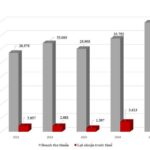

Pre-Tax Profit Surges 21% Annually

According to the 2025 consolidated financial report, TPBank recorded a pre-tax profit of VND 9,203 billion, marking a 21% increase compared to 2024. Amid a challenging market, this double-digit growth highlights the bank’s agile management and efficient resource allocation. Profitability improved further, with a return on equity (ROE) exceeding 18%, up from the previous year and outpacing market averages. This underscores sustained growth quality alongside scale expansion.

Alongside profit growth, TPBank’s operational scale continued to expand, with total assets surpassing VND 506 trillion. Credit growth rose by 18.08%, while market funding increased by approximately 20%, demonstrating robust credit growth and strengthened capital foundations amid intensified competition.

Notably, growth quality remained tightly controlled. The non-performing loan (NPL) ratio decreased to 0.96%, reflecting effective risk management and asset quality oversight. Additionally, the CASA ratio reached 23.02%, indicating stable non-term deposits, which reduce funding costs and enhance long-term profit margins.

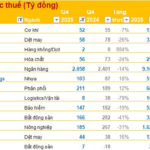

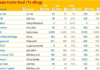

Digital Channels and Services Drive Growth, Enhancing Revenue Quality

In 2025, TPBank’s total operating income (TOI) reached nearly VND 18,900 billion, showcasing continued revenue expansion despite market challenges. Fee-based income totaled approximately VND 4,160 billion, accounting for 22% of total income and rising nearly 24% year-on-year. This highlights a positive trend toward revenue diversification and reduced reliance on traditional credit.

By 2025, TPBank reached 16 million customers, with 99% of transactions conducted via digital channels.

This growth momentum is fueled by the bank’s digital strategy. By year-end 2025, TPBank achieved 16 million customers, with 99% of transactions processed digitally. This shift underscores customers’ transition to digital banking, optimizing operational costs and boosting efficiency.

In 2025, TPBank’s “App TPBank – Peak Convenience. Peak Living” campaign made a significant impact. The 360° marketing initiative ranked TPBank among the top 3 most discussed brands on social media and secured the top spot for positive sentiment on Threads.

These achievements build on years of strategic technology investment. TPBank remains committed to data-driven and AI-powered innovation, with over 80% of core functionalities powered by artificial intelligence.

CEO Nguyen Hung stated, “Our unwavering focus on sustainable growth, rigorous risk management, and disciplined governance has been pivotal. These principles enabled TPBank to navigate 2025’s challenges and position us for future growth opportunities.”

ACB Surpasses VND 1 Quadrillion in Total Assets, Maintains Lowest NPL Ratio in the System, and Strengthens Foundation for Sustainable Growth

In 2025, amidst a volatile economic landscape, Asia Commercial Bank (ACB) achieved a milestone with total assets surpassing VND 1 quadrillion. Maintaining the lowest non-performing loan ratio in the industry, ACB solidified its robust financial foundation. This accomplishment sets the stage for ACB’s new growth cycle, aligned with its sustainable development strategy for 2025–2030.

The Future of Bitcoin (Part 1): Has the Year of Defense Arrived?

Over the past decade, Bitcoin has evolved from a rudimentary digital experiment into a sophisticated macro asset class. While many investors still view this market through the lens of chaotic randomness, where luck seems to reign supreme, even the most frenzied price movements leave behind distinct statistical footprints. These patterns empower savvy investors to gain a decisive trading edge.

GELEX Records Historic Pre-Tax Profit of VND 4.636 Trillion in 2025

GELEX Group Corporation (HoSE: GEX) achieved a pre-tax profit of VND 4,636 billion in 2025, marking the highest level in its history.

Nuclear Energy: Long-Term Preparation, Serious Investment

At the seminar titled “Nuclear Energy: International Experience and Practical Lessons for Vietnam,” experts emphasized that the success of nuclear power is not solely determined by reactor technology. It also critically depends on institutional frameworks, independent oversight mechanisms, safety culture, and, most importantly, the quality of human resources.