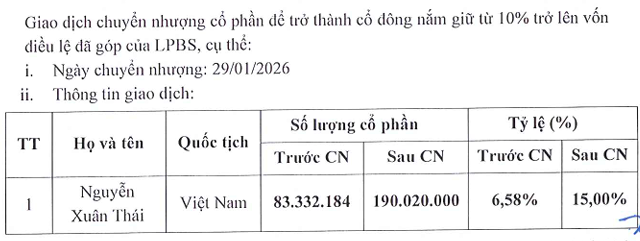

On January 29, 2026, Mr. Nguyễn Xuân Thái executed a transaction, increasing his shareholding from over 83.3 million shares (6.58%) to more than 190 million shares (15%).

Source: LPBS

|

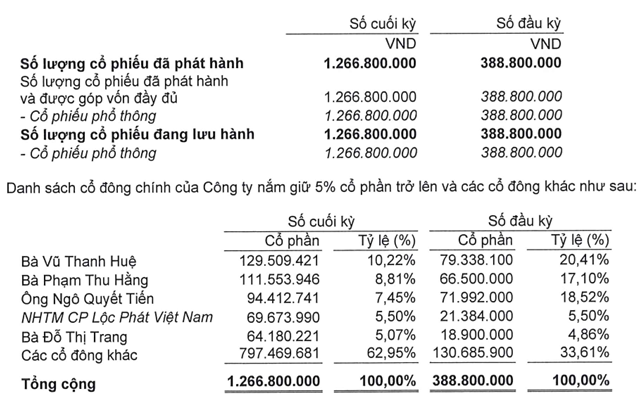

Notably, according to the announcement, Mr. Thái already held 6.58% of the capital before the transaction, qualifying him as a major shareholder. However, in LPBS’s Q4/2025 financial report published on December 31, 2025, Mr. Thái’s name was absent from the list of major shareholders. This indicates that he acquired a significant number of shares in early 2026.

Mr. Nguyễn Xuân Thái was not listed among shareholders holding 5% of LPBS capital as of December 31, 2025 – Source: LPBS’s Q4/2025 financial report

|

Mr. Nguyễn Xuân Thái is the son of Mr. Nguyễn Đức Thụy (also known as bầu Thụy), Chairman of Thaigroup and recently appointed Acting CEO of Sacombank (STB) after resigning as Chairman of LPBank’s Board of Directors (LPB). As of the end of 2025, LPB directly holds 5.5% of LPBS’s capital.

Currently, Mr. Nguyễn Xuân Thái serves as a Board Member of Phù Đổng Sports Investment Corporation, the parent company of Ninh Bình Football Club, competing in the Vietnamese National Football Championship (LPBank V.League 1). His sister, Ms. Nguyễn Ngọc Mỹ Anh, also made headlines in August 2025 when she was appointed Chairwoman of the club.

Before acquiring a 15% stake in LPBS, Mr. Thái was nominated as a Board Member candidate for LPBS for the 2023–2028 term, pending shareholder approval via written consent.

Initially, the nomination list included three candidates: Mr. Thái, Mr. Phan Thành Sơn, and Mr. Phạm Quang Hưng. However, the list was recently updated to include Mr. Hoàng Việt Anh, who was promoted from Deputy CEO in charge of external affairs to CEO on January 22, 2026. Following the election, LPBS’s Board of Directors is expected to consist of eight members.

In addition to increasing the number of Board candidates, LPBS extended the consent period from January 21 to February 2, 4 PM, instead of concluding within January as initially planned.

Another notable change is the increase in the IPO plan from a maximum of 126.68 million shares (10%) to 141.868 million shares (nearly 11.2%). Consequently, LPBS aims to raise its chartered capital from approximately VND 13,935 billion to nearly VND 14,087 billion.

Post-IPO, LPBS will register and centrally deposit all shares with the Vietnam Securities Depository and Clearing Corporation (VSDC) and list on the Ho Chi Minh City Stock Exchange (HOSE). If listing conditions are not met, LPBS will register for trading on the UPCoM market.

| LPBS aims to increase capital through IPO in 2026 |

LPBS plans IPO, nominates bầu Thụy’s son to Board

In 2025, the company reported revenue of VND 1,690 billion, 8.6 times higher than the previous year and exceeding the plan by 66%. After-tax profit reached VND 522 billion, 6.5 times higher than 2024.

Total assets grew to nearly VND 30,000 billion, with equity reaching VND 13,196 billion. The company’s market share in securities brokerage reached 1.8% by the end of 2025.

– 10:11 30/01/2026

Leadership Shakeup at Vietnam Airports Corporation

Vietnam Airlines Corporation (ACV) has announced changes to its Board of Directors. Mr. Dao Viet Dung has been relieved of his position as a Board member to focus on his role as the dedicated Deputy Secretary of ACV’s Party Committee. Concurrently, Mr. Nguyen Tien Viet, Deputy General Director of ACV, has been appointed as a new member of the Board of Directors.

Gen Z Leader Nominated to LPBank Securities Board: Son of Nguyen Duc Thuy, American University Graduate, Heads Sports Company

LPBank Securities JSC (LPBS) has officially released its shareholder consultation materials regarding its planned initial public offering (IPO) for listing on the Ho Chi Minh City Stock Exchange (HoSE). Alongside this strategic move, the company has strengthened its senior leadership team, notably appointing the son of Mr. Nguyễn Đức Thụy to a key position.