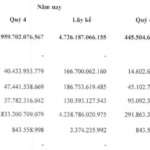

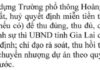

According to the Q4/2025 consolidated financial report, Kinh Bac City Development Shareholding Corporation (HOSE: KBC) recorded a net revenue of over 1.648 trillion VND, a 111% increase. Meanwhile, its net profit reached nearly 652 billion VND, more than 21 times higher than the same period last year.

KBC attributed this growth primarily to the surge in revenue from the industrial park (IP) segment. Additionally, other income of nearly 321 billion VND, over 54 times higher, stemmed from the difference between the acquired company’s net assets and the consolidation cost, significantly contributing to the quarter’s profit.

Source: VietstockFinance

|

Kinh Bac concluded 2025 with record-breaking business results, achieving a net revenue of over 6.687 trillion VND and a net profit of nearly 2.147 trillion VND, 2.4 and 5.6 times higher than the previous year, respectively. This growth was driven by land leasing and IP infrastructure services, which generated nearly 4.396 trillion VND, 3.5 times higher; real estate transfer revenue of nearly 1.460 trillion VND, up 61%; and approximately 133 billion VND from workshop sales.

However, compared to the ambitious 2025 plan of 10,000 billion VND in consolidated revenue and 3,200 billion VND in after-tax profit, KBC achieved only 70% of both targets.

| KBC concludes 2025 with record-high results |

Debt continues to swell

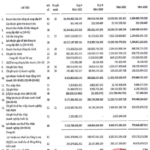

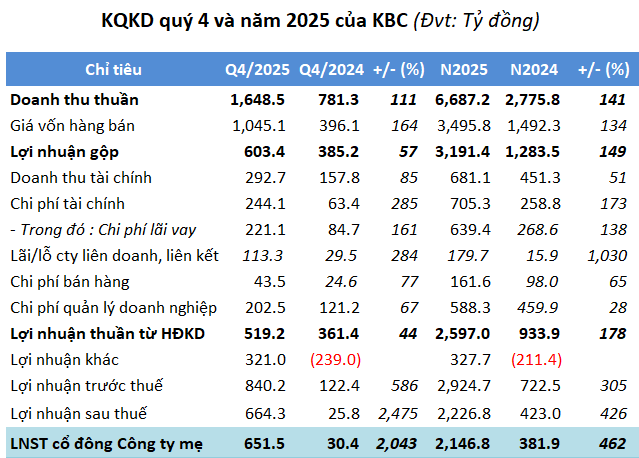

As of the end of Q4, Kinh Bac’s total assets reached nearly 69.8 trillion VND, a 56% increase from the beginning of the year. Cash and cash equivalents stood at nearly 8.4 trillion VND, up 28%. Notably, the company’s short-term receivables exceeded 17.4 trillion VND, a 31% increase, with the majority being other short-term receivables of over 6.5 trillion VND.

Source: KBC

|

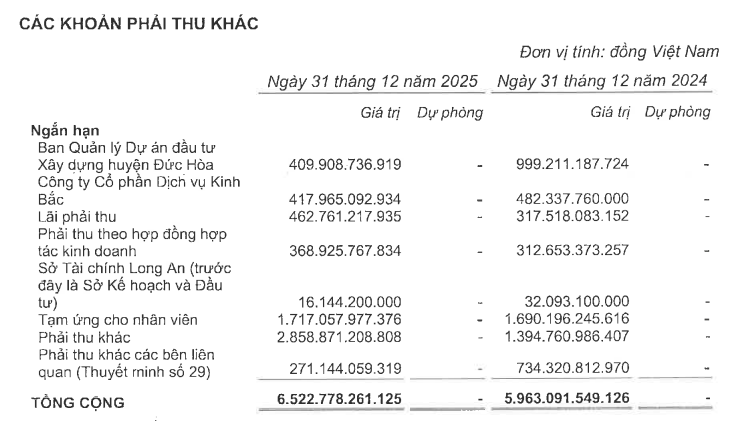

Inventory also surged to nearly 27 trillion VND, almost double the beginning of the year, due to the Trang Cat urban and service project reaching 100% completion, valued at over 16.9 trillion VND. Construction in progress exceeded 4.2 trillion VND, 5.8 times higher, with 3.5 trillion VND allocated to the Lang Ha commercial and office center project.

Source: KBC

|

The company also increased its total investment in subsidiaries from nearly 4.4 trillion VND to over 7.3 trillion VND in 2025.

Capital pressure is evident as Kinh Bac’s total liabilities rose by 79% to over 43 trillion VND. Financial debt alone exceeded 28.6 trillion VND (approximately 1.1 billion USD), mostly long-term bank loans, doubling from the beginning of the year and accounting for 67% of total debt. Since early 2025, Kinh Bac has continuously increased its borrowing to primarily fund the Trang Cat project and accelerate other project constructions.

| KBC‘s financial debt continues to swell |

In early January, the Gia Lai Provincial People’s Committee approved Saigon – Bac Giang Industrial Park JSC (a KBC subsidiary) as the investor for the Van Canh 1 and Van Canh 2 Wind Power Plants, with a total capacity of 340MW and an investment of nearly 14.7 trillion VND.

– 09:11 31/01/2026

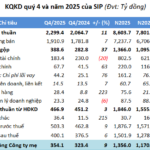

SIP Closes 2025 with Record-High Results, Lending Over 4.9 Trillion VND to Partners

Despite lacking explosive growth, SIP concluded 2025 with record-high business results, driven by steady increases in its utility and industrial park segments, both of which significantly surpassed initial targets.

The $5 Billion Handshake: Sunshine Group and Kita Invest Forge Landmark Partnership

In 2025, Sunshine Group Joint Stock Company (HNX: KSF) embarked on a transformative year marked by strategic M&A deals and aggressive project expansions across Vietnam, from the North to the South. This ambitious growth propelled their investment portfolio into the trillions of VND, partnering with leading real estate giants and amassing a project inventory surpassing 20 trillion VND.

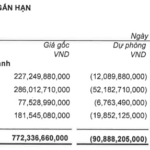

DigiWorld Invests Nearly VND 800 Billion in Stocks, Temporarily Records Over VND 90 Billion in Losses

For the first time, a distributor surpassing $1 billion in revenue has launched a stock portfolio valued in the hundreds of billions. However, the performance of this investment activity has significantly eroded profits.