Vietnam’s green transition holds immense potential, spanning renewable energy, carbon markets, and innovative financial instruments, particularly when coupled with digital transformation. Mr. Tuan emphasizes that green transition is inseparable from digital transformation, with finance playing a pivotal role.

Establishing green financial mechanisms to build a circular economic value chain

|

Vietnam must develop additional financial tools, expanding into green finance and groundbreaking financial products. International cooperation is a vital channel to bolster resources for the government’s green transition agenda.

The circular economy is emerging as a new growth driver for Vietnam’s dual transition. Decision No. 222/QĐ-TTg dated January 23, 2025, approving the National Action Plan for Circular Economy Implementation by 2035, is a strategic move, concretizing the 2020 Environmental Protection Law, Green Growth Strategy, and National Climate Change Strategy.

Developing a national circularity measurement framework, fostering a green innovation network, and establishing green finance and investment mechanisms for businesses transitioning production models—especially in agriculture, processing industries, and green urban development—are crucial for green economic development in the integration process. The role of international financial institutions, banks, and domestic and foreign credit organizations is increasingly significant.

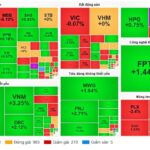

According to the International Finance Corporation (IFC), Vietnam’s green finance market is progressing positively. Green credit has grown at an average annual rate of 21.2%. As of December 31, 2024, environmental protection credit outstanding reached over VND 4,280 trillion, accounting for 27.4% of the total economy’s outstanding debt. Green credit outstanding was approximately VND 680 trillion, up 9.37% from 2023, primarily in renewable energy (41%) and green agriculture (29%). The green bond market recorded VND 33.5 trillion in issuances from 2016–2024. These figures highlight the growing demand for green capital in banking and business sectors.

Francesca Nardini, Deputy Resident Representative of UNDP in Vietnam, believes green transition and circular economy are essential for Vietnam’s sustainable high growth. With government, businesses, and citizens united, the circular economy will underpin a green, prosperous, and competitive Vietnam. International forecasts suggest circular economy could reduce 30-34% of urban waste and 40-70% of greenhouse gas emissions by 2030-2060, while creating jobs and reducing raw material imports. UNDP recommends pilot models to quantify risks and benefits before scaling up.

Despite progress, Vietnam’s green transition faces challenges. Many businesses and farmers maintain outdated production methods, with low sustainable farming standards. Green investment is imbalanced, focusing on energy and agriculture, while waste management, biodiversity, and industrial transformation lag. Despite legal frameworks, Vietnam lacks specific regulations for new financial markets like carbon credits, biodiversity credits, and green insurance.

Phạm Đại Dương, Deputy Head of the Central Policy and Strategy Department, stresses the urgency of dual transformation. Circular economy, integrated with technology and digital transformation, is a strategic pillar for new growth models. This approach optimizes secondary resources, fosters high-value industries, attracts quality investment, and enhances Vietnam’s global value chain position.

Thanh Tuyết

– 07:30 30/01/2026

Prime Minister: Ensuring Seamless Opportunities for Swedish Businesses Investing and Operating in Vietnam

Prime Minister affirms Vietnam’s continued commitment to supporting and facilitating foreign businesses, including SYRE Company, in their investment and operations within the country. This support is grounded in ensuring compliance with Vietnamese law and fostering a spirit of “mutual benefits and shared risks.”