Surge in Profits Fueled by Record-Breaking Growth

In 2025, Techcombank achieved a historic milestone with pre-tax profits (PBT) reaching VND 32.5 trillion, marking an 18.2% increase year-on-year and surpassing the targeted range of VND 31.5–31.7 trillion. This solidifies its position among Vietnam’s most profitable commercial banks. Notably, Q4 2025 set a third consecutive quarterly record, with PBT hitting VND 9.2 trillion—a remarkable 94.9% surge compared to Q4 2024.

Total operating income (TOI) for the year climbed to VND 53.4 trillion (+13.6%), driven primarily by net interest income (NII) of VND 38.2 trillion. The net interest margin (NIM) remained stable at 3.9%.

Beyond traditional banking, non-interest income (NFI) contributed VND 11.5 trillion, up 7.8% year-on-year. Investment banking (IB) continued its robust growth, with all core segments—securities brokerage, bond advisory, and other IB services—driving fees to VND 4.2 trillion (+20.7%). While Q4 2025 IB fees dipped 12.9% to VND 797 billion, this short-term slowdown is expected to reverse as market trends remain positive.

Card services revenue fell 15.1% year-on-year to VND 1.7 trillion but rebounded strongly in Q4 2025, rising 6.5% year-on-year and 20.7% quarter-on-quarter. This recovery highlights the success of initiatives aimed at boosting cardholder spending.

Foreign exchange (FX) services shone in Q4, generating VND 314.6 billion (+14.6% year-on-year), thanks to tailored product innovations. Full-year FX income surged 36.9% to VND 1.2 trillion.

Insurance fees skyrocketed 91.8% to VND 1.2 trillion in 2025, with Q4 fees leaping 31-fold year-on-year to VND 361.4 billion, following a successful business model transformation.

Techcombank maintained operational efficiency and prudent risk management. Operating expenses rose just 6.9% to VND 16.4 trillion, primarily due to investments in IT infrastructure. The cost-to-income ratio (CIR) remained at 30.8%.

Provisions increased slightly by 8.3% to VND 4.4 trillion, despite 18.4% credit growth, reflecting the bank’s conservative risk management. Credit costs stabilized at 0.6% and 0.4% post-recoveries, underscoring superior risk governance.

Jens Lottner, Techcombank’s CEO, remarked: *“2025 closed with exceptional momentum, capped by record Q4 profits. This was driven by accelerated net interest income, a strong fee income recovery, and disciplined cost management. Amid global economic uncertainties, these results reaffirm our resilient business model and Vietnam’s economic strength.”*

*“In 2025, we advanced our ecosystem strategy, expanding beyond banking to unlock new growth avenues. The successful IPO of TCX, launch of Techcom Life, and full-year operations of TCGIns enhanced our comprehensive financial services across banking, asset management, capital markets, and insurance.”*

*“As a leading Vietnamese financial group, we’re launching a new 5-year strategy to further shape the industry, strengthen our ecosystem, and deliver greater value to customers and shareholders.”*

Techcom Life, launched in July 2025, secured licensing within six months and introduced products with streamlined digital processes, processing large-value contracts in under 30 minutes.

Techcom Insurance (TCGIns) concluded its inaugural year with VND 500 billion in premiums and 650,000 customers. Its diverse portfolio—spanning health, motor, property, and corporate solutions—solidified its role in Techcombank’s ecosystem.

Robust Balance Sheet and Asset Quality

As of December 31, 2025, total assets surpassed VND 1,190 trillion (+22% year-on-year). Bank-only credit grew 18.4% to VND 824 trillion, fueled by both retail and corporate demand.

Focusing on high-yield assets, retail loans reached VND 372 trillion (+30.8%), led by a 3.5x surge in unsecured lending. Housing loans (+24.7%) and margin loans (+69.3%) also thrived, showcasing comprehensive customer solutions.

Corporate loans hit VND 452.1 trillion (+13.4%), with real estate exposure declining from 33.2% in 2024 to 30.7%, reflecting portfolio diversification.

Deposits grew 17.9% to VND 665.6 trillion, supported by a customer-centric strategy. Techcombank’s customer base expanded to 18 million (+2.7 million), with 62.3% acquired digitally. CASA deposits rose to 40.4% of total deposits, driven by digital solutions like Auto-earning 2.0 and tailored SME offerings.

Liquidity remained robust, with an LDR of 76.5% (vs. 81.2% in Q3) and short-term funding for medium/long-term loans at 24.6%. Despite a VND 7 trillion cash dividend payout in October 2025, the CAR stood at 14.6%, among Vietnam’s highest, balancing safety and shareholder value.

Asset quality remained stellar, with NPLs falling to 1.13% and NPL coverage reaching 127.9%—the ninth consecutive quarter above 100%. This underscores proactive risk mitigation.

Global recognition followed, with S&P Global Ratings upgrading Techcombank to BB and Fitch Ratings revising its outlook to “Positive” (BB-).

Cát Lam

– 18:54 20/01/2026

Vietnam’s “White Gold” Underground Treasure: A Billion-Dollar Export in Global Top 3 Faces Challenges

Vietnam proudly holds the third position globally in exporting this exceptional product. Renowned for its quality and craftsmanship, this item has become a cornerstone of Vietnam’s international trade, captivating markets worldwide. Discover the excellence that defines this globally sought-after export.

Unbelievable: One Tael of Gold Now Enough to Buy a Wave Alpha

With just one tael of gold, you can now own more than just a petrol-powered motorcycle. VinFast’s diverse range of electric motorbikes offers exceptional value, making it possible to purchase multiple models with the equivalent cost of a single tael of gold.

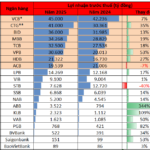

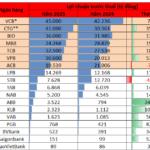

20 Banks Reveal 2025 Profits: HDBank Secures Spot Among Top 3 Private Banks in Earnings

As of January 30th, 2025, 20 leading banks have released their annual business results. This impressive list includes Vietcombank, VietinBank, BIDV, MB, Techcombank, VPBank, LPBank, Sacombank, Nam A Bank, Kienlongbank, ABBank, PGBank, BAOVIET Bank, VietABank, SeABank, ACB, Saigonbank, BVBank, VIB, and HDBank.

January 29th Bank Profit Update: 18 Banks Report Earnings – VietinBank and VPBank Surge, ACB and Sacombank Lag

As of January 29th, 2025, 18 leading Vietnamese banks have released their annual business results. This impressive list includes Vietcombank, VietinBank, BIDV, MB, Techcombank, VPBank, LPBank, Sacombank, Nam A Bank, Kienlongbank, ABBank, PGBank, BAOVIET Bank, VietABank, SeABank, ACB, Saigonbank, and BVBank.