In its 2026 macroeconomic report, VinaCapital presents an optimistic outlook for Vietnam’s economic growth, projecting a potential GDP increase of around 10% under a positive scenario. The driving forces behind this growth are attributed to the gradual recovery of domestic consumption, stable export performance, and the ripple effects of substantial infrastructure investment disbursements in 2025.

Michael Kokalari, Director of Macroeconomic Analysis and Market Research at VinaCapital, notes that Vietnam’s GDP growth in 2025 was primarily fueled by exports and tourism. Notably, electronics and computer exports to the U.S. surged by 80% year-on-year, while tourist arrivals from China and India increased by 42%. These factors have offset the relatively modest growth in domestic consumption over the past two years.

Looking ahead to 2026, Kokalari anticipates that both export growth and consumption will normalize and begin to support each other. Importantly, the delayed impact of large-scale infrastructure investments in 2025 is expected to become a significant pillar for economic growth.

VinaCapital identifies three key drivers for 2026 GDP growth: a moderate recovery in domestic consumption, the strong linkage between infrastructure investment and the real estate market, and sustained stable exports to the U.S.

The delayed impact of large-scale infrastructure investments in 2025 is expected to become a significant pillar for economic growth.

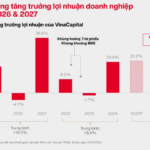

In its baseline scenario, VinaCapital forecasts Vietnam’s GDP to grow by approximately 8% in 2026. Under a more optimistic scenario, growth could reach 10%, supported by substantial policy flexibility that allows the government to implement growth-supportive measures as needed.

Regarding consumption, VinaCapital expects it to return to a more normal growth trajectory by mid-2026, though a significant surge is unlikely. After nearly three years of high savings rates, households have largely replenished their pre-pandemic savings. Additionally, household incomes have grown by 6-7% annually over the past two years, while the stock market and real estate prices both rose by over 30% in 2025, creating a positive wealth effect that supports spending.

VinaCapital estimates that these measures will contribute approximately 0.5% to GDP growth, indicating that there remains considerable room for the government to implement more aggressive policies.

Another critical pillar of the 2026 growth strategy is infrastructure investment. VinaCapital highlights the strong interconnection between public investment, real estate development, and consumption. Public investment disbursements increased by around 40% in 2025 and are projected to rise by an additional 20-30% in 2026.

With ample fiscal space, as public debt remains below 40% of GDP, and with ongoing resolutions to land clearance and project approval challenges, infrastructure investment is poised to continue driving growth.

Furthermore, legal reforms are paving the way for an increased supply of real estate. Many previously stalled projects may be reactivated, creating a ripple effect across consumption and related sectors.

Deo Ca Joint Venture Accelerates $1.6B Highway Project, Aiming for One-Year Early Completion; Chinese Firms Eager to Partner

Numerous contractors have expressed their eagerness to partner with the consortium of investors, ensuring the project reaches its completion as per the scheduled timeline.

Cautious Investors Beware: Market Margins Reach New Heights

In addition to margin risks, this securities company also highlights the potential dangers arising from the rapid surge in stock prices of mega-cap companies over the recent period.