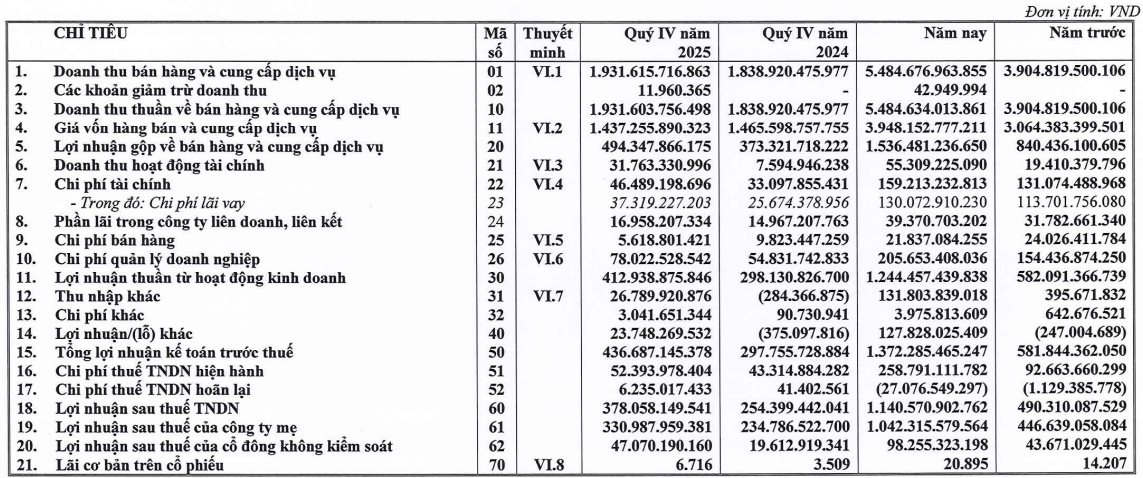

According to the recently released Q4 2025 financial report, Tan Cang Offshore Service Joint Stock Company (stock code: TOS) recorded an after-tax profit of VND 378 billion, a nearly 49% increase compared to the same period last year. This impressive result stems from a 5% rise in net revenue to VND 1,932 billion during Q4.

Notably, a 2% decrease in cost of goods sold significantly improved the gross profit margin. Gross profit from sales and services reached VND 494 billion, a 32% increase compared to Q4 2024, outpacing revenue growth.

The company attributes the surge in after-tax profit to the parent company’s successful deployment of most offshore service vessels and equipment both domestically and regionally, coupled with increased rental rates. Additionally, subsidiaries and associates maintained strong profits compared to the previous year. Furthermore, financial revenue increased due to higher interest income from deposits and loans.

For the full year 2025, TOS achieved a net revenue of VND 5,485 billion, a 40% increase year-over-year. Offshore services contributed the most, accounting for over 50% of total revenue at VND 2,750 billion. Construction contracts followed with 34%, while asset rental contributed 7%. The remaining revenue came from goods sales, business collaborations, and other sources.

After deducting expenses, pre-tax profit reached VND 1,372 billion, a 136% increase. After-tax profit soared to VND 1,141 billion, compared to VND 490 billion in the previous year, representing a remarkable 133% growth. This marks the highest annual profit in the company’s history. Earnings per share (EPS) peaked at VND 20,895, placing TOS among the most profitable companies on the stock market.

TOS significantly exceeded its annual targets, surpassing the revenue plan by 126% and nearly tripling the profit goal.

In terms of scale, as of December 31, 2025, TOS’s total assets reached VND 8,258 billion, an increase of nearly VND 2,600 billion (46%) compared to the beginning of the year. Cash, cash equivalents, and deposits surged to nearly VND 1,686 billion, a 145% increase. Notably, 12-month bank deposits amounted to over VND 632 billion by the end of 2025.

On the financing side, total liabilities increased by VND 1,350 billion to VND 5,487 billion, with short-term and long-term loans and finance leases totaling VND 2,517 billion.

Tan Cang Offshore Service is a member of the Saigon Port Corporation (SNP), a leading military enterprise in port operations and logistics. TOS’s financial statements highlight its close business relationships with related entities.

As of December 31, 2025, short-term receivables from the Navy and Saigon Port Corporation stood at VND 146 billion and VND 132 billion, respectively. Conversely, TOS recorded VND 751 billion in “Short-term customer deposits” from the Navy, a significant decrease from VND 1,402 billion at the beginning of 2025.

On the stock market, TOS shares are currently trading near their all-time high. As of January 29th, the closing price was VND 168,900 per share.

Offshore Drilling Rig Manufacturer Reports 300% Profit Surge in 2025

In 2025, PVY reported cumulative full-year net revenue of approximately VND 1,290 billion and after-tax profit of nearly VND 470 million, a significant improvement from the modest VND 177 million profit in 2024, marking a nearly threefold increase.