MARKET ANALYSIS FOR THE WEEK OF JANUARY 12-16, 2026

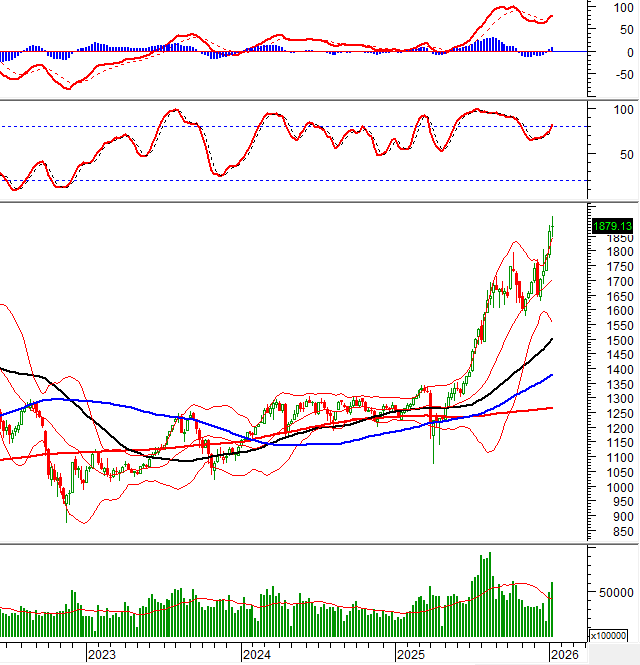

During the week of January 12-16, 2026, the VN-Index formed a Doji candlestick pattern, accompanied by trading volumes consistently above the 20-week average. This indicates a clear tug-of-war at the newly established peak.

The medium-term uptrend remains robust, with the index closely following the Upper Band of the Bollinger Bands and the MACD sustaining its upward trajectory after generating a buy signal.

However, short-term volatility risks should be noted as the Stochastic Oscillator has entered the overbought territory, suggesting the index is likely to continue oscillating around the peak to absorb supply pressure and consolidate the new price level.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – Stochastic Oscillator Has Issued a Sell Signal

In the trading session on January 16, 2026, the VN-Index experienced a tug-of-war, accompanied by a small-bodied candlestick pattern and a decrease in trading volume compared to the previous session, reflecting investor hesitation.

Currently, the MACD indicator is narrowing its gap with the Signal line. If conditions do not improve and a sell signal reemerges, the short-term outlook will become less optimistic.

Additionally, the Stochastic Oscillator continues to decline after issuing a sell signal in the overbought zone. This suggests that short-term risks will increase if the indicator exits this zone in upcoming sessions.

HNX-Index – Stochastic Oscillator Continues to Rise

In the trading session on January 16, 2026, the HNX-Index declined for the second consecutive session, accompanied by a small-bodied candlestick pattern and trading volume exceeding the 20-session average, indicating persistent investor pessimism.

Currently, the Stochastic Oscillator continues to rise after generating a buy signal, and the HNX-Index remains well-supported by the 20-day SMA, suggesting a short-term recovery is underway.

However, the index remains below the 50-day SMA, while the MACD indicator continues to rise after issuing a buy signal and is approaching the zero level. If conditions continue to improve, the short-term outlook will be further strengthened.

Money Flow Analysis

Smart Money Movement: The Negative Volume Index of the VN-Index has crossed above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will diminish.

Foreign Investor Money Flow: Foreign investors continued to net sell in the trading session on January 16, 2026. If foreign investors maintain this action in upcoming sessions, the outlook will become less optimistic.

Technical Analysis Department, Vietstock Advisory Division

– 16:58 January 18, 2026

Proprietary Trading Firms Seize Opportunity, Injecting Nearly 500 Billion VND in Net Buying During Market Plunge: Which Stocks Were Scooped Up the Most?

Proprietary trading desks at securities companies recorded a net buy of VND 485 billion on the Ho Chi Minh City Stock Exchange (HOSE).