Notably, VIB has successfully implemented the Basel III capital calculation system and risk management framework as per the standard method outlined in Circular 14/2025/TT-NHNN. This achievement further solidifies VIB’s position as a pioneer in adopting international governance standards within Vietnam’s banking sector.

Beyond achieving positive financial metrics, VIB has officially concluded its nearly decade-long foundation-building phase. This marks a pivotal transition, setting the stage for the bank’s growth phase starting in 2026—a growth driven by international standards, robust risk management, and sustainable scalability.

Quality-Driven Growth with a Prudent Risk Appetite

As of December 31, 2025, VIB’s total assets exceeded VND 556 trillion, marking a 13% year-on-year increase. Outstanding loans reached nearly VND 382 trillion, growing by 18%, fueled by all three core segments: retail customers, corporate clients, and financial institutions. VIB’s loan products offer competitive interest rates, coupled with streamlined, flexible, and swift processes.

Retail loan balances hit nearly VND 267 trillion, with the retail ratio maintained at a top-tier 70% of total loans. This balanced approach diversifies the customer base and fosters growth across other business segments. In retail banking, VIB continues to selectively expand credit, focusing on core products such as home loans, auto loans, and business loans targeting high-quality customers with robust collateral and full legal compliance.

For corporate and financial institution clients, VIB is accelerating growth in working capital loans, production and business loans, and project investment loans, targeting reputable, financially robust enterprises.

Deposits from retail and corporate customers grew by 10%, reaching nearly VND 306 trillion. CASA balances and Super Savings Accounts surged by 27% year-on-year, reflecting the success of the “Leading Profit Trends” strategy. This strategy combines Super Savings Accounts with the Smart Card cashback program, optimizing both idle and spending funds for customers, delivering a combined benefit of up to 9.3%. Additionally, Hi-Depo and iDepo products continue to diversify deposit portfolios, offering competitive returns.

Enhanced Asset Quality, Aligning with Basel III Risk Management Standards

Thanks to macroeconomic recovery and stringent risk management, VIB’s non-performing loan (NPL) ratio decreased to 2.16% by year-end 2025, the lowest in three years (2023–2025), down 0.28% from the beginning of the year. Stage 2 loans decreased by 15%, contributing to overall asset quality improvement.

As one of the first banks to complete all three Basel II pillars and publish IFRS reports, VIB was selected by the State Bank of Vietnam to join the Basel III implementation steering committee. In December 2025, VIB finalized its Basel III capital calculation system and risk management framework as per Circular 14/2025/TT-NHNN.

Key safety ratios remain optimal: the Basel II Capital Adequacy Ratio (CAR) stands at 11.3% (vs. the required ≥ 8%), the Loan-to-Deposit Ratio (LDR) is 78% (vs. ≤ 85%), the Short-term Funding for Medium-Long Term Loans ratio is 26% (vs. ≤ 30%), and the Net Stable Funding Ratio (NSFR) is 104% (Basel III standard: ≥ 100%).

Diversified Revenue Streams, Increased Contribution from Services and Non-Interest Income

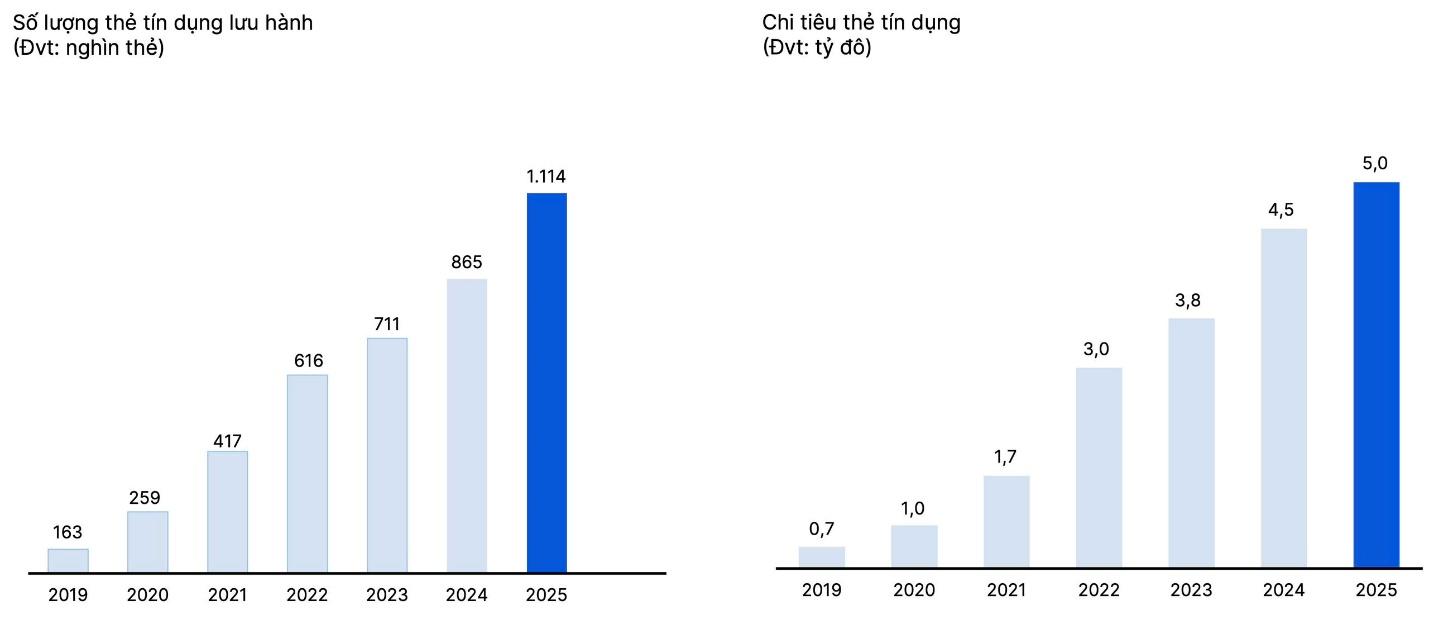

In 2025, VIB achieved total operating revenue of over VND 20 trillion, with non-interest income reaching over VND 3.9 trillion, up 3% year-on-year, accounting for nearly 20% of total operating revenue. Net service income exceeded VND 2.1 trillion, a 19% increase from the previous year. Significant contributions came from retail services, particularly credit cards and insurance. By year-end 2025, VIB officially joined the million-card club with over 1.1 million credit cards in circulation, up 29% year-on-year, and card spending reached USD 5 billion, up 10% year-on-year.

Following a restructuring of insurance products and operating models to better align with customer needs, enhance sales efficiency, and improve contract retention, insurance income surpassed VND 990 billion, more than doubling from the previous year. Income from resolved risky debts reached over VND 1.84 trillion in 2025, up 48% year-on-year, reflecting improved processes, asset quality, and support from the legal environment, including the effective implementation of Resolution 42.

In summary, 2025 saw VIB’s pre-tax profit exceed VND 9.1 trillion, up 1% year-on-year, driven by diversified revenue streams, improved asset quality, and effective cost control.

Foundation Phase Complete, Ready for a New Growth Era

VIB’s development journey can be divided into three phases: pre-2017 focused on building and refining the ecosystem of products, services, and core features; 2017–2025 centered on establishing international-standard governance, technology, and operational models; and from 2026, marking its 30th anniversary, VIB enters a growth phase with a proactive mindset—accelerated growth powered by technology, innovation, and modernity.

By year-end 2025, VIB had achieved its strategic goals a year ahead of schedule, maintaining an average annual growth rate of 20–30% in key metrics such as total assets, credit, customer base, and profit. This cements VIB’s position as a leading retail bank. In 2025, VIB was ranked among the Top 500 most valuable global bank brands by Brand Finance and honored as an Outstanding Asian Enterprise by Enterprise Asia. Additionally, the bank received numerous awards for its products and services from prestigious international partners and organizations such as IFC, J.P. Morgan, Visa, Euromoney, and Global Business Outlook.

VIB’s 9-year transformation results in key metrics

Amid the Vietnamese government’s ambitious targets for double-digit GDP growth, VIB has set equally ambitious growth goals. Building on its expanding asset base, the bank aims for an average annual growth rate of 20–30% in key metrics. The development strategy is built on pillars including strengthening retail banking, selectively expanding corporate banking, leveraging transaction banking strengths, driving digital banking and comprehensive digitalization, and focusing on talent acquisition and development. With a solid foundation, VIB is poised to become a leading bank—strong in scale and superior in quality.

Bank Doubles Loan Loss Provisions: Defensive Move or Preparation for Growth?

At the close of the 2025 fiscal year, Asia Commercial Bank (ACB) presented a business landscape characterized by both prudence and ambition. While total assets surpassed the 1 quadrillion VND milestone, propelling the bank into the elite group of “quadrillion-asset” institutions, a more than doubling of credit provisioning costs compared to 2024 eroded pre-tax profits, leaving them at approximately 19.5 trillion VND for the year.

ACB Surpasses VND 1 Quadrillion in Total Assets, Maintains Lowest NPL Ratio in the System, and Strengthens Foundation for Sustainable Growth

In 2025, amidst a volatile economic landscape, Asia Commercial Bank (ACB) achieved a milestone with total assets surpassing VND 1 quadrillion. Maintaining the lowest non-performing loan ratio in the industry, ACB solidified its robust financial foundation. This accomplishment sets the stage for ACB’s new growth cycle, aligned with its sustainable development strategy for 2025–2030.

The Future of Bitcoin (Part 1): Has the Year of Defense Arrived?

Over the past decade, Bitcoin has evolved from a rudimentary digital experiment into a sophisticated macro asset class. While many investors still view this market through the lens of chaotic randomness, where luck seems to reign supreme, even the most frenzied price movements leave behind distinct statistical footprints. These patterns empower savvy investors to gain a decisive trading edge.

Nuclear Energy: Long-Term Preparation, Serious Investment

At the seminar titled “Nuclear Energy: International Experience and Practical Lessons for Vietnam,” experts emphasized that the success of nuclear power is not solely determined by reactor technology. It also critically depends on institutional frameworks, independent oversight mechanisms, safety culture, and, most importantly, the quality of human resources.