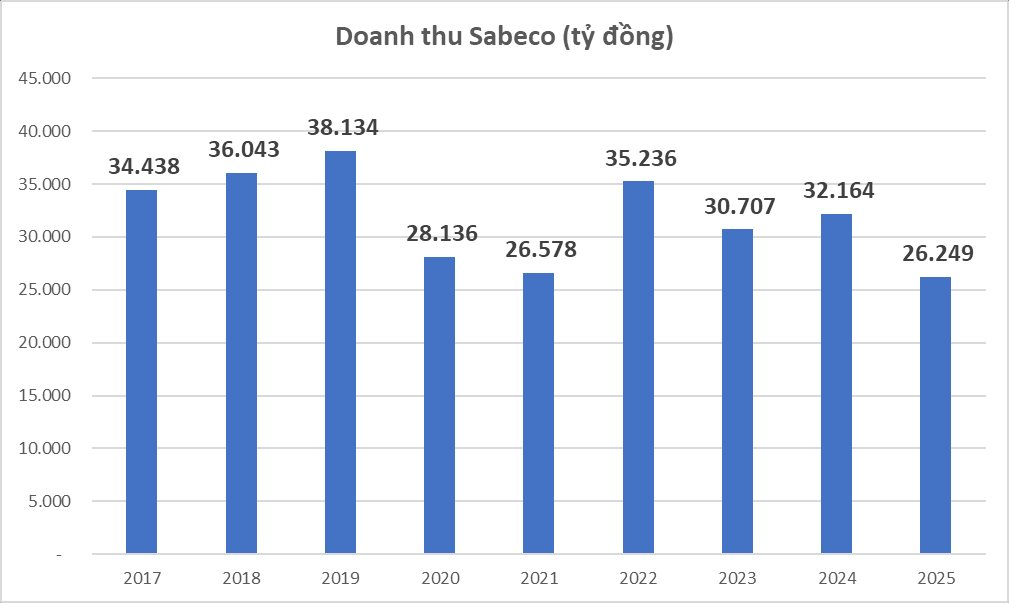

The financial landscape of Saigon Beer-Alcohol-Beverage Corporation (Sabeco – Stock Code: SAB) in 2025 reveals a contrasting picture between revenue scale and profit efficiency.

The consolidated financial report for Q4/2025 indicates a net revenue of VND 6,836 billion, a 23% decline compared to the same period last year. For the entire year of 2025, the beer industry giant recorded a revenue of VND 25,888 billion, approximately VND 6,000 billion (or 19%) lower than the VND 31,872 billion achieved in 2024.

Sabeco’s management attributes the revenue decline to reduced consumption amid fierce competition, compounded by natural disasters like storms and floods, and the earlier arrival of the 2025 Lunar New Year.

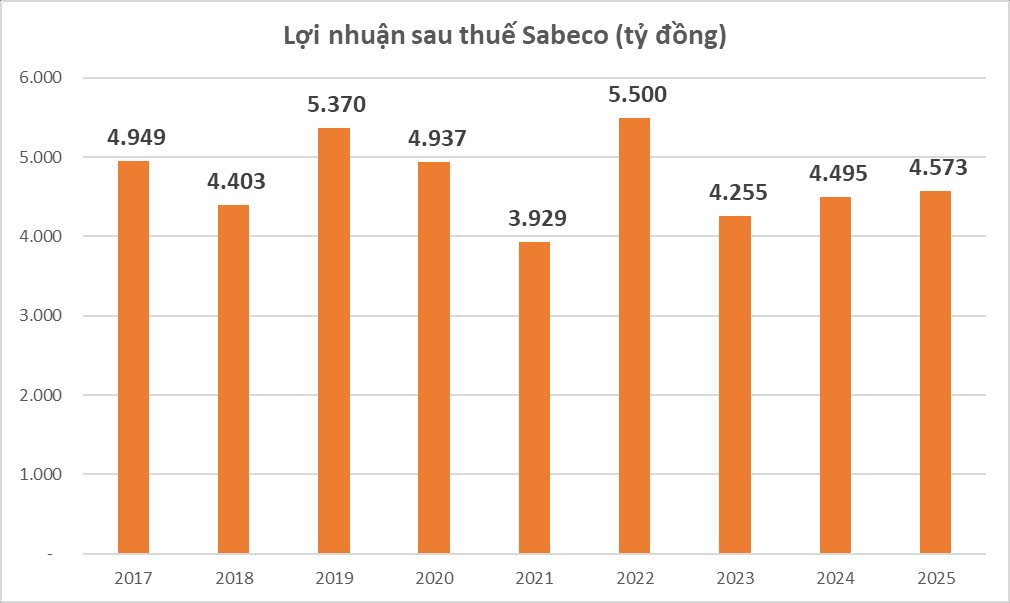

Despite these challenges, Sabeco demonstrated effective cost management. In Q4, the cost of goods sold decreased significantly by 34%, coupled with lower input material prices, expanding the gross profit margin to 37.9%.

As a result, the after-tax profit for 2025 reached VND 4,573 billion, maintaining a positive growth of 2% despite market pressures.

A notable highlight in Sabeco’s financial structure is its massive cash reserves. As of December 31, 2025, Sabeco’s total assets amounted to VND 32,597 billion.

Of this, cash, cash equivalents, and bank deposits (including short-term and long-term financial investments) totaled VND 20,976 billion, accounting for over 64% of the company’s total assets.

In 2025, interest income from bank deposits contributed VND 995 billion to Sabeco’s revenue. On average, Sabeco earned approximately VND 2.7 billion daily in interest without engaging in direct production or business activities.

Sabeco maintains a highly secure capital structure with minimal debt. As of year-end 2025, total financial liabilities stood at only VND 435.5 billion, a mere 1.3% of total capital, indicating negligible interest expense pressure.

Regarding profit distribution, the “Other short-term payables” account on the balance sheet records over VND 3,555 billion, primarily comprising dividends payable (over VND 2,611 billion), ready for the upcoming shareholder payout.

On the stock market, SAB closed the trading session on January 30, 2026, at VND 49,900 per share, with a trading volume exceeding 1.72 million units.

MB Targets 18% Pre-Tax Profit Growth by 2025 as Credit Surpasses 1 Million Billion Dong

In 2025, Military Commercial Joint Stock Bank (MB, HOSE: MBB) reported pre-tax profits exceeding VND 34,268 billion, marking an 18% year-on-year increase. This impressive growth is attributed to the bank’s robust core operations and a significant rise in service revenue, as reflected in its consolidated financial statements.

January 29th Bank Profit Update: 18 Banks Report Earnings – VietinBank and VPBank Surge, ACB and Sacombank Lag

As of January 29th, 2025, 18 leading Vietnamese banks have released their annual business results. This impressive list includes Vietcombank, VietinBank, BIDV, MB, Techcombank, VPBank, LPBank, Sacombank, Nam A Bank, Kienlongbank, ABBank, PGBank, BAOVIET Bank, VietABank, SeABank, ACB, Saigonbank, and BVBank.

NCB Accelerates in 2025: Early Capital Increase, Surpassing All Business Targets

By the end of 2025, National Commercial Bank (NCB) achieved record-breaking business results, surpassing all targets and accelerating the completion of key milestones outlined in its restructuring plan (PACCL). This remarkable performance underscores the bank’s strategic acumen and establishes a robust foundation for its upcoming growth phase.

GHC Officially Lists on HOSE

On January 30, 2026, approximately 47.7 million shares of Gia Lai Hydropower Joint Stock Company (GHC) were officially listed on the Ho Chi Minh City Stock Exchange (HOSE) with a reference price of 29,000 VND per share.