Illustrative image

According to preliminary statistics from the General Department of Customs, Vietnam’s textile and garment exports in December 2025 surged by 22.9% compared to November, reaching over $3.65 billion. For the entire year of 2025, the total export turnover exceeded $39.64 billion, marking a 7% increase from 2024.

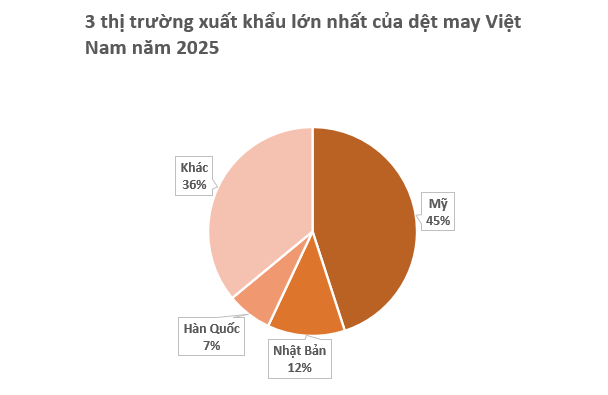

Currently, Vietnamese textile and garment products are present in 138 markets worldwide. The United States remains the largest market, with exports totaling over $17.88 billion, a 10% rise compared to 2024. Japan follows as the second-largest market with $4.6 billion, up 6%, while South Korea ranks third with $2.89 billion, despite an 8.3% decline.

Additionally, exports to Southeast Asian markets accounted for 5.4%, reaching over $2.13 billion, a 1.7% increase from 2024.

Vietnam maintains its position as the world’s third-largest textile and garment exporter, trailing only China and Bangladesh. In 2025, the industry faced significant challenges, including volatile cotton and fiber prices, rising logistics costs, and stricter customer demands for delivery timelines, product quality, and traceability. Meanwhile, processing prices trended downward.

U.S. tariff policies further pressured the global textile supply chain, forcing manufacturers, including Vietnamese enterprises, to share increased costs, eroding their competitive edge against low-cost exporters like Bangladesh and Indonesia.

Natural disasters in northern and central Vietnam directly impacted production. Flooding halted operations at several factories, and labor shortages during peak production periods delayed deliveries, incurring additional costs for businesses.

Despite these challenges, 2025 was another year of resilience for the textile industry. Apparel exports remained dominant, contributing over $38 billion to total export turnover.

This success stems from the industry’s flexible and adaptive management, particularly the efforts of the Vietnam Textile and Garment Group (Vinatex). In 2025, Vinatex launched the “90-Day Sprint” campaign to maximize output and meet deadlines, hosted industry seminars to update market insights, expanded its customer base, diversified export markets, and increased focus on mid- to high-end segments and technically complex products.

Guided by VITAS, the industry will focus on three strategic pillars from 2026 onward: market, customer, and product diversification; domestic raw material supply development; and accelerated automation, digital transformation, and new technology adoption. Export targets are set at $48–49 billion for 2026 and $64.5 billion by 2030.

According to VITAS leadership, there is significant potential to enhance the value-added of garment exports. To boost profitability and competitiveness, enterprises must shift from mass production to higher-skilled, knowledge-intensive segments. Foreign customers are increasingly opting for custom-tailored orders rather than bulk purchases, signaling this shift.

What Vinatex Leaders Forecast for 2026 Amid Sluggish Global Textile Demand?

Despite the textile market’s modest 3% growth forecast, Vietnam National Textile and Garment Group (Vinatex, UPCoM: VGT) ambitiously targets higher growth. This strategy hinges on expanding market share and enhancing operational efficiency.

Vinatex Units Unveil 2025 Results and 2026 Plans in Unison

The year-end financial landscape reveals a notable upswing across numerous member companies, as the parent entity, Vietnam National Textile and Garment Group (Vinatex, UPCoM: VGT), simultaneously surpasses its profit targets.