over 8 points, trading around 1,864 points. The HNX-Index fell by 2.7 points, trading around 250 points.

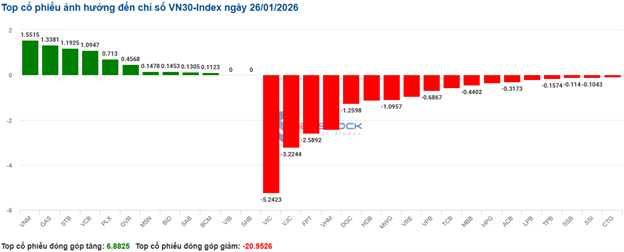

Stocks in the VN30 basket faced overwhelming selling pressure, reducing the overall index by over 20 points. Notable decliners included VIC, VJC, FPT, and VHM, with respective impacts of 5.24 points, 3.22 points, 2.58 points, and 2.42 points. Following were stocks like DGC, HDB, MWG, and VRE, which also recorded significant declines.

Source: VietstockFinance

|

Red continued to dominate the real estate sector, causing most stocks in the industry to decline. Specifically, strong selling pressure was observed in VIC (-3.39%), VHM (-2.61%), and VRE (-2.31%). Additionally, red was also present in stocks like KBC (-1.65%), PDR (-1.4%), IDC (-1.1%), and SIP (-0.34%)…

Next, industrial sector stocks were in a state of strong polarization, with selling pressure slightly dominating in stocks like VCG (-2.19%), VJC (-4.03%), GEX (-1.28%), and GMD (-3.5%). In contrast, green appeared only in stocks like VTP, CII, PC1, and PAC, but the increases were insignificant.

Furthermore, the financial sector gradually recorded widespread selling pressure, with red dominating most stocks like SSI, MBB, SHB, TCB, and VPB, all with slight declines of under 1%. Only a few stocks like STB (+0.96%), VCB (+2.48%), BID (+1.57%), and VCI (+3.06%) remained in the green.

Compared to the opening, the market continued to polarize strongly with over 990 reference stocks, and sellers maintained a stronger position with 330 declining stocks and 232 advancing stocks.

Source: VietstockFinance

|

Opening: Continued Tug-of-War in Early Trading

At the start of the session on January 26, as of 9:30 AM, the VN-Index rose slightly by over 1 point, reaching 1,871 points. The HNX-Index also rose slightly and traded around 253 points.

Green and red alternated across sectors, with some leading energy stocks rising positively from the opening, such as PLX (+3.85%), BSR (+1.21%), PVS (+1.29%), and PVD (+1.63%).

Utility stocks continued to grow steadily in the market, with most maintaining green. Notable gainers included GAS (+4.66%), POW (+1.08%), QTP (+1.59%), and REE (+0.32%)…

Large-cap stocks like VCB, GAS, GVR, and BSR led the upward trend, contributing a combined increase of over 4.7 points. Conversely, VIC, VJC, HDB, and BVH weighed on the market, with a combined decrease of over 3.7 points.

– 15:25 26/01/2026

Market Pulse 19/01: Foreign Investors Return to Net Buying in Large Caps, VN-Index Continues Its Rally

At the close of trading, the VN-Index climbed 17.46 points (+0.93%) to reach 1,896.59, while the HNX-Index rose 2.67 points (+1.06%) to 254.95. Market breadth was relatively balanced, with 344 gainers and 355 decliners. Within the VN30 basket, bullish sentiment prevailed, as 18 stocks advanced, 9 retreated, and 3 remained unchanged.

Vietstock Daily 27/01/2026: Widespread Selling Pressure Intensifies

The VN-Index plunged dramatically, forming a long red candle accompanied by trading volume surpassing the 20-day average, reflecting investors’ subdued sentiment. The index is currently retesting the Middle Band of the Bollinger Bands, while both the Stochastic Oscillator and MACD indicators continue their sharp decline following earlier sell signals.

Market Pulse 20/01: Sellers Dominate, VN-Index Fails to Reclaim 1,900 Mark

Despite a robust surge of nearly 18 points during the afternoon session, the stock market failed to sustain its positive momentum. By the close, the VN-Index dipped nearly 3 points below the reference level, settling at 1,893.78. Meanwhile, the HNX-Index experienced a steeper decline of 0.7%, ending at 253.1 points.