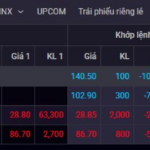

After seven consecutive sessions of decline, the market rebounded positively on January 29th. The benchmark index rose, driven by the retail and consumer stocks, reflecting short-term capital rotation. At the close, the VN-Index gained 12.07 points (+0.67%), reaching 1,814.98 points. Foreign investors continued their net selling streak, offloading nearly VND 600 billion across the market.

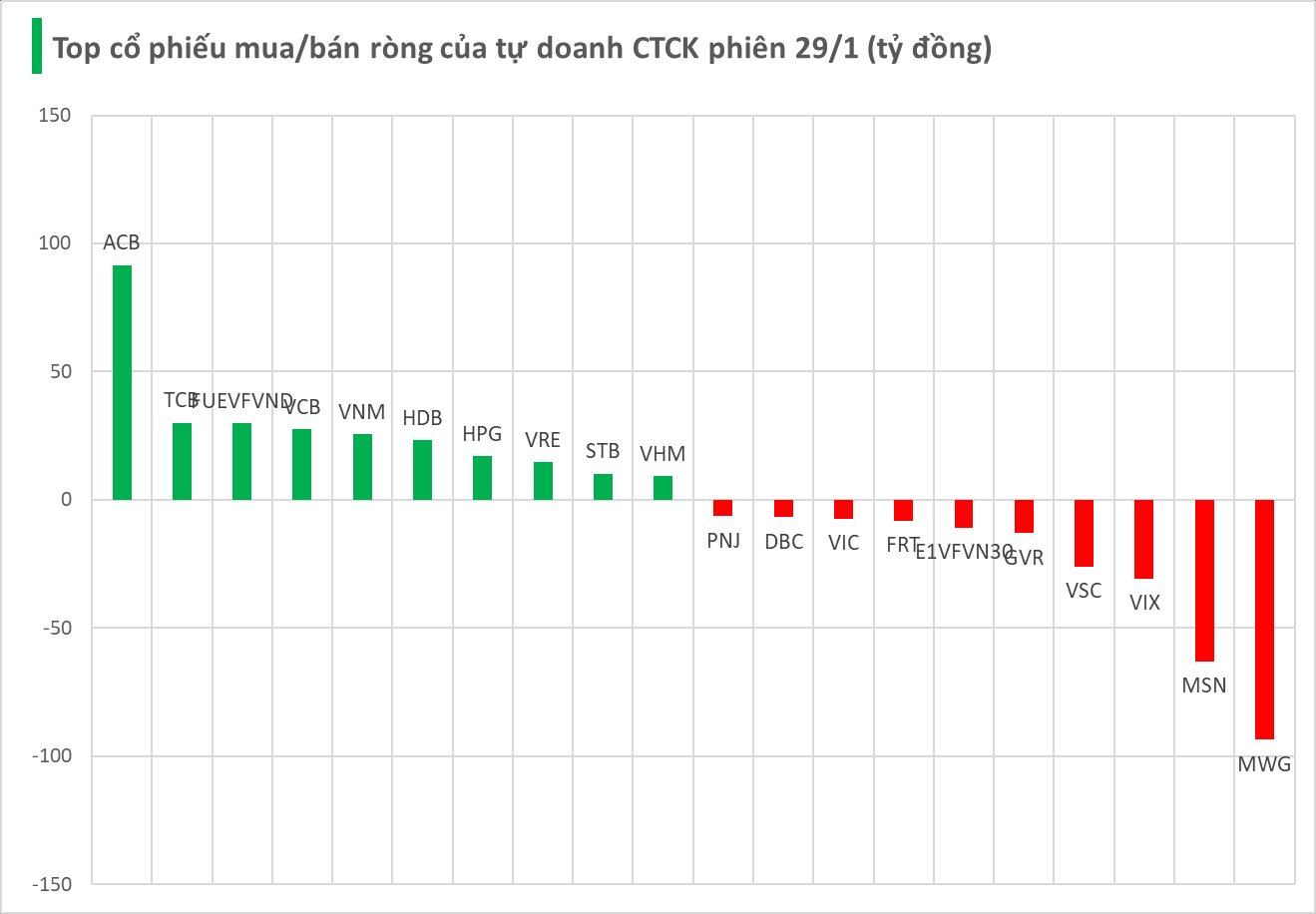

Securities firms’ proprietary trading desks net sold VND 63 billion on HOSE.

Specifically, proprietary trading desks of securities firms were the heaviest net sellers in MWG, with a value of -VND 94 billion, followed by MSN (-VND 63 billion), VIX (-VND 31 billion), VSC (-VND 26 billion), and GVR (-VND 13 billion). Other stocks also saw notable net selling, including E1VFVN30 (-VND 11 billion), FRT (-VND 8 billion), VIC (-VND 7 billion), DBC (-VND 7 billion), and PNJ (-VND 6 billion).

Conversely, ACB led the net buying with VND 92 billion. This was followed by DBC and FUEVFVND (both at VND 30 billion), VCB (VND 27 billion), VNM (VND 26 billion), HDB (VND 23 billion), HPG (VND 17 billion), VRE (VND 15 billion), STB (VND 10 billion), and VHM (VND 9 billion).

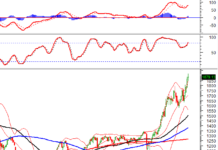

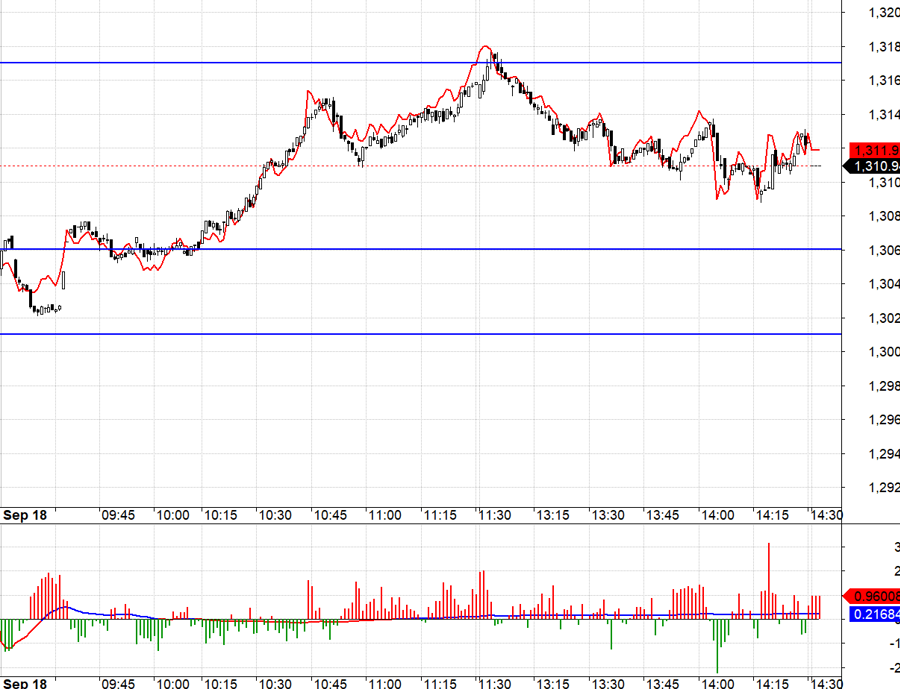

Technical Analysis for the Afternoon Session of January 22: Struggling to Break Free from the Tug-of-War

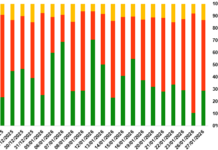

The VN-Index experienced intense volatility but maintained its recovery momentum, with trading volumes consistently surpassing the 20-day average. Meanwhile, the HNX-Index rebounded strongly, edging closer to its price target outlined by the Falling Wedge pattern.

Vietstock Daily 22/01/2026: Rising Risks?

The VN-Index persists in its corrective phase, accompanied by trading volumes surpassing the 20-day average. The MACD indicator is weakening, gradually narrowing its gap with the Signal line. Should a sell signal emerge in upcoming sessions, the index’s short-term downside risk will significantly escalate.