Digiworld Corporation (Digiworld, HOSE: DGW) has released its consolidated financial report for Q4/2025, revealing a net profit of nearly VND 160 billion, a 14% increase year-over-year. However, this growth lags significantly behind the 36% surge in revenue, primarily due to losses in financial investment activities.

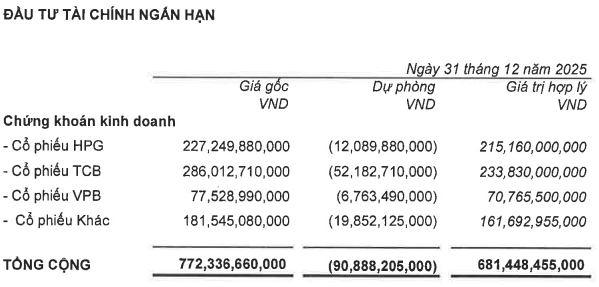

During Q4, Digiworld recorded investment provisions of VND 91 billion and incurred a loss of nearly VND 22 billion from the liquidation of trading securities.

This marks the first time Digiworld’s financial report reflects such a substantial equity investment portfolio, valued at over VND 772 billion in principal. Notably, the investment in TCB bank shares is currently showing an 18% loss, suggesting Digiworld likely invested during mid-October 2025, when TCB’s stock price was at its historical peak.

Source: Digiworld Parent Company Financial Report

|

For the full year 2025, Digiworld achieved net revenue of over VND 26.6 trillion and a net profit of VND 548 billion, up 21% and 23% respectively compared to 2024, surpassing its annual plan by approximately 5%.

On the stock market, DGW shares hit their ceiling price on January 29, the day the Q4/2025 financial report was announced. By 14:30 on January 30, the stock continued to rise by over 3.5%.

– 14:28 30/01/2026

Struggling to Survive: Once-Thriving Textile Giant Earning $65 Million Annually Now Rents Pickleball Courts for $130/Day, Still Operating at a Loss

Garmex Saigon concluded 2025 with losses across all four quarters, extending its streak of consecutive quarterly losses to seven and marking the fourth straight year without profit.

Foodcosa Reports Record Profits in Q4 2025, Barely Breaks Even for the Year

Despite a prolonged streak of poor business performance, Ho Chi Minh City Food Corporation (Foodcosa, UPCoM: FCS) unexpectedly recorded its highest-ever quarterly profit in Q4/2025. However, the full-year results still yielded only a slim profit, insufficient to significantly enhance its financial foundation.