Recently, Vina2 Investment and Construction Joint Stock Company (Vina2, Stock Code: VC2) announced a decision to increase its charter capital.

Accordingly, Vina2 has raised its charter capital from nearly VND 688 billion to approximately VND 760 billion through the issuance of shares to pay dividends; 100% of which is private capital.

Previously, at the end of the issuance period (December 15, 2025), Vina2 distributed nearly 6.9 million shares to 3,625 shareholders as a 10% dividend (equivalent to shareholders owning 100 old shares receiving 10 new shares).

The capital raised comes from undistributed after-tax profits as of December 31, 2024, according to the audited 2024 financial report. The total number of shares after the issuance is over 75.6 million.

Illustrative image

In another development, Vina2 announced a Board of Directors Resolution on contributing capital to establish a project company.

Specifically, Vina2 and Bac Nam Construction Company No. 2 (Bac Nam Construction No. 2) are investing in the establishment of a company to implement the Moc Chau Gateway Urban Service Area project. The project company is named Moc Chau Gateway LLC, headquartered at 910 Le Thanh Nghi Street, Thao Nguyen Ward, Son La Province, and is a limited liability company with two or more members.

The charter capital of Moc Chau Gateway is VND 380 billion, with Vina2 contributing VND 171 billion in cash, equivalent to a 45% stake. The remaining 55% is contributed by Bac Nam Construction No. 2 in cash, amounting to VND 209 billion.

Vina2 has appointed Mr. Vu Trong Hung, a Board Member and CEO, as the second legal representative of Moc Chau Gateway. He will act as Vina2’s authorized representative at Moc Chau Gateway and fulfill the rights and obligations of a member corresponding to a 45% stake.

Mr. Nguyen Huy Quang, Vice Chairman of Vina2’s Board of Directors, has also been appointed as an authorized representative of Vina2 at Moc Chau Gateway.

Both Vina2 leaders have been appointed to the Members’ Council of Moc Chau Gateway in accordance with the Enterprise Law and the company’s charter.

According to the business registration announcement, Moc Chau Gateway was established on January 9, 2026, with its main business activity being real estate trading, land use rights owned, used, or leased.

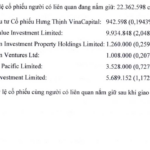

The charter capital and shareholder structure of Moc Chau Gateway are as announced by Vina2 above. The legal representative is Mr. Do Vinh Quang (born in 1989).

Regarding the Moc Chau Gateway Urban Service Area project, it is located in Van Son Ward, Son La Province, with a total area of approximately 387,403 m² and an expected population of around 2,600 people. The project includes technical infrastructure construction, social infrastructure works, and approximately 593 low-rise houses.

The total investment for the project is approximately VND 2,356.2 billion, including project implementation costs of about VND 2,230.9 billion, compensation and site clearance costs of around VND 117.3 billion, and costs for protecting and developing rice land of about VND 8 billion.

The funding sources are equity capital and other legally mobilized funds from the investor. The project is expected to be completed within 57 months.

Masan Consumer Boosts Capital to Nearly VND 13,000 Billion Following Stock Split

Following the issuance of 10.88 million treasury shares and nearly 226.9 million bonus shares, Masan Consumer has successfully increased its charter capital to approximately VND 13,000 billion.

Vĩnh Sơn – Sông Hinh Hydropower Invests 150 Billion VND to Acquire Leading Electricity Supplier

Vĩnh Sơn – Sông Hinh Hydropower has allocated 150 billion VND to acquire over 11.49 million common shares, representing 99.99826% of the charter capital of GE Tay Nguyen.