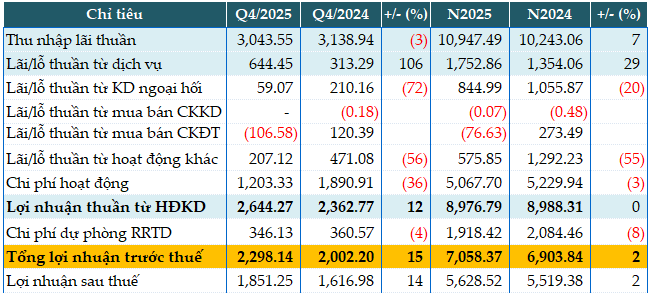

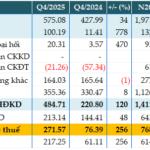

In 2025, MSB’s net interest income reached over 10,947 billion VND, marking a 7% increase compared to the previous year.

Service revenue also saw a significant 29% rise, reaching 1,753 billion VND. However, other non-interest income sources experienced declines, including foreign exchange trading, securities trading, investment securities, and other activities.

The bank successfully reduced operating expenses by 3% year-on-year, totaling 5,068 billion VND. As a result, net profit from business operations remained stable at approximately 8,977 billion VND, similar to the previous year.

Despite allocating 1,918 billion VND for credit risk provisions (an 8% decrease), pre-tax profit increased by 2% to 7,058 billion VND.

|

MSB’s Q4 and 2025 Business Results. Unit: Billion VND

Source: VietstockFinance

|

Total assets as of year-end 2025 grew by 27% compared to the beginning of the year, reaching 407,673 billion VND. This growth was primarily driven by lending activities. With a 15.8% credit growth limit granted by the State Bank of Vietnam (SBV) for the banking sector, the parent bank’s customer loan portfolio exceeded 201,000 billion VND. Additionally, thanks to digital investments, the loan portfolio of its subsidiary, Tnex Finance, reached nearly 4,000 billion VND, bringing MSB’s consolidated total customer loans to 205,208 billion VND as of December 31, 2025. MSB’s loan portfolio comprises over 76% contributions from individual customers and small and medium-sized enterprises (SMEs).

On the funding side, customer deposits reached 196,671 billion VND, a 27% increase from the beginning of the year. MSB’s CASA balance reached nearly 57,000 billion VND, growing by almost 40% year-on-year. Consequently, the CASA ratio improved from 26.4% to 28.9%. The bank’s consolidated net interest margin (NIM) stood at 3.22%.

Key safety ratios remained compliant with regulations: the consolidated capital adequacy ratio (CAR) was 12.5%, the loan-to-deposit ratio (LDR) was 62%, and the ratio of short-term funds used for medium and long-term loans was 26.74%. Profitability metrics included a return on assets (ROA) of 1.59% and a return on equity (ROE) of 14.04%.

|

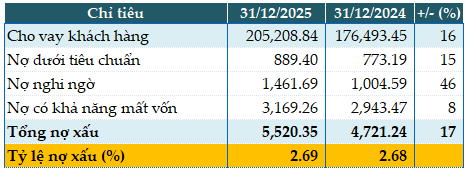

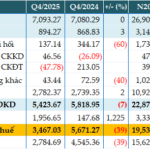

MSB’s Loan Quality as of December 31, 2025. Unit: Billion VND

Source: VietstockFinance

|

Total non-performing loans (NPLs) as of December 31, 2025, increased by 17% year-on-year to 5,520 billion VND. The NPL ratio slightly rose from 2.68% to 2.69%, while the consolidated NPL ratio was 1.82%.

– 09:21 31/01/2026

2025 Pre-Tax Profit Stagnates, Vietcombank’s NPL Ratio Improves

Vietcombank (HOSE: VCB) has reported a pre-tax profit of over VND 44,020 billion in its latest consolidated financial statement, marking a 4% increase compared to the previous year. This growth is primarily driven by a significant rise in non-interest income. Notably, the bank’s non-performing loans (NPLs) decreased by 31% at year-end compared to the beginning of the year.

VietinBank Projects 37% Pre-Tax Profit Surge by 2025, Credit Growth Nears VND 2 Trillion Milestone

VietinBank (HOSE: CTG) has reported a pre-tax profit of nearly VND 43,446 billion for 2025, marking a 37% increase year-on-year. This impressive growth is primarily attributed to a significant reduction in credit risk provisions. Notably, the bank’s customer loans outstanding at the end of the year surpassed VND 1,990 trillion.

ACB’s Total Assets Surpass 1 Quadrillion VND, FDI Credit Soars 170%

Asia Commercial Bank (HOSE: ACB) reported a pre-tax profit of nearly VND 19,539 billion in Q4/2025, reflecting a modest 7% year-on-year decline due to heightened credit risk provisions. Notably, total assets surpassed VND 1,000 trillion by year-end, while non-performing loans significantly decreased compared to the beginning of the year.