Seizing the Global Supply Chain Shift and Venture Capital Mindset Changes for Breakthrough Momentum

Over a decade after the 2008-2009 global financial crisis, the 2024-2026 world economic map is witnessing a strong reversal in macroeconomic governance thinking. For a long time, governments and central banks prioritized stability, accepting low growth to ensure systemic integrity. However, pressures from public debt, healthcare costs, and rapidly aging societies have forced many nations to shift their mindset. They are now relaxing regulations and embracing higher risks to seek new growth drivers, recognizing that excessive safety can lead to stagnation and fiscal depletion in the future. This pivotal shift has injected new vitality into international investment flows and cross-border trade, with Vietnam poised to be one of the biggest beneficiaries.

As the global economy embraces risk-taking for breakthroughs, Vietnam must skillfully leverage foreign capital to strengthen its internal capabilities and resolve long-term structural challenges.

According to Dr. Chu Thanh Tuan, Deputy Head of the Bachelor of Business Program at RMIT University Vietnam, the shift of major economies toward a “risk-accepting” state has inadvertently created a favorable corridor for countries with high economic openness. As massive consumer markets like the US, Europe, and Japan ramp up investment and consumption to stimulate growth, demand for Vietnamese exports will surge.

Notably, the ongoing global supply chain shift to diversify risks away from traditional production hubs continues to gain momentum. Vietnam is no longer seen merely as a low-cost manufacturing hub but is increasingly recognized as a strategic destination for high-tech industries, clean energy, and R&D centers. “The FDI flowing into Vietnam during this period brings not only financial resources but also stricter and more modern production standards, driving a comprehensive upgrade of the domestic production system,” noted economist Dr. Nguyen Minh Phong.

The synergy between the world’s risk-taking mindset and domestic enterprises’ breakthrough efforts is key for Vietnam to seize global tailwinds.

From the perspective of a business leader directly involved in supply chains, Mr. Tran Anh Duc, Director of a precision engineering firm in Bac Thang Long Industrial Park, noted a clear shift in foreign partners’ mindset. Orders from 2025 onward often come with long-term cooperation proposals and technology transfer support. Partners are willing to jointly invest in automation systems and meet European green certifications to ensure stability and sustainability in their supply chains. “I believe this is the time for domestic enterprises to ‘restructure their ranks’ and boldly invest in risky technologies to avoid being left behind. The synergy between the world’s risk-taking mindset and domestic enterprises’ breakthrough efforts is key for Vietnam to seize global tailwinds,” Mr. Duc emphasized.

However, the excitement from foreign capital and exports also brings inherent risks. Dr. Chu Thanh Tuan warned that the high degree of external dependence makes Vietnam’s economy more sensitive than ever to international financial shocks. If major economies fail to manage their risk-taking and trigger financial bubbles or sudden recessions, Vietnam will directly bear the consequences through reduced orders and capital outflows. Lessons from past supply chain disruptions remain highly relevant. Therefore, instead of attracting FDI at all costs, Vietnam needs a more nuanced filter, prioritizing projects with strong linkages to domestic enterprises and avoiding the creation of “production enclaves” that exploit tax and labor incentives before leaving when conditions are no longer favorable.

Building Robust Internal Capabilities and Fiscal Discipline to Avert the Risk of ‘Growing Old Before Growing Rich’ in the Digital Age

While the world presents many opportunities for acceleration, internal capabilities are the decisive factor in whether Vietnam can go far and sustainably. According to many economic experts, one of the biggest structural challenges the economy faces is the rapid aging of the population. Vietnam is entering this phase at one of the fastest rates globally, posing a critical challenge to improve labor productivity and offset future labor supply shortages. The risk of ‘growing old before growing rich’ is real if we fail to utilize the next 10-15 years to shift the growth model from resource- and cheap labor-based to knowledge- and technology-based.

The biggest risk for Vietnamese enterprises today is the delay in upgrading management capabilities and technological levels.

Commenting on this issue, Dr. Mac Quoc Anh, Vice Chairman and Secretary-General of the Hanoi Small and Medium Enterprises Association (Hanoisme), believes that the domestic business community faces a harsh test of its ability to reinvent itself. According to Mr. Anh, most small and medium enterprises still operate in the lower segments of the value chain, primarily engaged in processing and assembly based on existing designs. This results in thin profit margins and low resilience to input cost fluctuations or stringent environmental regulations from export markets.

Furthermore, he stressed that the biggest risk for Vietnamese enterprises today is not investing in digital transformation but the delay in upgrading management capabilities and technological levels. To survive and thrive, enterprises must boldly invest in higher value-added stages such as design, branding, and after-sales service.

Additionally, the Vice Chairman of the Hanoi Small and Medium Enterprises Association urged the government to implement more substantive and tailored policies to help domestic enterprises strengthen their linkages. Diversifying export markets through free trade agreements (FTAs) requires detailed guidance for each industry to ensure enterprises can truly benefit. When the internal capabilities of domestic enterprises are strengthened, they will become important “satellites” for multinational corporations, retaining more economic value within Vietnam. This is also the best way to build a self-reliant economy capable of withstanding the unpredictable fluctuations of the global financial market.

From a macroeconomic perspective, Dr. Chu Thanh Tuan affirmed that despite the global trend toward risk acceptance, Vietnam must maintain fiscal discipline and banking system safety. We do not have the policy space of developed economies to conduct extreme relaxation experiments. Controlling inflation, stabilizing exchange rates, and ensuring credit flows into real production sectors are vital tasks. Revenues from this favorable growth period should be prioritized for strategic infrastructure investments such as transportation, renewable energy, and especially high-quality education systems. Investing in people is the most robust “breakwater” for Vietnam to overcome demographic shocks and achieve high-income status.

Looking at the broader picture, the 2024-2026 period is not just about pursuing short-term growth figures but a golden opportunity for Vietnam to implement substantive economic structural reforms. The courage to accept calculated risks for innovation must be accompanied by a long-term vision and steadfastness in safeguarding macroeconomic foundations. As economic experts consistently emphasize, Vietnam has the opportunity to accelerate its development trajectory, but this journey will only be sustainable if each step strengthens internal capabilities, transforming fleeting opportunities into enduring national strength.

Three Key Variables Stock Investors Must Monitor Over the Next 3–6 Months, According to Dragon Capital

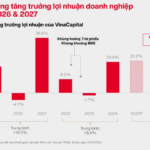

Dragon Capital highlights a powerful convergence of factors fueling optimism: accelerated production, rebounding consumer spending, record-breaking tourism, and consistent investment inflows. This combination sets the stage for robust profit growth and strengthens market confidence.

Unprecedented Milestone: Vietnamese Stock Market Achieves Historic Feat

In 2025, Vietnam’s stock market achieved an unprecedented milestone: mobilizing a record-breaking 141 trillion VND, a feat never seen before, according to Mr. Nguyễn Quang Thuân, Chairman of FiinGroup and FiinRatings.

“VIP Guests Gather at FChoice 2025 Honors Ceremony, Sharing Insights on Seizing Investment Opportunities in 2026”

With the participation of numerous experts, business leaders, and entrepreneurs, the FChoice 2025 Awards Ceremony and the “Double-Digit Economic Growth Drivers and Investment Opportunities in 2026” Seminar emerged as a pivotal platform. This event seamlessly bridges macroeconomic perspectives with practical investment insights, fostering meaningful connections and strategic discussions.