In late January, the bustling gold and silver trading district of Jongno in Seoul witnessed long queues stretching from jewelry stores onto the sidewalks. Surprisingly, these crowds weren’t there to buy gold or hoard precious metals—they were selling silver at its peak price. Many reported waiting up to four hours for their turn to transact.

Silver Cutlery Transforms into a Profitable Asset

The most commonly sold items were silver spoons and chopsticks (Sujeo), traditional gifts for weddings and holidays in South Korea. Historically, these items were kept as mementos, often displayed or stored away, rarely used.

Residents flock to jewelry shops in Jongno, central Seoul, to sell silver items on January 24. Photo: Channel A

At a Jongno jewelry store, a customer sold three old silver spoon sets stored for years. After verifying purity and weight, the owner paid 936,800 KRW (approximately $730)—a price higher than the value of an ounce of gold at the time, astonishing onlookers.

“We skipped lunch to secure our spot, fearing we’d miss out. We hope this money helps cover our upcoming wedding expenses,” shared a young couple in line.

The silver-selling frenzy wasn’t limited to physical stores; it dominated online forums too. On Daum, threads like “Treasure hunting in your kitchen” attracted thousands of discussions. Many excitedly shared discoveries of heirloom silverware, once deemed outdated but now valuable assets.

A Jongno jeweler noted a sharp increase in silver sellers within days. “People bring everything from spoons to plates and pure silver decor. Rarely seen before, it’s now a daily occurrence,” they said.

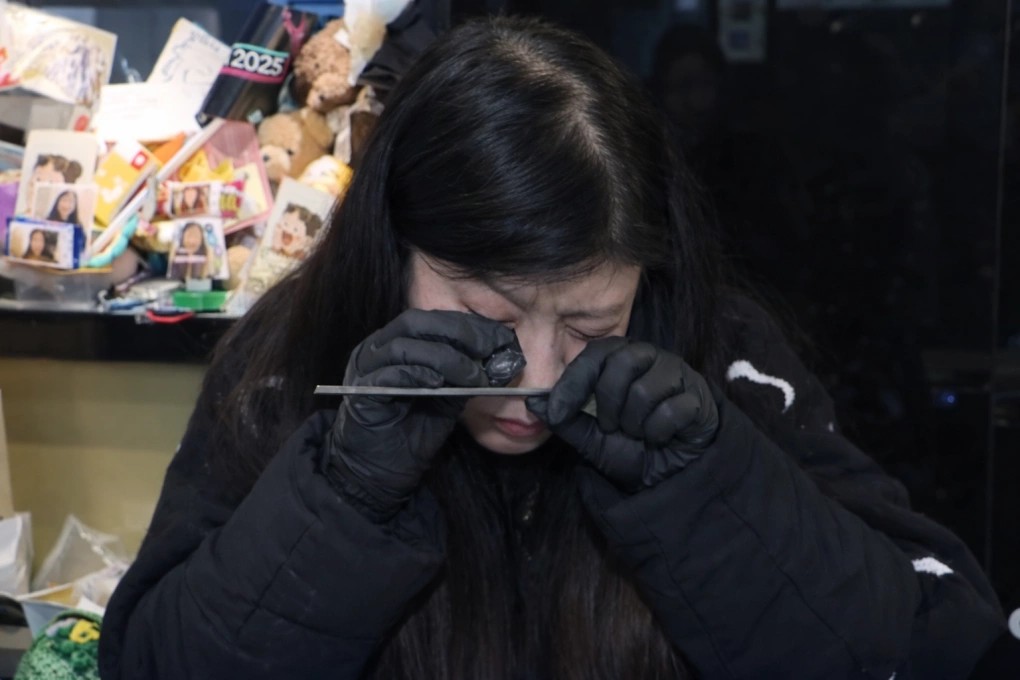

A Jongno jeweler inspects a silver spoon’s quality brought in by a customer on January 24. Photo: Channel A

Tarnished Silver Still Commands High Prices

This silver-selling boom coincides with global price surges. On January 23, silver surpassed $100 per ounce for the first time, closing at $103—a 12% weekly increase. Since the year’s start, it’s risen 45%, pushing its market cap past $5.8 trillion, making it the world’s second-most valuable asset after gold.

In South Korea, silver prices are triple last year’s levels. Sellers aren’t the only beneficiaries; increased demand for small silver bars has led to shortages. A 1 kg silver bar costs nearly 6.8 million KRW ($5,300), requiring deposits and two-month waits for delivery.

Silver cutlery and dishes fetch high prices in South Korea. Photo: Channel A

Jewelry experts confirm that tarnished silver doesn’t diminish resale value. “Purity and weight are key. If they meet standards, sellers receive market-rate offers,” a Jongno shop owner assured.

Lee Jong-won, a Seoul office worker, observed, “Amid economic uncertainty, gold remains the top safe-haven asset, but silver is emerging as the next best option. Clearly, I’m not alone in thinking this.”

As gold prices fluctuate and silver peaks, once-forgotten kitchen utensils are now financial lifelines for many families, at least in the short term.

Silver’s Physical Shortage Deepens, Prices Double, Forecast Hits $100/Ounce

The silver market has witnessed unprecedented volatility in recent months. By the end of November, silver prices surged to an all-time high, marking a remarkable 95% increase from the beginning of 2025. A severe physical silver shortage looms over the market, fueling predictions of sustained price growth.