With just a few weeks left until the 2026 Lunar New Year, numerous prime storefronts along major streets in Ho Chi Minh City remain vacant, displaying “For Rent” signs. Many have been shuttered for weeks, even months, without finding new tenants.

A vacant storefront on Hai Ba Trung Street awaits a tenant.

On Hai Ba Trung Street (Xuan Hoa Ward), a bustling hub for shops and services, this trend is evident. A large 500 sqm space (7m frontage, 25m depth, 1 ground + 2 floors) has been vacant for over a year, despite its prime location.

“It’s been empty since last year,” said Ms. N., a local resident. “It used to be a clothing store. The rent was around 200 million VND monthly. A few people looked, but no one took it.”

Nearby, a 6-story space (450 sqm floor area, 5m frontage, 13m depth), formerly a spa, has been vacant for months. Listed at 90 million VND monthly, it’s seen limited interest, according to agents.

Price Cuts Aren’t Enough: Why the Struggle to Rent?

Rental prices in central areas have significantly dropped compared to 2022-2023, even on prime streets. Many landlords have slashed rates by 30-50% to retain tenants.

Despite price cuts, many prime storefronts remain vacant.

However, price adjustments haven’t sparked a rental surge. Many spaces remain closed, indicating the issue goes beyond rent. High operating costs, coupled with sluggish consumer spending, are deterring businesses.

“Even with lower rent, it’s nearly 100 million VND monthly—unsustainable for my drink shop,” said Mr. T., who recently vacated a space. “High costs erode profits, especially in a tough market.”

Tenants Hesitate

Unlike previous years, many SMEs are adopting a defensive strategy. Instead of long-term leases, they’re focusing on online sales, pop-up stores, and Tet fairs to minimize fixed costs.

“I’m selling through Shopee and TikTok Shop this Tet,” said Mr. Son, a former fashion retailer on Cach Mang Thang Tam Street. “Long-term leases feel risky right now.”

Tenants are waiting to assess post-Tet market conditions rather than betting on a short, high-risk peak season.

Landlords’ Dilemma

Landlords argue they can’t cut prices further. Prime rentals reflect not just monthly income but long-term asset value. Deep cuts could make it hard to revert to previous rates.

“My Le Van Sy Street property, once rented by a cosmetics brand for over a decade, is now down from 60 million VND to 40 million VND monthly,” said Ms. Mai. “Further cuts are difficult.”

This mismatch in expectations creates a stalemate: tenants await better prices, while landlords protect asset value and seek long-term, committed renters, especially pre-Tet.

Why Isn’t Pre-Tet a “Golden Season” Anymore?

Pre-Tet used to be prime time for new stores, especially in fashion, cosmetics, and gifts. However, consumer behavior has shifted. Online shopping and e-commerce platforms now dominate, reducing reliance on physical stores.

High-cost central locations are less appealing for many businesses. While Tet remains peak season, it’s no longer a strong enough incentive for long-term leases.

Who’s Still Renting Prime Spaces?

The market isn’t entirely stagnant. Major brands, retail chains, and companies with long-term brand strategies are still active renters.

Streets like Dong Khoi, Le Loi, and Pasteur retain appeal due to high foot traffic. Prime corner units (2-3 frontages) or wide spaces (5m+) in these areas are quickly snapped up.

Agents report a 10-15% price drop in these areas year-over-year, but demand remains strong for premium locations. Such spaces are scarce, keeping the market competitive.

Ho Chi Minh City Approves Nearly $2 Billion Investment by Three Companies for Cai Mep Ha Port Development

Geleximco, a leading International Transportation and Trading Joint Stock Company, in collaboration with the State Capital Investment Corporation, is set to invest in the Cai Mep Ha General and Container Port Project.

Phat Dat Targets 1.9 Trillion VND in Revenue from Project Transfers by 2026, Focusing on Ho Chi Minh City and Dong Nai

During the investor meeting livestream on January 29th, representatives from Phat Dat Real Estate Development Corporation (HOSE: PDR) announced a strategic shift. The company will now prioritize projects with complete legal frameworks, genuine residential demand, and the potential to generate cash flow in the short to medium term. This refocus also involves narrowing investment scope to key strategic locations.

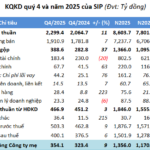

SIP Closes 2025 with Record-High Results, Lending Over 4.9 Trillion VND to Partners

Despite lacking explosive growth, SIP concluded 2025 with record-high business results, driven by steady increases in its utility and industrial park segments, both of which significantly surpassed initial targets.