According to a report by DKRA Consulting, the apartment segment emerged as the most prominent in 2025. The primary supply reached nearly 8,955 units, a significant increase from the previous year and the highest in five years. Consumption stood at approximately 7,419 units, resulting in an absorption rate of 83%, indicating a notable recovery in demand within the primary market.

Notably, transactions were concentrated primarily on newly launched projects, accounting for over 90% of total consumption. This highlights buyers’ preference for projects with clear legal frameworks, transparent progress, and timely launches coinciding with market improvements.

The primary driver of the apartment segment was the luxury product group. High-end and luxury apartments constituted around 90% of the total supply in 2025, pushing primary market prices up by 10-15% year-on-year. In the secondary market, the increase was even more pronounced, ranging from 30-35%, particularly in central and coastal areas.

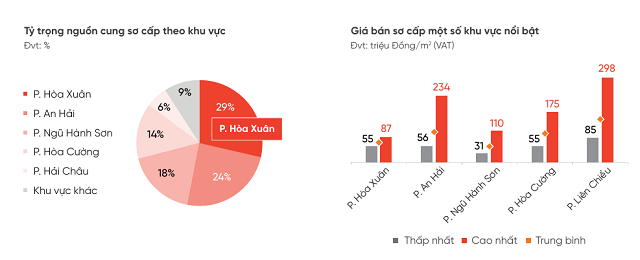

The top 3 primary supply sources in Da Nang are located in Hoa Xuan, An Hai, and Ngu Hanh Son wards. Meanwhile, Lien Chieu ward recorded the highest selling price, reaching nearly 300 million VND/m2. Source: DKRA

|

Alongside apartments, the land plot market saw a 79% increase in primary supply compared to 2024, with consumption surging sixfold, resulting in an absorption rate of approximately 60%. However, transactions were primarily concentrated in a few new projects in Ngu Hanh Son, indicating a localized recovery that has yet to spread evenly across the market.

The townhouse and villa segments were less vibrant. Primary supply slightly decreased from the previous year, with most inventory coming from previously launched projects. Liquidity improved as consumption rose by over 30%, but transactions were limited to large-scale projects with complete legal frameworks and reputable developers. This reflects buyers’ heightened selectivity amidst the market’s recovery phase.

In contrast to the housing segment, the hospitality real estate sector continued to face challenges. In the luxury villa segment, supply increased slightly but primarily consisted of old inventory, accounting for nearly 90% of total listings. Despite a slight uptick in consumption compared to the previous year’s low, the absorption rate remained around 16%, indicating limited liquidity.

The situation was even more subdued in the hospitality townhouse and shophouse segment, with no primary transactions recorded throughout the year, despite existing supply. For condotels, consumption improved compared to 2024, but the absorption rate was only around 9%, reflecting weak demand and prolonged investor caution.

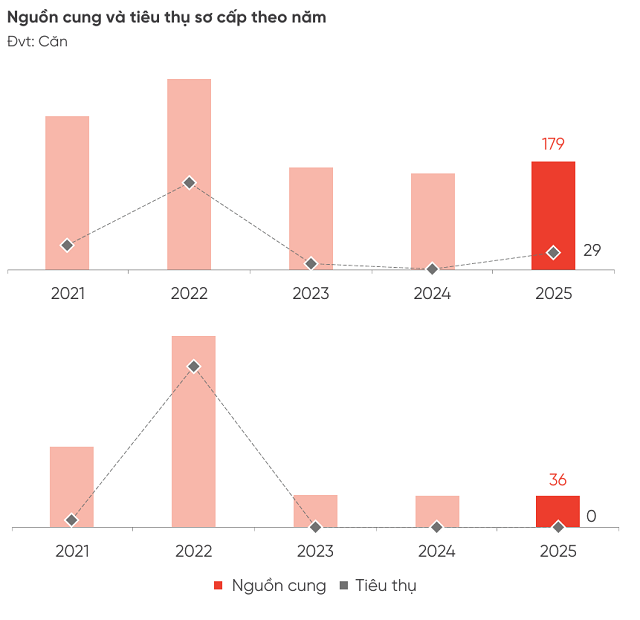

Primary supply and consumption of luxury villas (top) and hospitality townhouses/shophouses (bottom) remain sluggish. Source: DKRA

|

Notably, the stagnation in hospitality real estate occurred despite Da Nang’s tourism sector experiencing a robust recovery. In 2025, the city welcomed approximately 17.8 million visitors, an 18% increase from the previous year, with accommodation revenue reaching nearly 18.5 trillion VND, up by almost 25%. However, according to DKRA, these positive tourism indicators were not strong enough to stimulate the hospitality market, as investor confidence remains low, legal issues persist, and actual operational efficiency raises questions.

Looking ahead to 2026, DKRA forecasts that this polarization will continue. For the apartment segment, new supply is expected to remain at a similar level to 2025, ranging from 6,000 to 7,000 units, primarily in Ngu Hanh Son, An Hai, and Hoa Cuong. High-end and luxury segments will continue to dominate, while primary market prices are projected to remain high due to input costs and supply-demand imbalances.

For land plots and landed housing, new supply is anticipated to increase slightly, but transactions will still focus on projects with complete legal frameworks and large-scale developers. The secondary market may gradually improve, especially for products that have been handed over and possess high liquidity.

Conversely, the hospitality real estate sector is expected to face continued challenges in 2026. New supply will remain scarce, and liquidity is unlikely to improve significantly until legal issues are resolved and investor confidence is restored. Primary market prices are likely to remain stable, while financial support policies will continue to be implemented to stimulate demand, though their short-term effectiveness remains uncertain.

– 10:58 23/01/2026

Da Nang Grants Certifications to Financial Institutions, Ho Chi Minh City Finalizes Financial Hub Framework

At the Steering Committee meeting for the International Financial Center, chaired by Prime Minister Pham Minh Chinh on January 16th in Hanoi, leaders from Ho Chi Minh City and Da Nang presented updates on the implementation progress of key tasks. These tasks encompass institutional frameworks, organizational structures, personnel, and ensuring conditions to achieve the goal of launching the Vietnam International Financial Center into substantive operation as soon as possible.

Unusual Shifts in the Condominium Market After Years of Price Surges

The prolonged price surge in the apartment segment shows signs of stagnation as numerous investors begin to list properties at a loss. Market reports indicate a decline in liquidity, with genuine demand now steering price dynamics, signaling the onset of a corrective phase following the rapid growth cycle.

The 2026 Real Estate Market and Short-Term Speculative Waves

The real estate market outlook for 2026 is poised to enter a new growth cycle, albeit one characterized by selective expansion. This shift will disrupt short-term speculative surges, curbing rapid price escalations in favor of a more sustainable, long-term development trajectory.