|

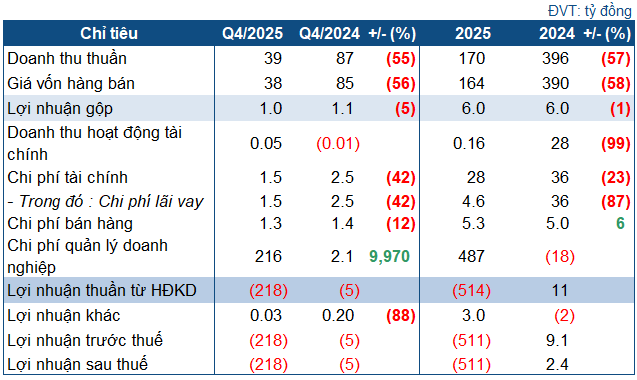

ABS’s Q4/2025 Business Targets

Source: VietstockFinance

|

In Q4/2025, ABS recorded a revenue of only VND 39 billion, a staggering 55% decline compared to the same period last year. Despite a corresponding reduction in cost of goods sold, gross profit plummeted to a mere VND 1 billion, reflecting a 5% decrease.

The most striking aspect was the surge in corporate management expenses, skyrocketing to over VND 216 billion (compared to just over VND 2 billion in the same quarter last year). The primary reason behind this was ABS’s necessity to provision for bad debts amounting to VND 214 billion solely in Q4. Consequently, the company reported a net loss of VND 218 billion in the final quarter, escalating the cumulative loss for 2025 to a staggering VND 511 billion.

Notably, in the 2025 semi-annual audited financial statements, the auditing firm issued a qualified opinion regarding ABS’s “misclassification” of a VND 216 billion loss incurred in 2024 as a 2025 expense. If retrospectively adjusted, ABS would have actually incurred significant losses as early as 2024. The concentration of provisions in 2025 further exacerbated the severity of last year’s losses.

As of late December 2025, ABS’s total assets had dwindled to VND 493 billion, a more than 50% decline since the beginning of the year. The majority of these assets, approximately VND 457 billion, were short-term. The primary cause of this reduction was the provisioning of VND 526 billion (compared to only VND 21.5 billion at the start of the year). According to the notes, ABS’s largest debtors were Smart Eco City (provisioned over VND 196 billion), Bira Construction (VND 178 billion), and Dao Ngoc Investment (VND 176 billion).

While cash and cash equivalents increased significantly by the end of the period, they only amounted to slightly over VND 1 billion. In comparison to the total liabilities (almost entirely short-term) of over VND 87 billion, with short-term loans slightly rising to nearly VND 64 billion, this amount is akin to a drop in the ocean.

Due to the substantial losses, ABS’s undistributed after-tax profit has plunged to a negative VND 437.5 billion, eroding into the owner’s equity.

– 19:45 30/01/2026

Struggling to Survive: Once-Thriving Textile Giant Earning $65 Million Annually Now Rents Pickleball Courts for $130/Day, Still Operating at a Loss

Garmex Saigon concluded 2025 with losses across all four quarters, extending its streak of consecutive quarterly losses to seven and marking the fourth straight year without profit.

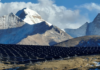

Thailand’s Renewable Energy Giant Rakes in Over $90 Million in Vietnam in Just 9 Months

Super Energy, a leading Thai renewable energy company, has made significant strides in Vietnam with its impressive portfolio of projects. Among its notable ventures are the Lộc Ninh 1, 2, and 3 solar power plants and the HBRE Chư Prông wind farm. The company recently released its third-quarter business report for this year, showcasing its continued growth and impact in the region’s renewable energy sector.

Pomina Reports Over 500 Billion VND Loss in First Nine Months, Negative Equity

Once a steel giant rivaling Hoa Phat, Pomina (UPCoM: POM) has spiraled into a vortex of losses, culminating in a staggering negative equity of nearly VND 187 billion by the end of September 2025.