Illustrative image

On January 27, 2026, Saigon Far Eastern Technology Joint Stock Company (Savitech, Stock Code: SVT) received a decision from the Ho Chi Minh City Tax Department regarding administrative penalties for tax and invoice violations.

According to the decision, Savitech inaccurately declared and underpaid Value-Added Tax (VAT) for the years 2016-2020, as well as Corporate Income Tax (CIT) for the same period. Additionally, the company failed to issue four invoices for capital transfer transactions.

SVT was fined over 1.2 million VND for underreporting VAT in December 2020 (item 4254), more than 500,000 VND for underreporting CIT in 2020 (item 4254), and 6 million VND for not issuing the four required invoices (item 4254).

Furthermore, the company was required to pay over 194.5 million VND in back taxes to the state budget, along with over 150.4 million VND in late payment penalties. The late payment amount was calculated up to January 19, 2026. Savitech is responsible for calculating and paying any additional late fees from January 20, 2026, until the actual payment of taxes and fines to the state budget.

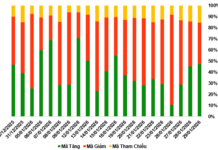

Regarding business performance, in Q4/2025, revenue from sales and services reached nearly 7.4 billion VND, an increase of approximately 6.7 billion VND compared to the same period last year. After-tax profit also rose from 8.4 billion VND to nearly 13.4 billion VND.

The company explained that the significant growth was primarily due to the direct implementation of primary education activities starting from the 2025-2026 academic year, as per the Board of Directors’ resolution. This initiative led to a substantial increase in revenue compared to the previous year.

Additionally, financial income from dividends distributed by affiliated companies during this quarter contributed to the higher financial investment efficiency in Q4/2025 compared to the same period in 2024.

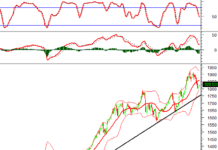

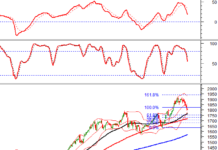

Vinhomes Records Staggering VND 42.111 Trillion Profit in 2025

In 2025, Vinhomes achieved a consolidated net revenue of VND 154,102 billion. The total consolidated net revenue, including core operations and joint business ventures, reached VND 183,923 billion, with a consolidated after-tax profit of VND 42,111 billion, setting new records. These figures surpassed the year’s initial targets, marking a 30% and 20% increase compared to 2024, respectively.

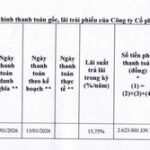

Heart Tam Duc Hospital Declares Additional 10% Cash Dividend

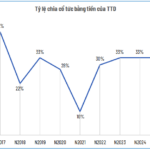

Heart Tam Duc Joint Stock Hospital (UPCoM: TTD) announces the finalization of the shareholder list for the interim dividend payment in cash for the second phase of 2025. The ex-dividend date is set for January 23rd.