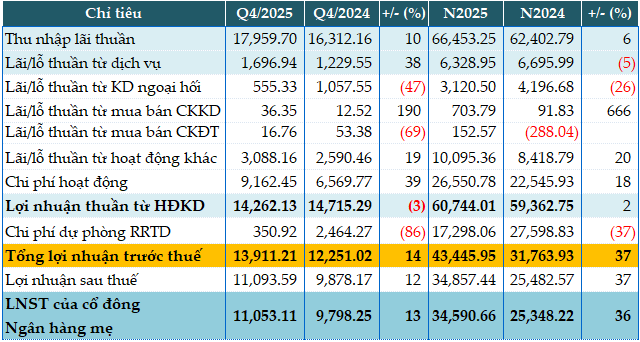

In 2025, VietinBank’s net interest income rose by 6% year-on-year, reaching over VND 66,453 billion.

Conversely, service income dipped by 5% to VND 6,329 billion, and foreign exchange trading profits declined by 26% to VND 3,121 billion.

On a positive note, securities trading generated nearly VND 704 billion, a 7.6-fold increase from the previous year, while investment securities turned a loss into a VND 153 billion profit. Other operating income also saw a 20% uptick, reaching VND 10,095 billion.

However, operating expenses climbed by 18% to VND 26,550 billion, resulting in a modest 2% growth in net operating profit to VND 60,744 billion.

VietinBank significantly reduced its risk provisioning costs by 37%, allocating only VND 17,298 billion, which led to a 37% surge in pre-tax profit to VND 43,445 billion.

|

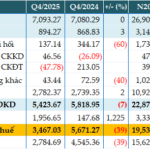

Q4 and 2025 Business Results of CTG. Unit: Billion VND

Source: VietstockFinance

|

The bank’s total assets as of year-end stood at nearly VND 2,770 trillion, a 16% increase from the beginning of the year. Customer loans grew by 16% to over VND 1,990 trillion, while customer deposits rose by 12% to VND 1,790 trillion.

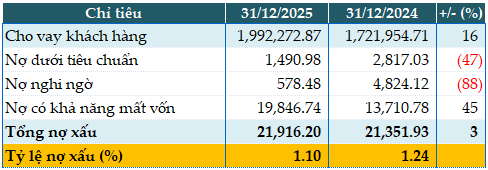

Non-performing loans as of December 31, 2025, edged up by 3% from the start of the year to VND 21,916 billion. This shift was marked by a transition from substandard and doubtful debts to potential loss debts. Consequently, the NPL ratio decreased from 1.24% at the beginning of the year to 1.1%.

|

Loan Quality of CTG as of December 31, 2025. Unit: Billion VND

Source: VietstockFinance

|

– 10:56 AM, January 31, 2026

ACB’s Total Assets Surpass 1 Quadrillion VND, FDI Credit Soars 170%

Asia Commercial Bank (HOSE: ACB) reported a pre-tax profit of nearly VND 19,539 billion in Q4/2025, reflecting a modest 7% year-on-year decline due to heightened credit risk provisions. Notably, total assets surpassed VND 1,000 trillion by year-end, while non-performing loans significantly decreased compared to the beginning of the year.