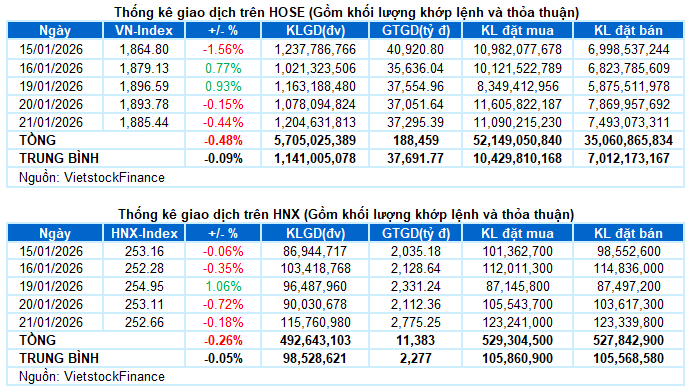

I. MARKET ANALYSIS OF THE UNDERLYING STOCK MARKET ON JANUARY 21, 2026

– Major indices continued to decline during the January 21 trading session. The VN-Index fell by 0.44%, closing at 1,885.44 points. The HNX-Index also experienced a slight decrease of 0.18%, reaching 252.66 points.

– Trading volume on the HOSE increased by 13.9%, surpassing 1.1 billion units. The HNX recorded nearly 107 million matched orders, a 24.2% rise compared to the previous session.

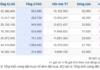

– Foreign investors continued to net sell, with a value exceeding VND 344 billion on the HOSE, but still net bought over VND 88 billion on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

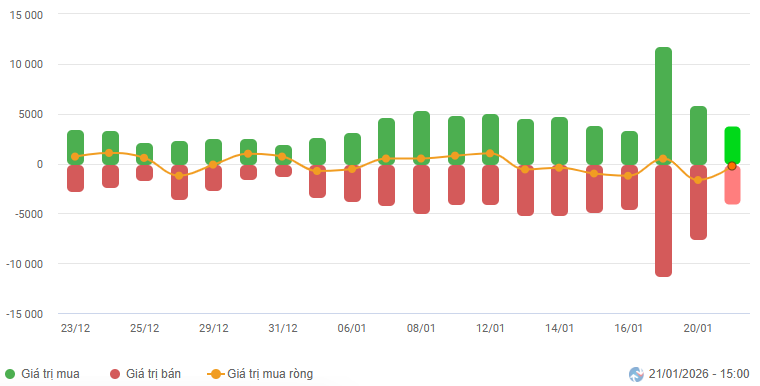

Net Trading Value by Stock Code. Unit: Billion VND

– The market experienced widespread adjustments during the January 21 session. Under significant pressure from large-cap stocks, the VN-Index quickly lost over 20 points just minutes after opening. Despite bottom-fishing demand emerging and helping the index recover briefly, each upward attempt faced increased selling pressure, preventing the VN-Index from turning green. In the afternoon session, the volatility persisted with a widened range, dipping to around 1,860 points at one point before recovering and narrowing the decline by the close. The VN-Index ended at 1,885.44 points, down 0.44% from the previous session.

– Across market capitalization groups, all three indices—VS-LargeCap, VS-MidCap, and VS-SmallCap—declined, indicating widespread adjustment pressure.

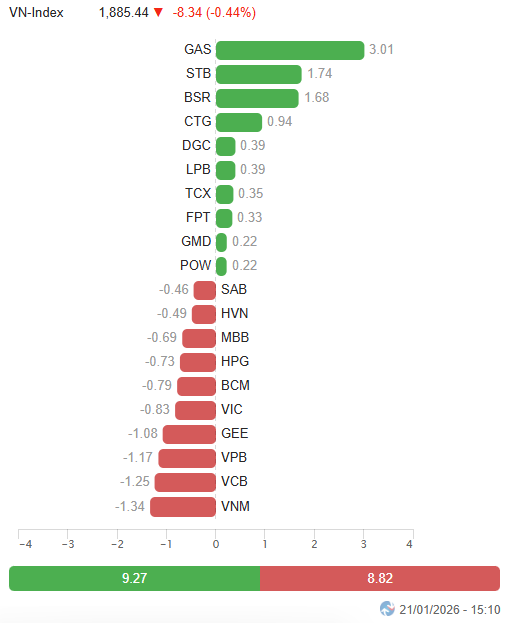

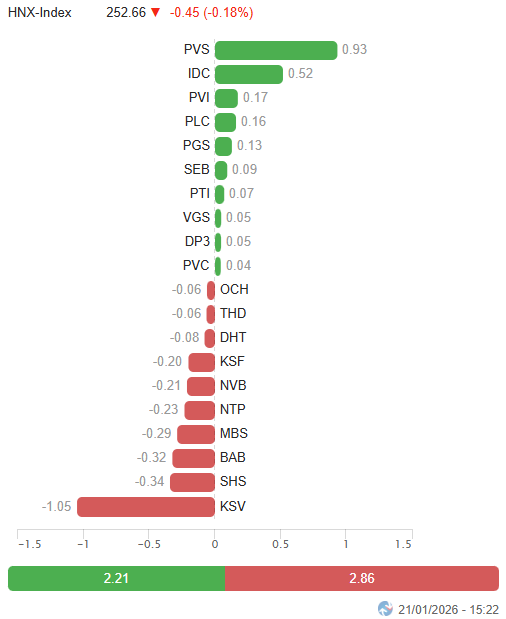

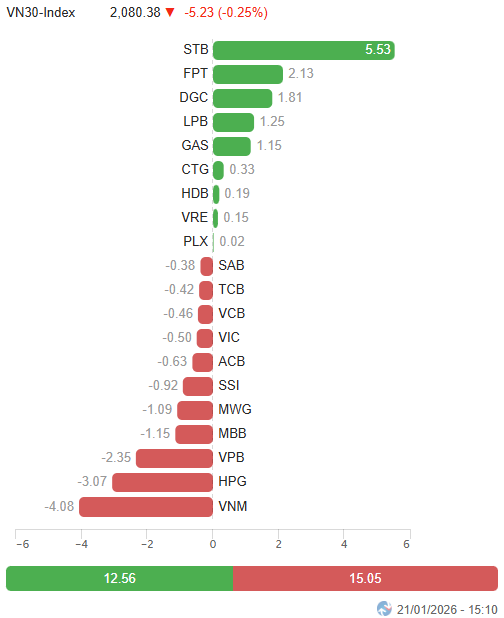

– In terms of impact, GAS led by contributing 3 points to the VN-Index, followed by STB and BSR adding 3.4 points. Conversely, the most significant downward pressure came from VNM, VCB, VPB, and GEE, which collectively reduced the index by 4.8 points.

Top Stocks Influencing the Index. Unit: Points

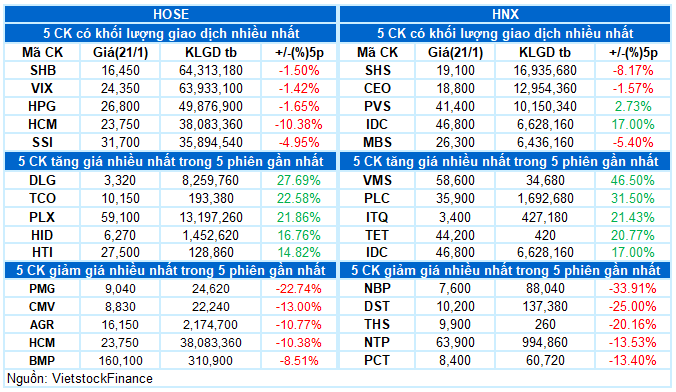

– The VN30-Index fell by 5.23 points (-0.25%), closing at 2,080.38 points. The breadth was negative, with 20 decliners, 9 advancers, and 1 unchanged stock. Notably, BCM and VNM led the decline with over 4% drops, followed by SAB, SSI, and VPB, which faced significant pressure with declines exceeding 2%. Conversely, DGC and STB bucked the trend with strong gains, while GAS also attracted positive demand, surging by 5.3%.

Among sectors, industrials were the hardest hit, with numerous stocks facing over 2% adjustments, including ACV, HVN, MVN, GEE, VEA, GEX, VGC, VEF, VTP, CII, HAH, and PC1.

Additionally, financials and essentials added pressure, with deep declines in stocks like HCM and DSC hitting the floor, VIX (-4.7%), SSI (-2.76%), VPB (-2.35%), MBB (-1.46%), VND (-3.06%); VNM (-4.22%), VHC (-1.59%), HNG (-4.41%), ANV (-2.96%), SAB (-3.25%), and MCH (-1.24%). However, these sectors still saw some bright spots, such as STB and F88 hitting their ceilings, and CTG (+1.39%), LPB (+1.42%), and DBC (+1.44%) gaining.

On the positive side, energy and utilities stood out with gains exceeding 2%. Notable performers included BSR reaching its upper limit, PVS (+7.81%), PVD (+4.39%), PVC (+6.47%), PVB (+2.76%); GAS (+5.26%), and POW (+2.45%).

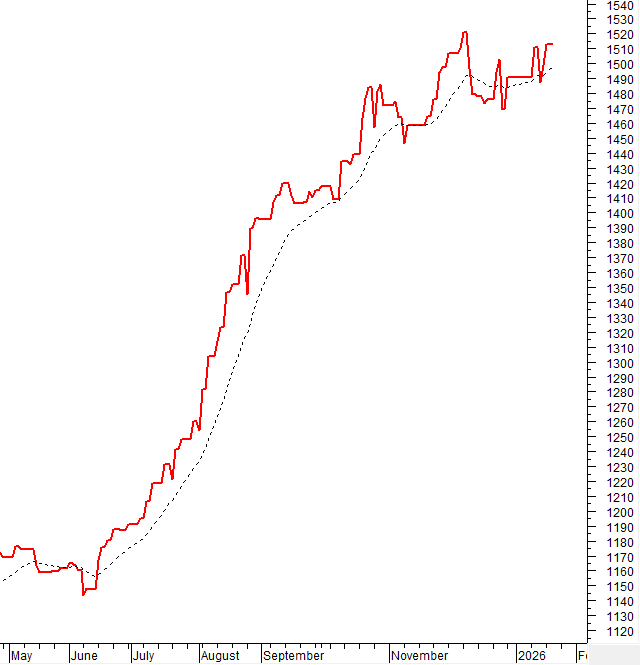

The VN-Index continued its adjustment with trading volume above the 20-day average. The MACD indicator is weakening and narrowing its gap with the Signal line. If a sell signal emerges in upcoming sessions, the index’s short-term risk will significantly increase.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – MACD Narrowing Gap with Signal Line

The VN-Index continued its adjustment with trading volume above the 20-day average.

Currently, the Stochastic Oscillator is declining after giving a sell signal, while the MACD is also weakening and narrowing its gap with the Signal line. If the MACD generates a sell signal in the coming sessions, the index’s short-term risk will significantly increase.

The previously breached October 2025 peak will serve as a crucial support level in the near term.

HNX-Index – Long Lower Shadow Candle Formation

The HNX-Index narrowed its decline toward the end of the session, forming a Long Lower Shadow candle, indicating that the 200-day SMA continues to provide short-term support.

However, volatility is likely to persist as the Stochastic Oscillator has given another sell signal.

Liquidity Analysis

Smart Money Flow: The Negative Volume Index of the VN-Index remains above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Investor Flow: Foreign investors continued to net sell during the January 21, 2026 session. If overseas investors maintain this action in upcoming sessions, the outlook may become more pessimistic.

III. MARKET STATISTICS FOR JANUARY 21, 2026

Economic & Market Strategy Analysis Department, Vietstock Consulting

– 17:13 January 21, 2026

Market Pulse 23/01: VN-Index Continues to Decline, State-Owned Stocks Face Heavy Selling Pressure

At the close of trading, the VN-Index fell by 11.94 points (-0.63%), settling at 1,870.79 points, while the HNX-Index dropped by 5.47 points (-2.12%), closing at 252.96 points. Market breadth was overwhelmingly negative, with 504 decliners outpacing 239 advancers. Similarly, the VN30 basket saw red dominate, as 19 stocks declined, 8 advanced, and 3 remained unchanged.

Vietstock Weekly 26-30/01/2026: Will the Tug-of-War Continue?

The VN-Index retraced after a five-week winning streak, yet its medium-term uptrend remains intact. The index’s proximity to the Bollinger Bands’ Upper Band and the MACD’s sustained upward trajectory post-buy signal reinforce this outlook. However, short-term volatility is likely to persist as the Stochastic Oscillator hovers in overbought territory.

Market Volatility Persists: Stock Market Outlook for January 19-23, 2026

The VN-Index paused its upward momentum last week, experiencing four consecutive sessions of adjustment. Investor sentiment turned cautious, with a notable divergence in market flows as the 1,900-point threshold remains a significant short-term challenge.