Domestic gold prices continue to surprise as they surge to unprecedented highs, with selling prices exceeding 19 million VND per tael at many major gold retailers.

According to the updated price list on November 29, SJC gold bars at several retailers are quoted at around 18.83 million VND per tael (buy) and 19.13 million VND per tael (sell). Other products like round gold rings, 24K gold sheets, Dragon Thang Long gold, and gold bars from other brands are also trading in the 19.0–19.13 million VND per tael range for selling prices.

These prices are staggering when compared to high-value consumer goods. For instance, with over 19 million VND per tael, buyers can now purchase a Honda Wave Alpha—a popular gasoline-powered motorcycle in Vietnam. The suggested retail price for the Wave Alpha is approximately 18.7 million VND, lower than the selling price of one tael of gold at many stores.

Beyond gasoline motorcycles, the equivalent value of one tael of gold can also buy several popular electric motorcycle models from VinFast. Electric bikes like the Motio, Evo Lite Neo, and Zgoo are priced between 12–16.9 million VND, significantly below the 19 million VND per tael threshold. Even higher-end models within VinFast’s electric motorcycle lineup remain within reach of the current gold price equivalent.

This comparison is particularly striking when recalling events from over a decade ago. Around 2009–2010, it took an entire tael of gold to purchase a Wave Alpha. At that time, gold was measured in taels, with prices only in the tens of millions of VND per tael, equivalent to the cost of a standard motorcycle.

Today, however, the balance has shifted dramatically. Instead of requiring a full tael, just one-tenth of a tael—equivalent to one tael—is now sufficient to buy a new Wave Alpha, with money left over. This disparity highlights the significant changes in domestic gold prices over the years.

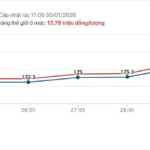

Globally, international gold prices have also caused unprecedented shockwaves, surging past the $5,500 per ounce mark in today’s trading session. Precious metals continue to shatter records amid a severely weakened U.S. dollar, coupled with escalating economic and geopolitical uncertainties reaching alarming levels.

In its latest meeting, the Fed opted to maintain interest rates, assessing that the U.S. economy remains resilient. However, the agency could not conceal its concerns over rising inflation and a bleak outlook. Notably, the presence of two officials advocating for immediate rate cuts has further fueled expectations of policy easing this year.

Additionally, the specter of war in the Middle East has driven safe-haven demand to unprecedented heights. Warnings of military action against Iran, coupled with stern declarations that U.S. naval forces in the region are prepared for “swift and decisive” action, have triggered a gold rush. Compounding this are fears of fiscal deficits, aggressive central bank buying, and massive capital inflows into gold ETFs.

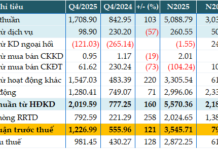

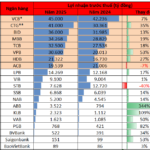

20 Banks Reveal 2025 Profits: HDBank Secures Spot Among Top 3 Private Banks in Earnings

As of January 30th, 2025, 20 leading banks have released their annual business results. This impressive list includes Vietcombank, VietinBank, BIDV, MB, Techcombank, VPBank, LPBank, Sacombank, Nam A Bank, Kienlongbank, ABBank, PGBank, BAOVIET Bank, VietABank, SeABank, ACB, Saigonbank, BVBank, VIB, and HDBank.

Gold Prices Surge to Record High of $5,110/Ounce Globally, Domestic Prices Follow Suit on January 27th

The price of gold bars and gold rings at several leading brands has surged by approximately 300,000 to 600,000 VND per tael today.