Recently, the adjustment of lending rates for real estate purchases by several major banks has garnered significant market attention.

During a live investor meeting on the afternoon of January 29, 2026, Mr. Nguyễn Văn Đạt – Chairman of the Board of Directors of Phat Dat Real Estate Development Corporation (PDR: HOSE) candidly acknowledged that the recent rate hike was somewhat abrupt. However, he believes this is likely a short-term development within the broader macroeconomic management cycle.

The Phat Dat Chairman noted that from the second quarter onward, interest rates may gradually stabilize. He emphasized that while the company remains cautious about rate fluctuations, it is not overly pessimistic, as the real estate market still holds potential for products that meet genuine demand.

According to Mr. Đạt, despite the current high interest rates, Phat Dat can adapt and sustain operations through its strategy of focusing on prime land plots at reasonable prices. Projects in Binh Duong, Dong Nai, and other regions are tailored to meet real housing needs—a critical factor ensuring project resilience even in challenging market conditions.

The Chairman also shared that since the beginning of 2026, the company has identified two key areas: Dong Nai and Ho Chi Minh City, regions with substantial and relatively stable real estate demand. He noted that while rising rates pose short-term challenges for both developers and buyers, Phat Dat’s well-located, affordable, and demand-driven products can maintain growth momentum.

Mr. Nguyễn Văn Đạt – Chairman of the Board of Directors of Phat Dat Real Estate Development Corporation.

At the event, Mr. Huỳnh Minh Tuấn, founder of FIDT, noted that the rate increase was anticipated as the economy gradually recovers. He stressed that rising rates reflect growing capital demand and are not entirely negative, as they will create a natural selection process.

Mr. Đạt echoed this view, stating that credit control and higher rates will weed out inexperienced developers, while reputable firms with strong financial foundations will have opportunities to solidify their positions and grow more steadily in the market’s new cycle.

He further emphasized that projects in strategic locations meeting real demand will remain resilient. Even with rising rates and prices, such products will outperform speculative offerings heavily reliant on market cycles.

Phat Dat Targets 1.9 Trillion VND in Revenue from Project Transfers by 2026, Focusing on Ho Chi Minh City and Dong Nai

During the investor meeting livestream on January 29th, representatives from Phat Dat Real Estate Development Corporation (HOSE: PDR) announced a strategic shift. The company will now prioritize projects with complete legal frameworks, genuine residential demand, and the potential to generate cash flow in the short to medium term. This refocus also involves narrowing investment scope to key strategic locations.

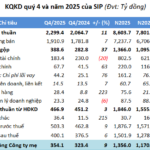

SIP Closes 2025 with Record-High Results, Lending Over 4.9 Trillion VND to Partners

Despite lacking explosive growth, SIP concluded 2025 with record-high business results, driven by steady increases in its utility and industrial park segments, both of which significantly surpassed initial targets.