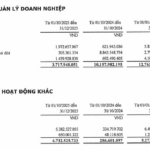

Dabaco Vietnam Group Joint Stock Company (Dabaco, Stock Code: DBC, HoSE) has released its consolidated financial report for Q4/2025, revealing a net revenue of over VND 3,729 billion, a 3.3% increase compared to Q4/2024.

However, high production costs have pressured gross profit, reducing it from nearly VND 530.5 billion to approximately VND 452.2 billion, a 14.8% decline.

During this period, the company generated nearly VND 21.5 billion in financial revenue, a 4.9% rise year-over-year. Additionally, profits from joint ventures and associates amounted to nearly VND 2.1 billion.

Regarding expenses, Dabaco’s financial costs in Q4/2025 decreased from VND 70.7 billion to VND 63.5 billion. Conversely, selling expenses rose by 3.7% to nearly VND 125.8 billion, and administrative expenses increased from VND 100.9 billion to nearly VND 106.7 billion.

Illustrative image

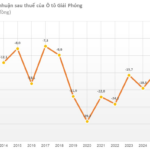

After deducting taxes and fees, Dabaco reported a net profit of nearly VND 148.6 billion, a 37.8% decrease compared to the same period last year.

According to Dabaco’s explanation, the decline in after-tax profit in Q4/2025 was due to lower pig prices compared to the previous year, impacting the performance of the group’s livestock companies.

On a positive note, the group’s poultry farming companies achieved a profit of VND 53.4 billion, compared to a loss of VND 88.8 billion in the same period last year.

For the full year 2025, Dabaco recorded a net revenue of nearly VND 14,897.7 billion, a 9.8% increase from 2024; after-tax profit reached nearly VND 1,506.8 billion, up 96%.

In 2025, Dabaco set a business target of VND 1,007 billion in consolidated after-tax profit. Thus, by the end of the 2025 fiscal year, the company achieved 149.6% of its planned profit.

As of December 31, 2025, Dabaco’s total assets increased by 13.1% from the beginning of the year to over VND 15,976.7 billion. Inventory accounted for the largest share at over VND 6,358.1 billion, representing 39.8% of total assets.

Additionally, held-to-maturity investments totaled over VND 1,855.2 billion, or 11.6% of total assets; long-term work in progress amounted to over VND 1,750 billion, or 11% of total assets.

On the liabilities side, total payables stood at nearly VND 7,907.7 billion, a 7.5% increase from the beginning of the year. Of this, loans and finance leases were VND 5,876.6 billion, accounting for 74.3% of total liabilities.

Offshore Drilling Rig Manufacturer Reports 300% Profit Surge in 2025

In 2025, PVY reported cumulative full-year net revenue of approximately VND 1,290 billion and after-tax profit of nearly VND 470 million, a significant improvement from the modest VND 177 million profit in 2024, marking a nearly threefold increase.

VVS Stock Fluctuates Ahead of Q4 2025 Earnings Report

“Ahead of the Q4/2025 financial report release, VVS stock experienced a sharp short-term decline. This movement starkly contrasts with the company’s highly positive business outlook and growth that surpassed initial projections.”