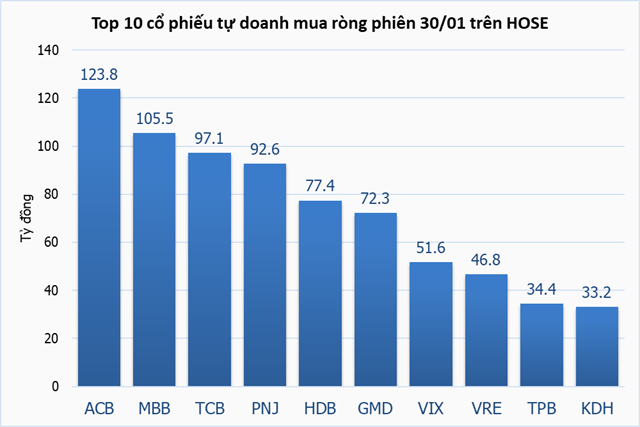

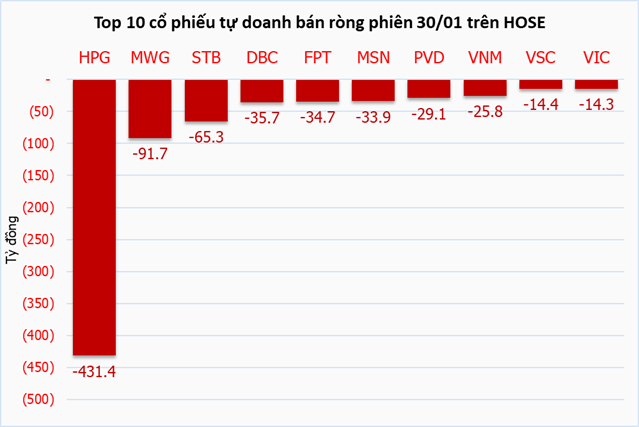

Proprietary trading firms net bought over VND 164 billion on the HOSE today. ACB led the pack with nearly VND 124 billion, followed by MBB at approximately VND 106 billion. Conversely, HPG was the most heavily sold stock by proprietary traders, with a net value of VND 431 billion, far surpassing other stocks.

Source: VietstockFinance

|

Source: VietstockFinance

|

Similarly, foreign investors also net bought today, recording a value of over VND 736 billion. However, in contrast to being the most sold stock in the proprietary trading rankings, HPG became the most heavily purchased stock by foreign investors today, with a value exceeding VND 385 billion.

On the selling side, VIC was the most sold stock by foreign investors, recording over VND 323 billion, followed by ACB at nearly VND 108 billion.

| Foreign Investors Net Buy Again in the January 30 Session |

| Top Stocks with the Highest Net Trading by Foreign Investors in the January 30 Session |

– 6:33 PM, January 30, 2026

Vietstock Daily 29/01/2026: Navigating the 1,800-Point Threshold Challenge

The VN-Index has continued its downward spiral, forming a Big Black Candle pattern, and is now poised to test the critical 50-day Simple Moving Average (SMA) support level. This test will be pivotal in determining the index’s trajectory in the near future.

Market Pulse 19/01: Foreign Investors Return to Net Buying in Large Caps, VN-Index Continues Its Rally

At the close of trading, the VN-Index climbed 17.46 points (+0.93%) to reach 1,896.59, while the HNX-Index rose 2.67 points (+1.06%) to 254.95. Market breadth was relatively balanced, with 344 gainers and 355 decliners. Within the VN30 basket, bullish sentiment prevailed, as 18 stocks advanced, 9 retreated, and 3 remained unchanged.

Vietstock Daily 27/01/2026: Widespread Selling Pressure Intensifies

The VN-Index plunged dramatically, forming a long red candle accompanied by trading volume surpassing the 20-day average, reflecting investors’ subdued sentiment. The index is currently retesting the Middle Band of the Bollinger Bands, while both the Stochastic Oscillator and MACD indicators continue their sharp decline following earlier sell signals.

Vietstock Daily 20/01/2026: Aiming for New Target Zones

The VN-Index regained its upward momentum towards the end of the session, forming a Long Lower Shadow candlestick pattern. In the near term, the index is targeting the 1,935-1,950 range, which aligns with the Fibonacci Projection level of 161.8%.