Masan Group’s stocks (HOSE: MSN) and Masan High-Tech Materials (UPCoM: MSR) surged at the opening of the trading session. After hitting the ceiling price of 85,000 VND per share, MSN cooled down to around 82,800 VND per share, pushing its market capitalization to nearly 126 trillion VND. The trading volume exceeded 17 million shares, with a total transaction value of over 1.4 trillion VND.

Source: VietstockFinance

|

Another notable stock within the Masan ecosystem on January 29th was MSR, which surpassed its 2022 peak, reaching the ceiling price of 36,400 VND per share. The trading volume exceeded 6 million units, with a total transaction value of over 216 billion VND, pushing its market capitalization to over 40 trillion VND.

Source: VietstockFinance

|

| MSR stock price movement from 2022 to present |

Other stocks within the same ecosystem, such as Masan Consumer (HOSE: MCH), also rose by nearly 2% to 159,900 VND per share. Masan MEATLife (UPCoM: MML) hit the ceiling price of 43,200 VND per share at the opening and retreated to around 41,300 VND per share.

The positive performance of Masan stocks comes amid the group’s announcement of strong 2025 results and a double-digit growth plan for 2026.

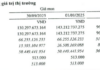

At the investor conference themed “Scaling Up, Leading Growth” held by Masan Group Corporation (HOSE: MSN) on the afternoon of January 28th, CEO Danny Le shared that the group’s consolidated financial indicators for 2025 were positive. Total revenue reached 81,621 billion VND, up 8.7%, with EBITDA increasing by 10.3%. Notably, net profit after tax reached 6,764 billion VND, nearly 1.6 times higher than in 2024. Additionally, Masan Group reduced its Net Debt/EBITDA ratio to 2.74 times.

WinCommerce, Masan MEATLife, Phúc Long, Masan High-Tech Materials, and Techcombank all recorded growth rates of approximately 20%.

Notably, Masan High-Tech Materials (UPCOM: MSR) returned to profitability in 2025, with the highest quarterly profit in Q4/2025 after the COVID-19 period in 2022. Net profit for the year reached 11 billion VND. Full-year revenue was 7,443 billion VND, up 19% on an LFL basis, driven by price factors as commodity prices remained high due to tight supply and geopolitical factors.

Profitability improved significantly, with EBITDA margins expanding to 29% in 2025, supported by the deconsolidation of HCS, improved product mix, and reduced unit costs due to better operational efficiency at the Núi Pháo mine. Optimization of production lines after maintenance periods enhanced recovery rates, including a record fluorspar recovery rate and high APT recovery rates in Q4/2025.

For 2026, Masan Group projects a 15-20% increase in both revenue and profit. WinCommerce is expected to remain the main growth driver, with revenue projected to rise by 15-21%. Masan Consumer aims for 15-20% revenue growth, while Masan MEATLife targets 9-14%. Masan High-Tech Materials anticipates a 33-45% increase in EBITDA. Phúc Long is expected to achieve 5-18% revenue growth.

– 11:32 29/01/2026

Rural Vietnam: The Long-Term Runway for Modern Retail Growth

According to the Retail Industry Report by SHS Research, Vietnam’s food retail market is currently valued at approximately $70 billion. However, the penetration rate of modern retail channels stands at only about 14%—significantly lower than Thailand (approximately 48%) and Indonesia (around 23%). This gap highlights the substantial growth potential for modern retail in Vietnam, particularly as domestic consumption rebounds and consumer behavior increasingly prioritizes product quality and convenience.

Vietnam’s Top Leaders, General Secretary To Lam and Prime Minister Pham Minh Chinh, Visit Cutting-Edge High-Tech Material Mine Owned by Vietnamese Enterprise

The presence of top-tier leadership at the Masan High-Tech Materials booth underscores the critical importance of mastering core technologies and essential mineral value chains for Vietnam’s economic advancement.