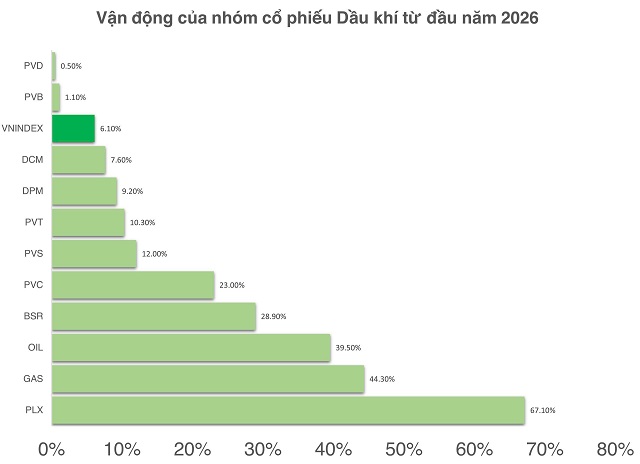

Energy Stocks Surge After a Year of Underperformance

As the VN-Index approaches the 1,900-point mark, energy stocks have emerged as a notable highlight in the market. Not only have they seen significant price increases, but several large-cap energy stocks have also set new record highs, reflecting strong investor interest in the early stages of 2026.

Among major energy companies, BSR recorded a 28.9% increase as of the close of trading on January 20, breaking its previous price record.

Notably, BSR is now the top-performing energy stock in terms of liquidity, indicating robust participation from institutional investors.

Meanwhile, GAS surged by 44.3%, propelling its market capitalization deeper into the billion-dollar territory.

These two stocks set new historical highs after the first 12 trading sessions of 2026.

Nearly all energy stocks are in positive territory after the first 12 trading sessions of 2026.

|

Although PLX has not yet reached a historical high, it has climbed by 67.1%, making it the top performer among stocks with a market cap exceeding 1 billion USD.

On other exchanges, OIL on UPCoM rose by 39.5%, while PVC saw a 23% increase on HNX.

As of the close of trading on January 20, 2026, 9 out of 11 energy stocks outperformed the VN-Index (+6.1%). This contrasts sharply with 2025, when no energy stocks outperformed the benchmark index, and the sector was largely overshadowed in the market.

The Energy Sector in Transition

The resurgence of energy stocks comes amid expectations that global oil prices will not remain at elevated levels. According to Agriseco Securities (AGR), Brent oil prices are projected to fall to the $60–65 per barrel range in 2026, as global demand growth slows while supply continues to expand.

However, Agriseco suggests that the lower oil prices in 2026 could serve as a “pivot point” for market rebalancing. By 2027, Brent oil prices are expected to recover to around $67 per barrel as excess supply gradually diminishes.

Notably, the rally in Vietnamese energy stocks in early 2026 is not solely driven by oil price expectations but reflects the reactivation of domestic investment cycles. Key projects such as Block B – Ô Môn and Lạc Đà Vàng are accelerating, laying the groundwork for sector-wide growth in 2026–2027.

According to Nguyễn Văn Trúc, Deputy Head of Securities Analysis at NSI, Resolution 79 is driving fundamental changes. Qualitatively, state-owned corporations must adopt OECD governance standards, enhancing transparency and capital efficiency.

Quantitatively, the goal of elevating state-owned enterprises into the region’s largest companies could spur capital increases, M&A deals, or large-scale asset revaluations. Additionally, the divestment from non-core state-held sectors is seen as a significant catalyst for stock prices.

Localized FOMO and Portfolio Management Challenges

However, investors should be cautious of the Fear of Missing Out (FOMO) effect—a psychological state common in bullish markets where investors fear being left behind.

According to Nguyễn Anh Khoa, Director of Securities Analysis at Agriseco, FOMO is currently localized, appearing only in select stocks that have rallied sharply over a short period. The greatest risk lies in chasing overheated stocks, particularly those with high speculative activity, as profit-taking could trigger steep price declines.

From a portfolio management perspective, Khoa advises investors to maintain a balanced structure, combining short-term momentum plays with fundamentally strong companies that offer long-term growth prospects and stable price accumulation.

– 12:00 21/01/2026

Technical Analysis for the Afternoon Session of January 22: Struggling to Break Free from the Tug-of-War

The VN-Index experienced intense volatility but maintained its recovery momentum, with trading volumes consistently surpassing the 20-day average. Meanwhile, the HNX-Index rebounded strongly, edging closer to its price target outlined by the Falling Wedge pattern.

Vietstock Daily 22/01/2026: Rising Risks?

The VN-Index persists in its corrective phase, accompanied by trading volumes surpassing the 20-day average. The MACD indicator is weakening, gradually narrowing its gap with the Signal line. Should a sell signal emerge in upcoming sessions, the index’s short-term downside risk will significantly escalate.

Market Pulse 23/01: VN-Index Continues to Decline, State-Owned Stocks Face Heavy Selling Pressure

At the close of trading, the VN-Index fell by 11.94 points (-0.63%), settling at 1,870.79 points, while the HNX-Index dropped by 5.47 points (-2.12%), closing at 252.96 points. Market breadth was overwhelmingly negative, with 504 decliners outpacing 239 advancers. Similarly, the VN30 basket saw red dominate, as 19 stocks declined, 8 advanced, and 3 remained unchanged.

Vietstock Weekly 26-30/01/2026: Will the Tug-of-War Continue?

The VN-Index retraced after a five-week winning streak, yet its medium-term uptrend remains intact. The index’s proximity to the Bollinger Bands’ Upper Band and the MACD’s sustained upward trajectory post-buy signal reinforce this outlook. However, short-term volatility is likely to persist as the Stochastic Oscillator hovers in overbought territory.