|

Source: VietstockFinance

|

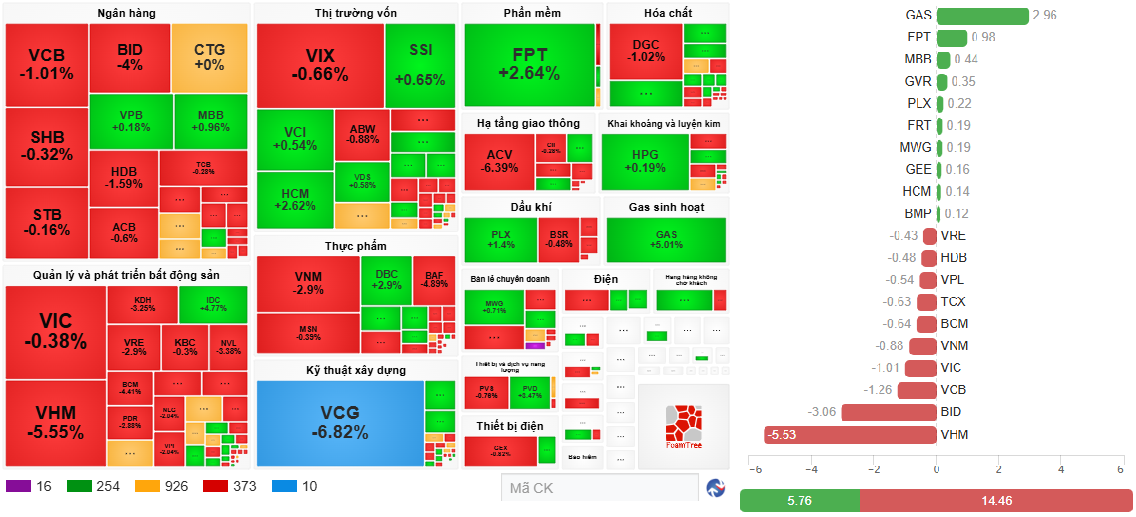

Overall, buying pressure remained dominant today, with 380 stocks rising and nearly 340 falling. The main pressure came from the sharp decline of many large-cap stocks. VHM hit the floor, while VIC dropped by 5.6%. VCG also plummeted to the floor. ACV fell by 6.6%. Additionally, some bank stocks like TCB and EIB saw declines. The top 10 stocks dragging the market down accounted for nearly 25 points.

Today’s market savior was the energy sector. The green and purple hues from this group significantly boosted the overall market. PLX, PVD, and GAS hit their ceiling prices. Other stocks like BSR, PVS, and PVC also rose by over 3%. This upward momentum helped cushion the VN-Index from falling too deeply.

The media services sector also saw widespread gains, with VGI, CTR, FOX, and YEG leading the charge.

Today, the healthcare equipment and services sector surged, with JVC and DNM hitting their ceilings. This movement may be linked to concerns over the Nipah virus outbreak in India, prompting investors to seek opportunities.

Insurance stocks continued their positive streak, with three consecutive months of price increases. Today, BVH, PVI, BIC, VNR, MIG, and BMI all saw solid gains.

In other sectors, performance was mixed. Financial, real estate, and essential consumer stocks saw a blend of gains and losses.

Total market trading value dipped slightly today, reaching nearly 28 trillion VND. Foreign investors net sold lightly, at nearly 300 billion VND. Recently, their net selling has eased, with intermittent net buying sessions.

| Top 10 Foreign-Traded Stocks on 27/01/2026 |

Morning Session: Banks and Real Estate Shine Red, VCG and ACV Continue to Plummet

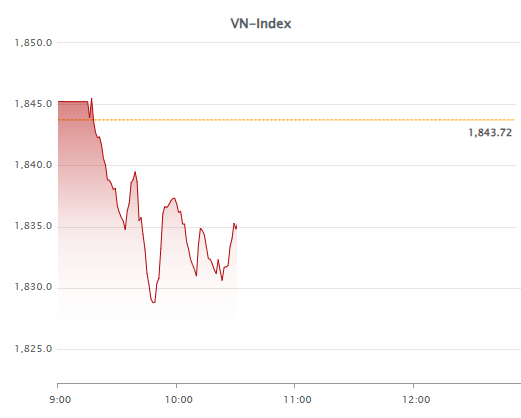

By the end of the morning session, the VN-Index closed in the red, down 11.92 points to 1,831.8, amid significant pressure. Meanwhile, the HNX-Index rose 1.14 points to 248.44, and the UPCoM-Index gained 0.39 points to 126.95.

Source: VietstockFinance

|

The VN-Index’s loss of 0.65% outpaced the VN30-Index’s 0.22% decline, indicating stronger resistance among large-cap stocks.

Many securities firms view the recent VN-Index correction as expected. The critical support level is at 1,800, and investors are advised to remain cautious.

This morning, 383 stocks fell, including 10 that hit the floor. Notably, ACV dropped 6.4%, and VCG hit the floor with a surge in trading volume to nearly 37 million shares and a remaining sell order of 212,000 shares. Both companies are set for inspections by the Government Inspectorate in 2026.

Despite their sharp declines, the stocks taking the most points from the VN-Index were VHM (5.53 points, down 5.55%), followed by BID, VCB, and VIC (3.06, 1.26, and 1.01 points, respectively). These names highlight the struggles in the banking and real estate sectors.

In banking, BID fell 4%, VCB dropped 1.01%, and others like HDB, ACB, and MSB also declined. Only a few, like CTG, VPB, and MBB, saw positive results.

In real estate, the Vingroup trio led the decline, along with KDH, NVL, BCM, PDR, and NLG.

Other notable decliners included DGC and VNM.

On the upside, 270 stocks rose (16 hit their ceilings), including FPT (up 2.64%), GAS (up 5.01%), and several brokerage stocks like HCM, SSI, VCI, and VDS.

|

Market Map at the End of the Morning Session, 27/01

Source: VietstockFinance

|

Total morning trading value exceeded 12 trillion VND, a notable decline from recent sessions. Foreign investors traded cautiously, buying 1.4 trillion VND and selling nearly 2.3 trillion VND, resulting in a net sell of 850 billion VND.

VIC, VHM, VCB, and ACV were the top net-sold stocks, while FPT was the only stock net-bought in the hundreds of billions.

10:30 AM: Continuous Tug-of-War

After a challenging start and a dip to 1,828 points, the VN-Index attempted a recovery but couldn’t sustain it.

Each rebound was met with strong resistance, leaving the VN-Index at 1,834.84 by 10:30 AM, down 8.88 points. Meanwhile, the HNX-Index and UPCoM-Index remained in the green, up 1.07 and 0.57 points, respectively.

Source: VietstockFinance

|

The market landscape mirrored the morning session, with red dominating large-cap sectors like banking and real estate. Stocks like ACV, DGC, and VCG continued to underperform, with VCG hitting the floor.

A bright spot was the brokerage sector, gradually turning green. Notable gainers included SSI (up 0.65%), VDS (up 0.58%), HCM (up 1.75%), and VCI (up 0.68%). FPT (up 2.34%) and GAS (up 5.47%) also supported the index.

Among the top 10 positive contributors to the VN-Index, GAS led with 3.02 points, followed by FPT with 0.87 points. Other notables included MBB, CTG, GEE, and HPG.

Despite these gains, the market remained under pressure, down nearly 9 points. The top decliners were VHM (minus 4.01 points), VCB and BID (1.78 points each), and VNM (0.83 points).

Foreign investors continued to net sell, exceeding 500 billion VND, focusing on ACV and VCB with net sells of around 85 billion VND each.

Early Pressure

The morning session opened with the VN-Index quickly adjusting under pressure from large-cap sectors like banking, real estate, and brokerage. Attention also focused on ACV, DGC, and VCG, which continued their negative trends.

|

Market Map at 9:30 AM

Source: VietstockFinance

|

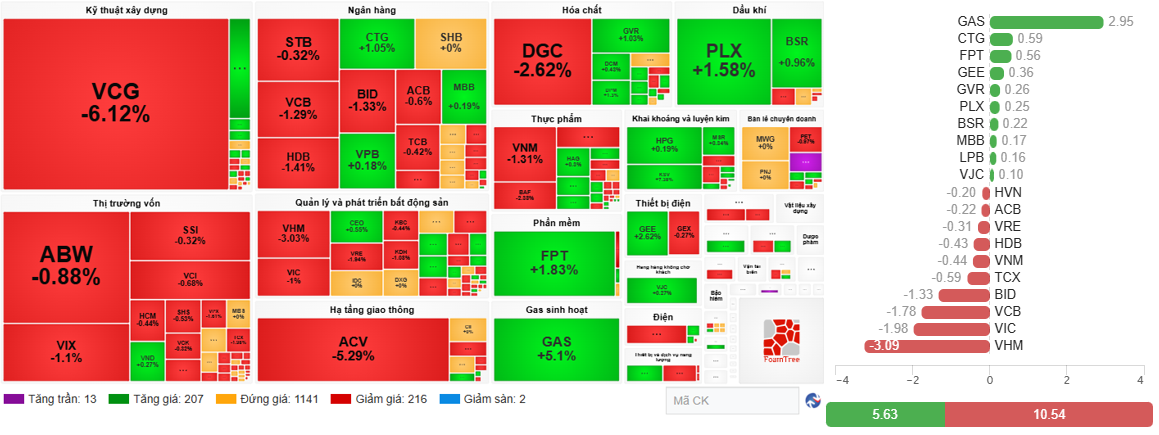

By 9:30 AM, the VN-Index had fallen 5.33 points to 1,838.39, with trading volume exceeding 2.2 trillion VND. Large-cap sectors like banking, brokerage, and real estate were bathed in red.

In banking, state-owned banks VCB (down 1.29%) and BID (down 1.33%) led the decline, affecting others. The real estate sector drew significant attention, with VHM (down 3.03%), VIC (down 1%), and VRE (down 1.94%). These names, along with VCB and BID, were the main drags on the market.

Other notable decliners included VCG (down 6.12%), DGC (down 2.62%), and ACV (down 5.29%), continuing their recent negative trends. ACV was also the most net-sold stock by foreign investors, with over 71 billion VND.

Amid this, energy giants like GAS (up 5.1%), PLX (up 1.58%), and BSR (up nearly 1%) provided support. FPT (up 1.83%), GVR (up 1.03%), and GEE (up 2.62%) also helped the VN-Index recover some points.

– 15:53 27/01/2026

Market Pulse 20/01: Sellers Dominate, VN-Index Fails to Reclaim 1,900 Mark

Despite a robust surge of nearly 18 points during the afternoon session, the stock market failed to sustain its positive momentum. By the close, the VN-Index dipped nearly 3 points below the reference level, settling at 1,893.78. Meanwhile, the HNX-Index experienced a steeper decline of 0.7%, ending at 253.1 points.

Market Pulse 30/01: VN-Index Extends Recovery, Energy and Non-Essential Consumer Sectors Shine

At the close of trading, the VN-Index climbed 14.06 points (+0.77%) to reach 1,829.04, while the HNX-Index rose 3.41 points (+1.35%) to 256.13. Market breadth favored the bulls, with 476 gainers outpacing 292 decliners. The VN30 mirrored this trend, boasting 19 advancers, 9 decliners, and 2 unchanged stocks.

Stock Market Week 26-30/01/2026: Restoring Balance

The VN-Index extended its recovery in the final trading session of the week, partially offsetting the sharp declines seen earlier. However, market sentiment remains cautious as liquidity continues to linger below the 20-session average. It’s likely the market will require additional accumulation time to absorb selling pressure before establishing a clearer trend in the coming period.