Illustrative Image

This product is cassava.

In reality, cassava and its derivatives are considered one of Vietnam’s key agricultural export commodities, significantly contributing to the country’s agricultural export turnover. They also play a vital role in creating jobs and income for farmers.

According to the Vietnam Cassava Association, in recent years, while many major agricultural exports have faced challenges, the export turnover of cassava and its products has maintained relatively stable growth. Specifically, in 2025, the total domestic consumption and export value of the cassava industry is estimated to reach approximately 1.3 – 1.5 billion USD. This achievement positions Vietnam as the world’s third-largest cassava exporter and the second-largest consumer globally.

According to statistics from the General Department of Customs, in 2025, Vietnam’s exports of cassava and its products reached over 3.9 million tons, equivalent to more than 1.26 billion USD; representing a 52.2% increase in volume and a 9.8% increase in value. Experts note that the significant disparity between the growth rates in volume and value indicates that the export efficiency of cassava has not yet matched its export scale.

Furthermore, in 2025, Vietnam’s cassava exports remained heavily concentrated in the Chinese market, with a volume of approximately 3.7 million tons, equivalent to 1.17 billion USD (accounting for 94.1% of the total volume and 92.6% of the total export value). However, compared to 2024, while the total export volume to China increased by 54.3%, the value only rose by 10.8%. This reflects a trend of declining average export prices and the risk of price suppression due to heavy reliance on a single market.

Besides China, Vietnam also exports cassava to other markets such as Malaysia, Taiwan (China), and the Philippines. However, the export scale to these markets remains small and insufficient to balance the market structure.

According to experts, Vietnam’s cassava supply chain still faces numerous challenges, particularly in meeting new requirements for traceability and environmental sustainability.

This information was shared and discussed at a meeting themed “Vietnam’s Cassava Supply Chain: Current Situation and Challenges,” organized by the Vietnam Association of Agricultural Economists and Rural Development in collaboration with the Vietnam Cassava Association and Forest Trends in Hanoi on January 28.

Vietnam’s Cassava Industry Faces Numerous Challenges

Cassava and its products generate billion-dollar export revenues for Vietnam. Illustrative Image

At the meeting, Mr. Nghiem Minh Tien, Chairman of the Vietnam Cassava Association, stated that the production, processing, and trade of cassava significantly contribute to Vietnam’s agricultural trade. Over time, the cassava industry has gradually invested in environmentally friendly practices and expanded the application potential of its products.

The Chairman of the Vietnam Cassava Association shared that currently, Vietnam is both a major producer of raw cassava and a regional processing and export hub. In fact, the country’s annual raw cassava supply exceeds 18 million tons (fresh weight). Of this, approximately 58% comes from domestic production, and 42% from imports, primarily from Laos and Cambodia. The domestic cassava cultivation area is over 500,000 hectares, providing around 10 million tons of fresh cassava annually. Therefore, the imported cassava volume is approximately 8 million tons.

At the meeting, experts suggested that in the context of strong growth in cassava export volume but slow growth in value, the fundamental and long-term solution is to enhance added value through deeper processing. In the immediate term, there is a need to gradually reduce the proportion of dried cassava chips and preliminary processed starch exports. Simultaneously, investment in high-tech products such as modified starch and products for the food and pharmaceutical industries should be encouraged. According to experts, this direction is crucial for improving efficiency, sustainability, and reducing dependence on raw material market fluctuations.

Additionally, a significant challenge facing Vietnam’s cassava industry is traceability. On this issue, Mr. Nguyen Vinh Quang, representative of Forest Trends, stated that to ensure traceability, Vietnam’s cassava industry needs to restructure its current supply chain and strengthen production control, particularly land use management. Furthermore, informal activities should be gradually formalized, the entire chain should be made transparent, and sufficient evidence for traceability should be ensured.

Sharing the same view, Dr. To Xuan Phuc of Forest Trends added that restructuring the supply chain to enable traceability requires appropriate prioritization from the government and relevant agencies. According to him, compared to other billion-dollar industries like coffee and timber, the cassava industry has not received adequate attention from the government. In reality, with 1.2 million farming households (including many in difficult regions) participating in production, the cassava industry deserves greater government attention.

Vietnam is currently the world’s third-largest cassava exporter and the second-largest consumer globally. Illustrative Image

According to Dr. Ha Cong Tuan, Chairman of the Vietnam Association of Agricultural Economists and Rural Development, the biggest challenge in ensuring traceability for Vietnam’s cassava industry lies in the raw materials, both from domestic farmers and imports.

On the other hand, he noted that the domestic supply is primarily cultivated on small, dispersed farmlands, sold through intermediaries, and lacks information on land use and transactions between farmers and intermediaries. This makes traceability difficult and, in many cases, impossible. Similarly, challenges exist in the import supply chain, as importing enterprises lack information on cultivation areas and evidence of transactions.

From the business perspective, the Chairman of the Vietnam Cassava Association affirmed that domestic cassava enterprises are committed to building a transparent supply chain that meets requirements for forest protection, environmental conservation, and traceability. Additionally, cassava businesses have requested that relevant agencies promptly provide specific guidelines and appropriate support mechanisms to effectively implement these new requirements.

In reality, the Vietnamese government has issued several important policies to guide the sustainable development of the cassava industry, notably the “Sustainable Development Plan for the Cassava Industry until 2030, with a Vision to 2050,” along with mechanisms to encourage production linkages and appropriate development.

However, the implementation of these policies in practice still faces many limitations. Specifically, there is a lack of detailed guidance, monitoring tools, and insufficient incentives to encourage supply chain actors to comply with traceability, transparency, and forest protection requirements.

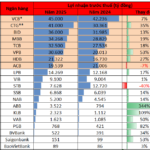

20 Banks Reveal 2025 Profits: HDBank Secures Spot Among Top 3 Private Banks in Earnings

As of January 30th, 2025, 20 leading banks have released their annual business results. This impressive list includes Vietcombank, VietinBank, BIDV, MB, Techcombank, VPBank, LPBank, Sacombank, Nam A Bank, Kienlongbank, ABBank, PGBank, BAOVIET Bank, VietABank, SeABank, ACB, Saigonbank, BVBank, VIB, and HDBank.

Electric Scooter Race: Industry Giants Compete for Dominance

Leading international motorcycle brands such as Honda, Yamaha, and SYM are strategically expanding their electric motorcycle offerings in Vietnam.