At the Vietstock LIVE program on January 23, 2026, themed “Investment Perspectives 2026,” Mr. Nguyễn Thế Minh, Director of Research and Product Development at Yuanta Vietnam Securities, shared an optimistic outlook on the digital currency market when asked about its prospects.

Specifically, the potential weakening of the US dollar in 2026 is expected to support other currencies and assets, including digital currencies.

Digital currencies have significant growth potential as countries’ reserves are diversifying away from the USD, shifting towards assets like gold and even digital currencies. This shift could position digital currencies as a preferred asset class in the future, reducing reliance on the USD. Additionally, the trend of asset tokenization will further bolster the growth of the digital currency market.

However, Mr. Minh cautioned that digital currencies, such as Bitcoin, are highly volatile and may not be suitable for inexperienced investors. Leveraged investments in digital currencies significantly increase risk exposure.

“While the digital currency trend may continue to grow, investors should focus on risk management. Those with a low risk tolerance should allocate funds to appropriate assets, such as digital currency ETFs, and minimize the use of leverage in their investments,” advised Mr. Thế Minh.

Regarding Resolution 05 recently issued by the Government, Mr. Minh highlighted its role in opening new avenues for businesses to issue and raise capital.

Traditionally, businesses raised capital through IPOs or stock issuances. Resolution 05 introduces an additional option, allowing companies to tokenize their assets or commodities for fundraising.

While Resolution 05 benefits domestic businesses by providing a new capital-raising channel, the current legal framework remains restrictive for individual investors. Further amendments or new policies are needed to create a more inclusive mechanism, particularly for retail investors.

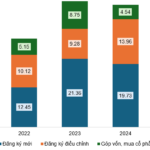

Vietnam’s digital asset market is already substantial, with the country ranking among the top 5 globally in Bitcoin holdings. This underscores the significant demand for digital asset investment in Vietnam.

Looking ahead, Mr. Minh anticipates the launch of digital currency ETFs in Vietnam, offering a more accessible and potentially less risky investment option compared to direct crypto investments. Thailand is expected to launch a similar ETF within the next month.

During the program, Mr. Nguyễn Quang Minh, Director of Research at Vietstock, echoed the sentiment that digital currency investment opportunities are promising in 2026.

Analyzing the past decade’s trends, particularly for Bitcoin, the longest downturns typically lasted around 12 months. Since the peak in August 2025, the market has undergone a prolonged correction, suggesting that the long-term bottom for digital currencies may occur in 2026, likely in Q2 or Q3.

“Based on cycle analysis and various methods, most predictions indicate that the bottom will be reached around mid-year, or at the latest, in Q3,” shared Mr. Quang Minh.

Screenshot of the event

|

Vietnam’s position among the top 5 countries in digital currency investment, despite having a smaller population compared to the top 3, indicates one of the highest digital currency investment rates globally.

Mr. Minh expressed hope for more concrete regulations in the near future, potentially leading to the establishment of an official digital currency exchange in Vietnam, enabling safer and more transparent trading for investors.

– 11:18 24/01/2026

By the End of 2025, Stock Market Capitalization Will Nearly Double Compared to 2020

In his keynote address at the 14th National Party Congress, Minister of Finance Nguyen Van Thang revealed ambitious plans for Vietnam’s financial landscape by 2025. These include upgrading the stock market, with a targeted 1.9-fold increase in market capitalization compared to 2020, as well as establishing and operationalizing an International Financial Center and next-generation free trade zones.

Digital Assets from 2026 and Beyond: Proactive Integration, Risk Management, and Development for National Interests

Starting in 2026, the central challenge will no longer be whether to develop the digital asset market, but rather how to do so in a way that maximizes innovative potential while ensuring absolute systemic security, safeguarding the legitimate rights of citizens, and maintaining national financial stability.

Belgian CEO Embraces “I Am Hai Phong,” Forecasts Unstoppable Growth in Vietnam’s Sector for Next 7-10 Years

Mr. Bruno Jaspaert proactively persuaded the EU delegation to stay in Hai Phong instead of opting for an overnight stop in a nearby coastal city, allowing them to immerse themselves in the local experience.