In Q4 2025, SCS, a leading air freight transportation company, reported a remarkable 11% year-on-year increase in net revenue, reaching nearly VND 327 billion. Net profit also surged by 10%, hitting VND 188 billion.

Impressively, SCS achieved a gross profit margin of 73%, a figure that many businesses aspire to attain.

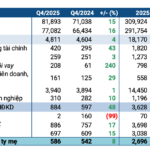

| SCS Quarterly Financial Performance |

According to SCS, the global economic recovery in 2025 played a significant role in boosting the company’s international output by 7%. This, in turn, positively impacted business operations and service quality, driving a 11% increase in service revenue.

Effective cash flow management and optimization strategies led to a substantial 38% growth in financial revenue, amounting to VND 21 billion. Additionally, SCS maintained tight cost control, ensuring efficient and economical operations, which contributed to enhanced profitability.

Record-Breaking Year

For the entire year 2025, SCS recorded a net revenue of VND 1,197 billion and a net profit of VND 751 billion, reflecting a 15% and 8% increase, respectively, compared to the previous year. This marks a historic high in the company’s financial performance.

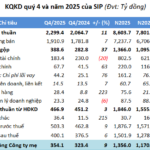

| SCS Annual Financial Performance |

The 2025 gross profit margin reached an astonishing 78%, equivalent to a “four-fold return on investment.” This outstanding result enabled the company to surpass its annual pre-tax profit target by 9%.

As of year-end 2025, SCS’s total assets amounted to VND 2,166 billion, a 14% increase from the beginning of the year. The majority of these assets comprise time deposits exceeding VND 1,448 billion (67% of total assets). Cash and cash equivalents reached over VND 108 billion, a decrease of more than VND 200 billion.

On the liabilities side, total debt stood at over VND 604 billion, an increase of VND 112 billion, primarily consisting of short-term debt (99%).

Concerns Over Market Share Loss Due to Long Thanh Airport

Despite SCS’s impressive 2025 performance and robust financial position, its stock price has struggled to take off. This may be attributed to concerns surrounding the impact of Long Thanh Airport, scheduled to commence operations in June 2026.

| SCS Stock Price Movement |

During the 2025 Annual General Meeting, SCS’s leadership revealed that the company would not be the primary investor in any cargo terminals during Long Thanh Airport’s initial phase. In the best-case scenario, SCS would only operate the general cargo warehouse No. 1 on behalf of ACV.

The inability to participate in Long Thanh Airport’s cargo terminal projects could deal a significant blow to SCS, especially considering that approximately 80% of international flights and 10% of domestic flights from Tan Son Nhat Airport will be relocated to Long Thanh. International cargo transportation typically yields significantly higher profit margins than domestic cargo.

Hope for Phase 2

SCS’s management is optimistic about becoming the primary investor in the general cargo terminal No. 2, with a capacity of 550,000 tons.

“Our goal is to become the primary investor in terminal No. 2, as merely operating it would not align with our leadership’s vision for rapid growth,” stated SCS CEO Nguyen Quoc Khanh during the 2025 Annual General Meeting in June.

Addressing concerns about the potential risk of not participating in Long Thanh Airport, SCS’s leadership assured that they have a contingency plan. The company currently manages 14 hectares of land at Tan Son Nhat Airport, with usage rights until 2057. Of this, 5 hectares are leased to ACV for aircraft parking and over 1 hectare is used as a football field. Once Long Thanh Airport becomes operational, ACV is expected to return the leased aircraft parking area.

SCS’s most significant challenge in the coming period will be maintaining its impressive growth rate as the most critical aviation infrastructure in Southern Vietnam shifts from Tan Son Nhat to Long Thanh Airport.

By Vu Hao

– 14:43 30/01/2026

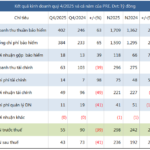

SIP Closes 2025 with Record-High Results, Lending Over 4.9 Trillion VND to Partners

Despite lacking explosive growth, SIP concluded 2025 with record-high business results, driven by steady increases in its utility and industrial park segments, both of which significantly surpassed initial targets.

NCB Surpasses All 2025 Business Plans and Achieves Multiple Milestones at PACCL

By the end of 2025, National Commercial Bank (NCB) achieved remarkable business results, surpassing all targets and accelerating the completion of key milestones outlined in its restructuring plan (PACCL). This success underscores the bank’s strategic acumen and establishes a robust foundation for its upcoming growth phase.

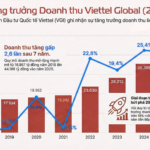

Viettel Global Achieves Record-Breaking Profit of Over 11,000 Billion VND

The year 2025 marks a significant milestone for Viettel Global Investment Joint Stock Company (Viettel Global – Code: VGI), as the company achieved its highest-ever revenue and profit to date.