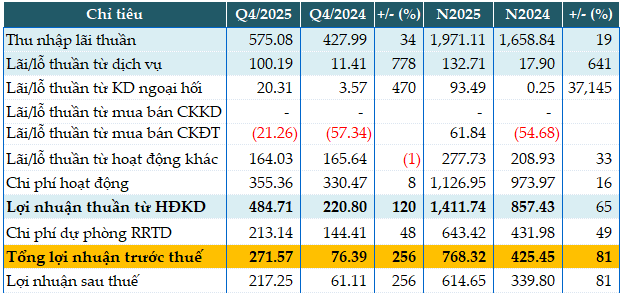

In 2025, PGBank witnessed significant growth across most of its business operations compared to the previous year.

Net interest income surged by 19%, reaching over 1.971 trillion VND. Service-related profits skyrocketed 7.7 times to nearly 133 billion VND, driven by increased revenue from treasury services, business services, insurance, and other sources.

Additionally, foreign exchange trading yielded a profit of over 93 billion VND, a stark contrast to the mere 251 million VND earned the year before. Trading activities in securities turned a loss into a profit of nearly 62 billion VND. Other operations also generated a profit of nearly 278 billion VND, an increase of 33 billion VND, attributed by PGBank to intensified debt recovery efforts, particularly in principal and interest collections utilizing provisions in the fourth quarter.

Operating expenses for the year rose by 16% to 1.127 trillion VND. Consequently, net profit from business operations soared by 65% to 1.412 trillion VND.

PGBank also increased its credit risk provisions by 49%, setting aside over 643 billion VND. As a result, the bank’s pre-tax profit exceeded 768 billion VND, an 81% increase compared to the previous year.

Surpassing its 2025 pre-tax profit target of 716 billion VND by 7%, the bank demonstrated strong performance.

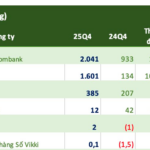

In the fourth quarter alone, the bank’s pre-tax profit reached nearly 273 billion VND, a 3.6-fold increase compared to the same period last year.

|

PGB’s Q4 and 2025 Business Results. Unit: Billion VND

Source: VietstockFinance

|

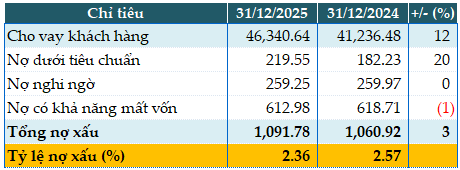

By the end of 2025, the bank’s total assets had grown by 22% compared to the beginning of the year, reaching nearly 88.882 trillion VND. Customer loans increased by 12% to 46.340 trillion VND, while customer deposits rose by 12% to 48.460 trillion VND.

PGBank’s total non-performing loans as of December 31, 2025, remained roughly the same as the beginning of the year, at approximately 1.092 trillion VND. The non-performing loan ratio to outstanding loans decreased from 2.57% at the beginning of the year to 2.36%.

|

PGB’s Loan Quality as of December 31, 2025

Source: VietstockFinance

|

– 11:44 27/01/2026

ACB’s Total Assets Surpass 1 Quadrillion VND, FDI Credit Soars 170%

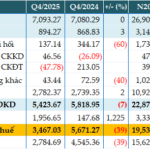

Asia Commercial Bank (HOSE: ACB) reported a pre-tax profit of nearly VND 19,539 billion in Q4/2025, reflecting a modest 7% year-on-year decline due to heightened credit risk provisions. Notably, total assets surpassed VND 1,000 trillion by year-end, while non-performing loans significantly decreased compared to the beginning of the year.

KienlongBank: Projected 2025 Profits Double, Nearly 50% of Loans at Risk of Default

KienlongBank (HOSE: KLB) has reported a remarkable pre-tax profit of nearly VND 2.323 trillion in 2025, doubling its previous year’s performance. This outstanding result surpasses the bank’s annual profit target by 68%. Notably, despite a 25% reduction, non-performing loans still amounted to over VND 625 billion by year-end, accounting for 47% of total bad debt.