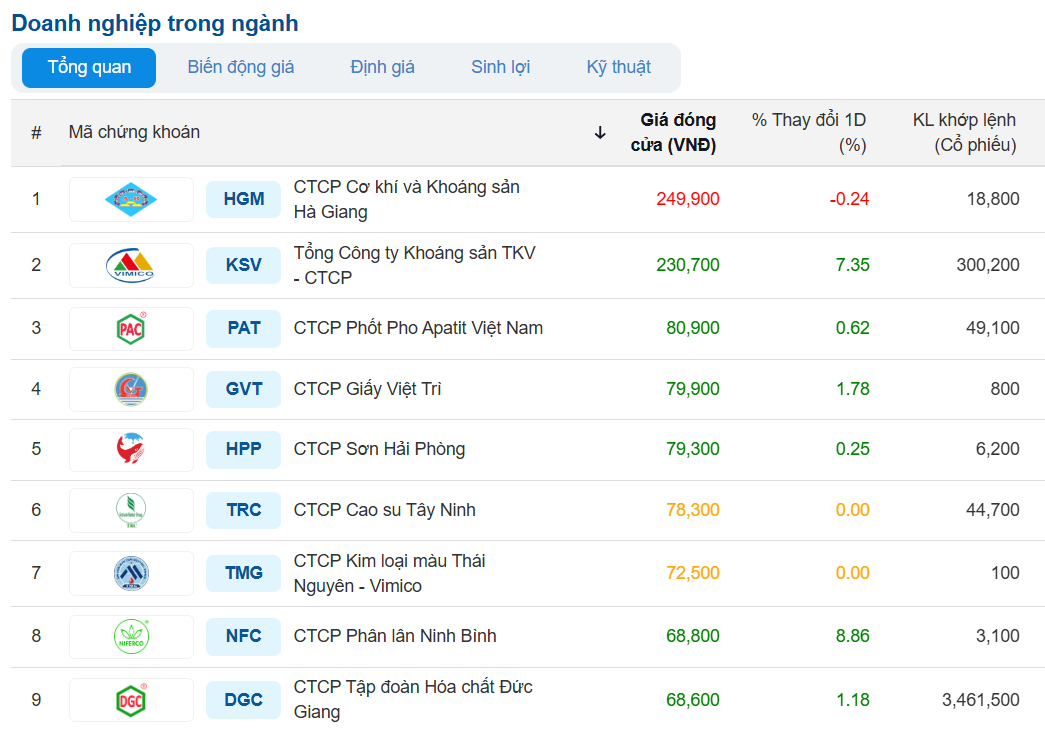

Closing the session on January 30, the stock KSV of TKV Mineral Corporation (Vimico) continued its sixth consecutive session of gains, reaching VND 230,700 per share, with liquidity exceeding 300,000 shares, 6.3 times higher than the session on January 29.

In the two previous sessions, KSV also hit its upper limit with explosive trading volumes in the hundreds of thousands of units and no sellers.

KSV shares had the second-highest price in the mining sector after HGM as of the close of trading on January 30. Source: VietstockFinance

|

From December 31, 2025, to January 30, 2026 (approximately one month), KSV recorded nine upper-limit sessions, driving the market price up nearly 157% compared to the end of 2025, with an average trading volume of 111,000 shares per session.

KSV has been listed on UPCoM since 2016 and on HNX since December 2022. However, its ownership structure is highly concentrated, and liquidity has remained very low for most of the time. Despite this, the stock price has consistently stayed in the three-digit range for many years. In February 2025, KSV approached its historical peak of VND 300,000 per share after surging more than sixfold since the end of 2024, amid global macroeconomic uncertainties and rising mineral prices. Following that period, the stock underwent a sharp correction, falling to nearly VND 90,000 per share by the end of 2025, before embarking on a nearly month-long rally.

| KSV Stock Performance Since Early 2025 |

In its explanation to the State Securities Commission (SSC) and the Hanoi Stock Exchange (HNX), KSV attributed the recent positive stock performance to overall market conditions, emphasizing that the consecutive upper-limit sessions were driven by market supply and demand, with investor buying and selling decisions beyond the company’s control.

Risk of Losing Public Company Status

Currently, the Vietnam National Coal and Mineral Industries Group (Vinacomin, TKV) holds 98.06% of KSV‘s charter capital, resulting in an almost entirely concentrated shareholder structure.

With such ownership, KSV fails to meet the criteria for a public company as defined in Point a, Clause 1, Article 32 of the Securities Law 54/2019/QH14, amended and supplemented by Point a, Clause 11, Article 1 of Law No. 56/2024/QH15. Specifically, the company does not have at least 10% of its voting shares held by a minimum of 100 investors who are not major shareholders.

In response, on January 14, the KSV Board of Directors authorized the CEO to continue reporting, explaining, and making recommendations to the State Securities Commission and relevant agencies to ensure the company operates stably, complies with legal regulations, and protects the interests of shareholders and the enterprise.

Record-High Net Profit

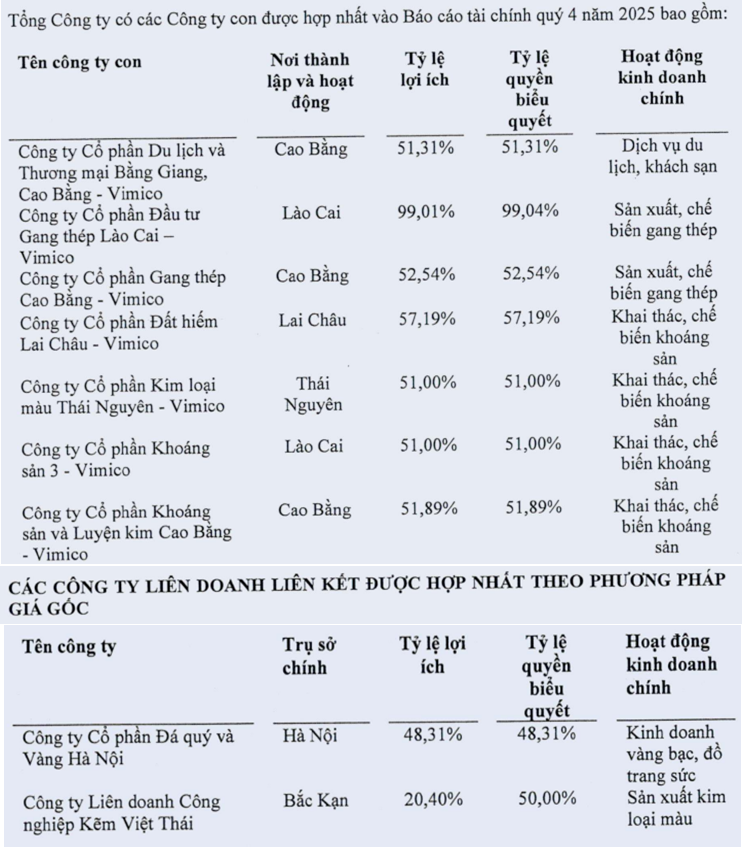

As a key subsidiary of TKV, Vimico owns several valuable mineral mines, including copper, gold, zinc, and tin, with copper contributing 50-60% of revenue, followed by iron ore at 15-20% and gold at 10-15%. It is also one of the few gold mining companies listed on HNX.

Additionally, KSV has an affiliated company engaged in precious metals trading and non-ferrous metal production.

Source: KSV‘s Q4/2025 Consolidated Financial Statements

|

The company recently released its Q4/2025 consolidated financial statements, reporting net revenue of nearly VND 3,549 billion, up 17% year-on-year, while net profit reached nearly VND 587 billion, 2.6 times higher.

KSV attributed this growth to higher average selling prices in 2025 for its main products compared to the same period last year, including a VND 32 million per ton increase for copper sheets, a nearly VND 759 million per kg increase for gold, a 25 kg rise in gold sales volume, a VND 4.3 million per kg increase for silver with an 85 kg sales volume increase, and a VND 4.9 million per ton increase for zinc ingots with a 29 kg sales volume increase.

For the full year 2025, Vimico achieved net revenue of nearly VND 14,400 billion and a net profit of over VND 2,023 billion, up 9% and 58% respectively compared to the previous year. This marks the company’s highest-ever business results and exceeds its set targets.

| KSV Concludes 2025 with Record-High Business Results |

In 2026, the company forecasts a challenging business environment due to global and domestic economic difficulties, volatile input prices, unpredictable mineral markets, deeper mining conditions, and lower ore grades.

Additionally, progress in resource development, land clearance, and investment construction for some projects remains slow, while raw material supply for mineral processing and metallurgical plants faces numerous obstacles.

Despite these challenges, Vimico aims to fully achieve the targets set by TKV. Specifically, for 2026, the company targets consolidated revenue of VND 13,842 billion and a profit of VND 2,042 billion.

It also plans to maintain stable production line operations, enhance deep processing to increase product value, complete licensing procedures and mining permit adjustments, and focus resources on key projects such as the Nà Rụa iron mine exploitation and the expansion and capacity increase of the Sin Quyền copper mine.

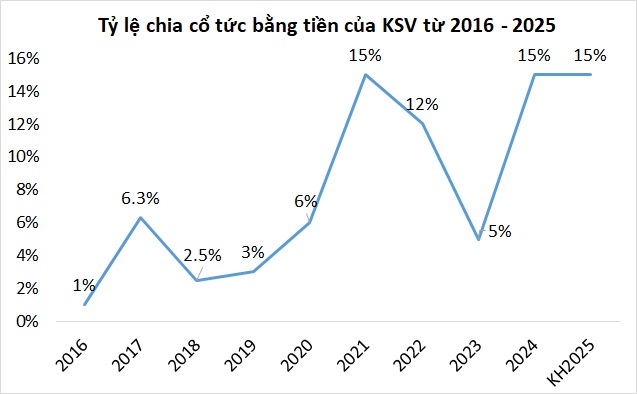

Stable Dividends

KSV boasts a large asset base and a history of stable cash dividend payments. From 2016 to the present, the dividend payout ratio has consistently ranged from 1% to 15%, with the highest payouts in 2021 and 2024. For 2025, Vimico plans a minimum dividend payout ratio of 15%.

Source: VietstockFinance

|

As of the end of 2025, KSV‘s undistributed after-tax profit reached over VND 2,600 billion. Total assets stood at nearly VND 10 trillion, up 4% from the beginning of the year. Cash and cash equivalents totaled over VND 700 billion, a 70% increase. Inventory amounted to over VND 2,817 billion, down slightly by 2%, primarily consisting of work-in-progress and finished goods.

Liabilities totaled VND 4,358 billion, down 22%, driven by a 39% reduction in financial debt to over VND 2,080 billion, accounting for 48% of total liabilities.

– 09:00 31/01/2026

Vietstock Daily 28/01/2026: Will the Downtrend Persist?

The VN-Index extended its losing streak to a sixth consecutive session, dipping below the Middle line of the Bollinger Bands. Short-term prospects face mounting challenges as the Stochastic Oscillator continues to weaken, retreating from overbought territory.

Drip-Feed Investment Funds: A New Year’s Strategy

Despite the VN-Index kicking off the new year with a bang, surpassing the 1,800-point milestone and climbing 4.67% in the first week of 2026, investment funds remain cautious in their trading activities.

Stock Market Week 05-09/01/2026: Kicking Off the Year with a Bang

The VN-Index kicked off 2026 with a remarkable start, surging 4.67% in the first trading week. This upward momentum was primarily driven by large-cap stocks, while liquidity expanded significantly, indicating a more optimistic investor sentiment after a prolonged period of caution. Additionally, the broader market saw improved capital flow across various sectors, further bolstering the positive outlook.