Exceptional Business Performance, Significantly Enhanced Credit Quality

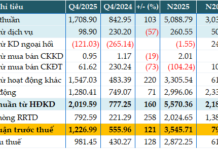

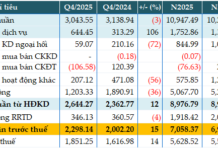

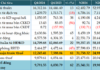

According to the financial report, by the end of 2025, NCB recorded remarkable growth across nearly all financial metrics. Specifically, as of December 31, 2025, the bank’s total assets reached over 163.615 trillion VND, a 38% increase compared to the end of 2024 and surpassing the set plan by 21%; customer loans reached 97.545 trillion VND, exceeding the plan by 5%; and total customer deposits reached 127.403 trillion VND, growing by 33% compared to the end of 2024 and surpassing the plan by 8%.

Notably, NCB’s non-term deposits (CASA) saw exceptional growth, reaching over 11.430 trillion VND, exceeding the 2025 plan by 51% and growing by 22% compared to the same period in 2024. This significant improvement in CASA not only reflects customer trust in NCB but also helps the bank reduce costs and enhance profit margins in an increasingly competitive financial market.

NCB surpasses all 2025 business targets.

The consolidated after-tax profit for 2025 also showed a positive result, a significant improvement from the loss recorded in the same period in 2024. Before provisioning and reversing accrued interest according to PACCL, NCB’s after-tax profit reached 947 billion VND, far exceeding the planned 59 billion VND approved earlier in the year and showing a strong increase compared to 2024.

According to PACCL, NCB does not plan to make additional provisions or reverse accrued interest in 2025. However, the proactive use of the entire profit to fulfill these obligations beyond the PACCL plan demonstrates NCB’s strong commitment and consistent actions in prioritizing the resolution of existing issues, establishing a healthy and sustainable financial foundation alongside business development goals.

Additionally, NCB effectively managed credit risk, controlled the quality of its loan portfolio, and implemented debt resolution solutions in line with the PACCL roadmap. The report shows that the non-performing loan ratio for new disbursements from June 30, 2024, was very low at 0.31% of total customer loans, while the non-performing loan ratio for the non-PACCL portfolio was 1.1%. These figures clearly indicate a significant improvement in NCB’s credit quality.

These achievements are the result of the comprehensive restructuring strategy that the bank has consistently pursued over the past five years. By implementing synchronized solutions to enhance senior leadership capabilities, develop a high-quality workforce to meet innovation needs, strengthen risk management, and drive digital transformation, NCB has not only gained customer trust and preference but also enhanced its competitive edge and market reputation.

Early Capital Increase, Surpassing Multiple PACCL Targets

A key milestone in 2025 was NCB’s successful increase of its charter capital to 19.280 trillion VND, one year ahead of the PACCL-approved schedule. This achievement reflects a well-structured and transparent strategy implementation, as well as investor and shareholder confidence in the bank’s development strategy and long-term prospects.

At the extraordinary shareholders’ meeting held in December, NCB approved an additional capital increase of 10.000 trillion VND, expected to be completed in 2026 through a private placement to professional investors. The capital increase plan was approved by the State Bank at the end of January 2026. If successful, the bank’s charter capital will exceed 29.000 trillion VND, ahead of the PACCL schedule, marking the fourth consecutive capital increase in five years (2022–2026).

NCB is determined to complete PACCL ahead of schedule.

The early capital increase strengthens NCB’s financial capacity, ensuring compliance with the State Bank’s safety ratios while creating room for business expansion in target customer segments and markets, driving differentiated and breakthrough growth. This is also a crucial foundation for the bank to accelerate PACCL completion, achieving safe, efficient, and sustainable development goals.

Alongside the early capital increase, key PACCL components such as bad debt recovery, provisioning, and reversing accrued interest have all exceeded targets, demonstrating NCB’s strong commitment to completing PACCL ahead of schedule.

The achievements in 2025 mark nearly five years of NCB’s synchronized and robust implementation of comprehensive restructuring solutions alongside its new strategy. From a bank facing numerous challenges, NCB has successfully transformed, building a reputation for a solid financial foundation, transparent governance, and clear development direction. This has created a positive momentum for growth, propelling the bank into a new era of prosperity, alongside the nation’s journey toward a thriving and powerful future.

C69 Surges 200% and Sparks Multi-Billion Dong Block Trades

Nearly 5.2 million shares of C69 were traded in block deals over three consecutive sessions from January 19th to 21st, coinciding with the stock reaching a five-year high.

An Binh Securities (ABS) Reports Profit Exceeding Targets, Poised for Billion-Dollar Capital Increase

Amidst the positive business growth achieved in 2025, An Binh Securities (ABS) is poised to accelerate its momentum in 2026, targeting a pre-tax profit of 600 billion VND. To fortify its financial capabilities, expand market share, and capitalize on the emerging growth cycle in the securities market, ABS plans to execute a capital increase strategy, elevating its capital to over 3,000 billion VND.

Hòa Bình Construction Appoints New Deputy General Director

Mr. Nguyễn Hùng Cường has been appointed as Deputy General Director of Hòa Bình Construction, effective February 1, 2026.