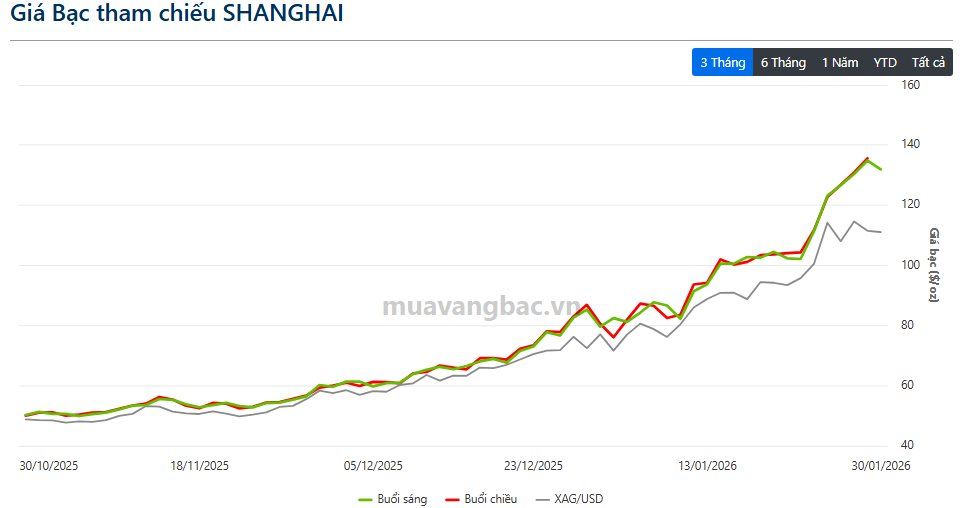

As of the morning update on January 30th from muavangbac.vn, the physical silver price in Shanghai adjusted to $131.97 per ounce, marking a 2% decline from the previous session. Notably, this correction follows a relentless 60% surge since the year’s start, reaching an all-time high.

The silver price on COMEX (USA) experienced an even more pronounced adjustment. Trading at $109.7 per ounce, it plummeted over 5% compared to the previous day. Consequently, the Shanghai-COMEX silver price spread skyrocketed to a record $22.7 per ounce.

Gold prices also retreated sharply. Shanghai gold fell to $5,278 per ounce after hitting a peak of $5,554 per ounce the previous day, a 5% drop.

This downturn primarily stemmed from investors’ profit-taking after the rapid price surge. However, the decline was short-lived as buying pressure at lower levels quickly resurfaced, aiding gold’s recovery.

Amidst this volatility, investor sentiment swung wildly, with price movements far exceeding typical forecasts and trends reversing at breakneck speeds.

The precious metals market was jolted on the afternoon of January 29th by one of the most abrupt and severe sell-offs on record. Gold prices plunged $380, nearly 7%, in just 28 minutes, while silver shockingly dropped 11% in the same timeframe.

According to Kitco News, the sell-off’s speed and severity stunned even seasoned commodity traders, prompting questions about whether precious metals had rallied too far, too fast, and if the January 29th volatility signaled the bull market’s end.

Despite the correction, spot gold remains up approximately 24% this month and 7% since the week’s start. UBS raised its gold price forecast to $6,200 per ounce for the first three quarters, anticipating a year-end 2026 price of around $5,900 per ounce.

VN-Index Slips Below 1,900 Points: What’s Next for the Stock Market Next Week?

The VN-Index concluded the trading week below the 1,900-point mark, following a prolonged rally and heightened profit-taking pressure. Amid rapid capital rotation and foreign investors shifting to net selling, market direction remains uncertain. Investors are advised to avoid FOMO and proceed with caution.