Urban Condos: The End of the Hot Price Surge

In a conversation with Tiền Phong’s reporters, Trần Quang Trung, Business Development Director at OneHousing, predicts that secondary condo transactions and prices in 2026 are unlikely to surge. Instead, they will likely stabilize as prices have already reached their peak.

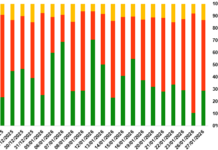

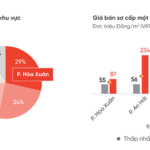

By the end of last year, secondary condo prices in Hanoi averaged around 90 million VND per square meter, a 7% increase year-over-year. However, the anticipated new supply is substantial, ranging from 35,000 to 40,000 units this year. Simultaneously, liquidity showed signs of weakening in Q4/2025, with only about 9,500 condo transactions recorded in Hanoi and its outskirts, a 22% decline compared to the same period last year.

“The condo segment, which has been leading the market, is now reversing its trend. The new supply will help cool down price increases and reduce speculative and short-term investment activities,” stated Mr. Trung.

The real estate market will undergo significant changes with the redevelopment of Ring Roads 1 and 2.

According to Mr. Trung, the redevelopment of Hanoi’s Ring Roads 1 and 2 will improve accessibility to the city center from various directions. However, it will also reduce the “location monopoly premium” of inner-city housing. As travel times from outlying districts shorten, the advantage of living close to the center will no longer justify excessively high prices.

Infrastructure Paves the Way for Satellite Cities

Hoàng Nguyệt Minh, General Director of Cushman & Wakefield Vietnam, also spoke with Tiền Phong, emphasizing that Vietnam’s real estate market is a long-term growth story. However, inner-city Hanoi prices have surpassed the affordability of most individual investors. The most liquid price range is currently between 4 and 7 billion VND per unit. As inner-city condos exceed this threshold, capital is shifting towards satellite areas.

In this context, the redevelopment of ring roads acts as a “capital conduit.” Upgraded infrastructure makes living 30 to 45 minutes from the city center the new normal. This shift creates growth opportunities for areas along the ring roads and radial axes connecting to the urban core.

The revamped Ring Roads 1 and 2 will not only alleviate congestion but also reshape the land price map. Areas once considered “outer central” may emerge as new balance points between pricing and accessibility to jobs and services.

Ms. Minh notes that retail real estate in the core areas is also indirectly affected by urban restructuring. The rental performance of commercial townhouses in central Hanoi and Ho Chi Minh City is declining, with increasing vacancy rates.

“With the redevelopment of Ring Roads 1 and 2, customers are likely to disperse to new commercial hubs rather than concentrate solely in the old core. Retail townhouses will retain sustainable appeal only in ultra-central streets associated with luxury brands,” Ms. Minh explained.

She added that, unlike previous phases where infrastructure news often triggered localized land price spikes, the Ring Roads 1 and 2 redevelopment occurs during a market adjustment phase following a strong growth cycle. Thus, the primary impact will be value redistribution rather than rapid price increases.

The urban core is gradually losing its absolute investment advantage, while outlying areas and satellite cities are gaining prominence due to improved connectivity.

“In the long term, infrastructure redevelopment and population decentralization will lead to a more balanced market. However, in the short term, this period will be challenging for assets overly reliant on central locations without strong operational efficiency,” Ms. Minh concluded.

The 2026 Real Estate Market and Short-Term Speculative Waves

The real estate market outlook for 2026 is poised to enter a new growth cycle, albeit one characterized by selective expansion. This shift will disrupt short-term speculative surges, curbing rapid price escalations in favor of a more sustainable, long-term development trajectory.