Market liquidity increased compared to the previous session, with the order-matching volume of the VN-Index reaching over 863 million shares, equivalent to a value of more than 29 trillion VND; the HNX-Index reached over 101 million shares, equivalent to a value of more than 2.7 trillion VND.

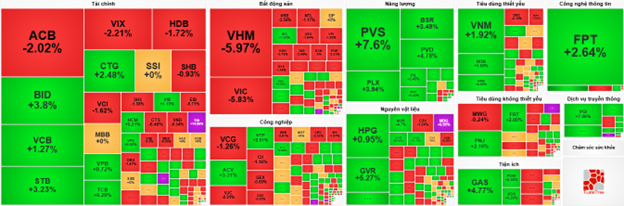

The VN-Index opened the afternoon session with the return of buyers, but selling pressure continued to rise, preventing the index from narrowing its decline and closing in pessimistic red. In terms of impact, VIC, VHM, VCB, and GVR were the most negatively influential stocks on the VN-Index, contributing to a 24.9-point decrease. Conversely, GAS, MSN, FPT, and STB maintained their green status, helping the index retain more than 3.8 points.

| Top 10 Stocks Most Impacting the VN-Index on January 28, 2026 (in points) |

Similarly, the HNX-Index showed a rather pessimistic trend, with negative impacts from stocks like KSF (-1.96%), NVB (-1.56%), SHS (-1.58%), and PVI (-1.11%).

| Top 10 Stocks Most Impacting the HNX-Index on January 28, 2026 (in points) |

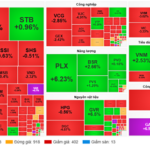

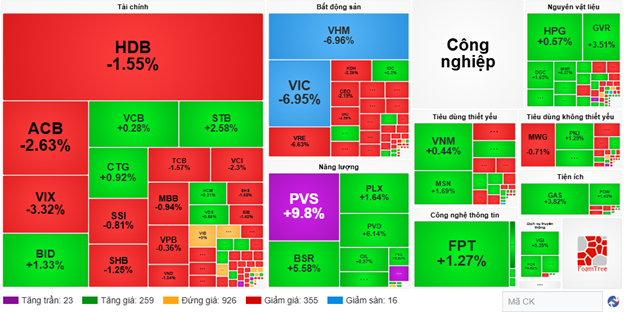

At the close, the market index declined despite green dominating most sectors. The real estate sector saw the sharpest decline at 4.83%, primarily due to stocks like VHM (-5.7%), VIC (-6.95%), VRE (-5.83%), DXS (-2.29%), and BCM (-1.64%). Following were the communication services and finance sectors, with declines of 0.87% and 0.62%, respectively. Notable stocks under selling pressure in these sectors included VGI (-1.68%), CTR (-0.31%), YEG (-0.81%), HDB (-1.72%), VIX (-2.43%), ACB (-3.24%), VCB (-1.42%), BID (-1.33%), and TPB (-1.74%).

Conversely, the information technology sector recorded the strongest increase at 2.11%, primarily driven by FPT (+2.35%), ELC (+1.66%), DLG (+4.48%), and CMG (+0.85%).

In terms of foreign trading, foreign investors continued to net sell over 1.787 trillion VND on the HOSE, concentrated in stocks like VCB (404.52 billion), VIC (371.64 billion), VNM (240.04 billion), and ACB (207.26 billion). On the HNX, foreign investors net bought over 20 billion VND, focusing on PVS (61.5 billion), PVB (6.09 billion), TNG (1.83 billion), and VFS (0.51 billion).

| Foreign Net Buying and Selling Trends |

Morning Session: Unstoppable Decline, VN-Index Approaching 1,800 Points

Increasing adjustment pressure from Vingroup stocks is challenging the index. By the mid-session break, the VN-Index fell nearly 25 points (-1.35%), to 1,805.73 points, while the HNX-Index hovered near the reference level at 252.87 points. Market breadth favored sellers, with 371 declining stocks and 282 advancing stocks.

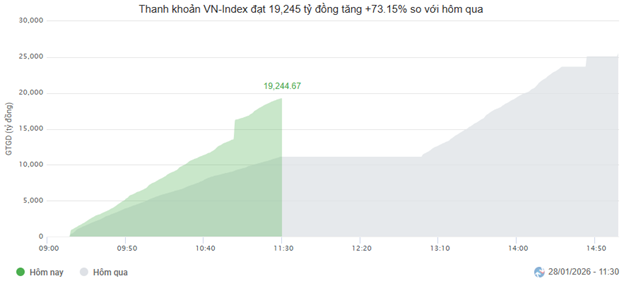

Market liquidity surged this morning. HOSE trading value exceeded 19 trillion VND, up 73.15% from the same period in the previous session. Similarly, HNX recorded a volume of over 49 million units, equivalent to nearly 1.4 trillion VND, up 141.78% from the previous session.

Source: VietstockFinance

|

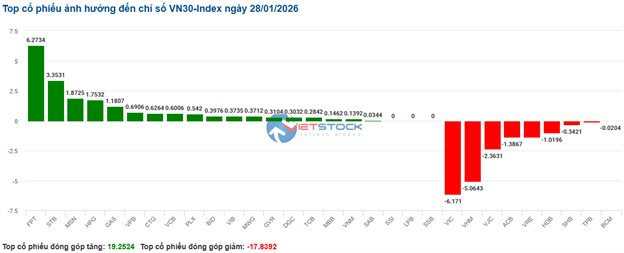

In terms of impact, the top 10 negatively influencing stocks took away over 30 points from the VN-Index. The Vingroup duo, VIC and VHM, exerted pressure of nearly 23 points. Conversely, GAS, BSR, GVR, and BID were the most positively influential, contributing a total of 6.12 points to the index.

| Top 10 Stocks Most Impacting the VN-Index in the Morning Session of January 28, 2026 (in points) |

Divergence continued to dominate. The real estate sector recorded the most negative performance this morning, declining 5.41%. Besides deep adjustment pressure from the Vingroup trio, numerous stocks also saw significant declines, including BCM (-2.09%), KDH (-2.25%), DXG (-2.33%), NLG (-1.45%), TCH (-3.08%), PDR (-3.18%), and DIG (-2.56%).

The finance and industrial sectors also exerted considerable pressure, with many stocks declining over 1%, such as TCB, HDB, ACB, SHB, VCK, EIB, VIX, VCI; VJC, GEX, GEE, VEF, VCG, HAH, TOS, and BMP. However, buying interest remained in some stocks like BID (+1.33%), CTG (+0.92%), STB (+2.58%), VPX (+1.47%); ACV (+3.12%), HVN (+1.75%), VGC (+2.22%), and SGP (+1.52%).

Conversely, communication services and energy emerged as temporary market leaders with impressive gains of 4.82% and 4.59%, respectively, driven by VGI (+5.29%), FOX (+4.62%); BSR (+5.58%), PLX (+1.64%), PVD (+6.14%), OIL (+8.97%), PVT (+3.65%), PVC (+5.63%), and PVB along with COM hitting their upper limits.

Source: VietstockFinance

|

Foreign investors continued to net sell over 1.3 trillion VND across all three exchanges. Selling pressure was concentrated in VCB and VNM, with values of 213.75 billion and 190.71 billion, respectively. Meanwhile, FPT led the net buying list with a value of 175.88 billion VND, far ahead of other stocks.

| Top 10 Stocks with Strongest Foreign Net Buying and Selling in the Morning Session of January 28, 2026 |

10:30 AM: Hovering Around the Reference Level, Money Flows Out of Vingroup Stocks

Balanced buying and selling kept the main indices from breaking out. As of 10:30 AM, the VN-Index fell slightly by 4.61 points, trading around 1,826.26 points. The HNX-Index decreased by 1.04 points, trading around 251.8 points.

Stocks in the VN30 basket showed a predominance of green, with only a few still under selling pressure. Specifically, FPT, STB, MSN, and HPG contributed 6.27 points, 3.35 points, 1.87 points, and 1.75 points, respectively, to the index. Conversely, VIC, VHM, VJC, and ACB faced selling pressure, taking away over 14.9 points from the VN30-Index.

Source: VietstockFinance

|

The real estate sector faced strong selling pressure, with major players like VHM down 5.79%, VIC down 5.23%, and VRE down 3.4%.

Conversely, the energy sector showed strong momentum, supporting the overall market with contributions from four major oil and gas companies: PVS up 6.86%, PVD up 4.78%, PlX up 4.11%, and BSR up 3.72%.

Additionally, communication services stocks maintained impressive gains from the start of the session. Notable performers included VGI up 7.06%, FOX up 5.93%, and CTR up 1.03%.

Compared to the opening, buyers and sellers engaged in a fierce tug-of-war, with over 1,000 stocks unchanged. Buyers gained the upper hand, with 284 advancing stocks (18 hitting their upper limits) and 266 declining stocks (7 hitting their lower limits).

Source: VietstockFinance

|

Opening: Vingroup Stocks Pressure the Index, Large ACB Agreement Transaction

At the start of the session on October 16, as of 9:30 AM, market breadth showed green dominance, indicating investor optimism. The VN-Index stood at 18.42 points, and the HNX-Index traded around 253 points. However, the VN-Index shifted from a strong gain to a decline of over 6 points, trading around 1,823 points, with selling pressure concentrated in large-cap stocks like VHM, VIC, and VRE.

The energy sector was among the top performers in the opening session, with buying interest across leading stocks like BSR up 1.63%, PLX up 5.09%, PVD up 2.73%, and PVS up 1.96%…

Communication services saw the strongest gains, driven by VGI up 5.37%, CTR up 2.37%, and FOX up 6.7%…

Besides these sectors, many Large Caps also showed positive movements. GAS, BID, and VIC significantly supported the index’s rise.

Notably, in the finance sector, ACB recorded a large agreement transaction among foreign investors, totaling over 426 billion VND.

– 15:25 28/01/2026

Technical Analysis for the Afternoon Session of January 30: Continued Recovery

Despite low trading volumes, the VN-Index continues its modest recovery and may retest the middle band of the Bollinger Bands in upcoming sessions. Meanwhile, the HNX-Index successfully tested its January 2026 low (around 244-250 points) and has shown a strong rebound.

Market Pulse 26/01: Foreign Investors Return to Net Buying, VN-Index Drops Over 27 Points

At the close of trading, the VN-Index fell by 27.07 points (-1.45%), settling at 1,843.72, while the HNX-Index dropped 5.66 points (-2.24%), closing at 247.3. Market breadth was overwhelmingly negative, with 548 decliners outpacing 188 advancers. Similarly, the VN30 basket saw red dominate, as 24 constituents declined and only 6 advanced.

Market Pulse 19/01: Foreign Investors Return to Net Buying in Large Caps, VN-Index Continues Its Rally

At the close of trading, the VN-Index climbed 17.46 points (+0.93%) to reach 1,896.59, while the HNX-Index rose 2.67 points (+1.06%) to 254.95. Market breadth was relatively balanced, with 344 gainers and 355 decliners. Within the VN30 basket, bullish sentiment prevailed, as 18 stocks advanced, 9 retreated, and 3 remained unchanged.