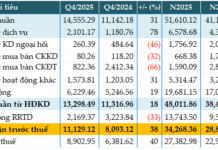

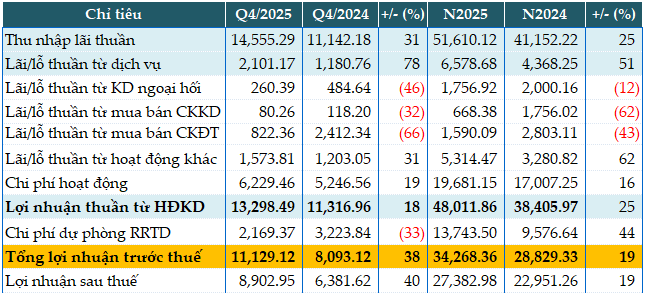

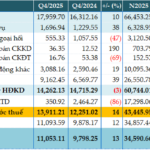

In 2025, MB’s core operations surged by 25% year-on-year, generating a net interest income of VND 51,610 billion.

Service revenue profits skyrocketed by 51%, reaching nearly VND 5,679 billion, fueled by a 3.5-fold increase in consulting fees and an 11% rise in insurance-related income.

Other operating profits climbed 63% to VND 5,314 billion, driven by VND 4,142 billion from resolved debts (+69%) and VND 295 billion from derivative financial instruments.

Some non-interest income streams declined compared to the previous year, including foreign exchange trading, investment securities, and trading securities.

Operating expenses rose 16% to VND 19,681 billion, yet net profit from operations still grew 25% to VND 48,011 billion.

MB provisioned VND 13,743 billion for credit risk, a 44% increase. Despite this, pre-tax profit exceeded VND 34,268 billion, up 19% year-on-year, surpassing the annual target of VND 31,712 billion by 8%.

|

Q4 and 2025 Business Results of MBB. Unit: Billion VND

Source: VietstockFinance

|

MB’s total assets by year-end 2025 soared 43% to over VND 1,600 trillion. Notably, customer loans jumped 40%, surpassing VND 1,000 trillion. Deposits at the State Bank rose sharply to VND 68,494 billion (2.3 times year-start), while interbank deposits and loans reached VND 182,923 billion (2.4 times higher).

On the funding side, customer deposits grew 29% to VND 921,368 billion. Government and SBV borrowings increased to VND 47,474 billion (5.8 times year-start).

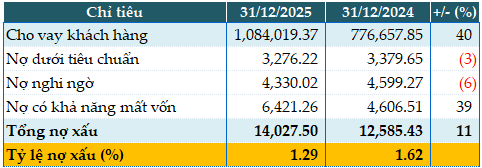

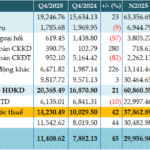

Total bad debts as of 31/12/2025 stood at VND 14,027 billion, up 11% year-on-year. Substandard and doubtful debts improved, with the NPL ratio dropping from 1.62% to 1.29%.

|

Loan Quality of MBB as of 31/12/2025. Unit: Billion VND

Source: VietstockFinance

|

– 16:13 30/01/2026

ABBank Profits Surge Ahead of New Brand Identity Launch

An Binh Commercial Joint Stock Bank (ABBank, UPCoM: ABB) has reported a remarkable pre-tax profit of nearly VND 3.546 trillion for 2025 in its consolidated financial statements, marking a 4.5-fold increase compared to the previous year and surpassing 97% of its annual target. Notably, the bank’s non-performing loans (NPLs) saw a significant improvement, decreasing by 73% from the beginning of the year, resulting in an NPL ratio of less than 1%.

2025 Pre-Tax Profit Stagnates, Vietcombank’s NPL Ratio Improves

Vietcombank (HOSE: VCB) has reported a pre-tax profit of over VND 44,020 billion in its latest consolidated financial statement, marking a 4% increase compared to the previous year. This growth is primarily driven by a significant rise in non-interest income. Notably, the bank’s non-performing loans (NPLs) decreased by 31% at year-end compared to the beginning of the year.

VietinBank Projects 37% Pre-Tax Profit Surge by 2025, Credit Growth Nears VND 2 Trillion Milestone

VietinBank (HOSE: CTG) has reported a pre-tax profit of nearly VND 43,446 billion for 2025, marking a 37% increase year-on-year. This impressive growth is primarily attributed to a significant reduction in credit risk provisions. Notably, the bank’s customer loans outstanding at the end of the year surpassed VND 1,990 trillion.