Source: Compiled by the author

|

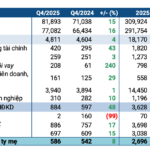

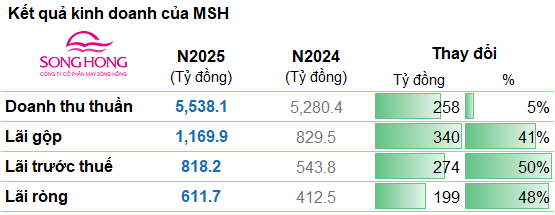

May Sông Hồng concluded 2025 with a series of new business records, achieving a net revenue of over 5.538 trillion VND, a 5% increase compared to the previous year. Net profit surged by 48%, reaching nearly 612 billion VND, surpassing the 600 billion VND mark for the first time in a single year.

Gross profit margin hit a record high of over 21.1%, a significant improvement from 15.7% in 2024. As a result, gross profit exceeded the one trillion VND milestone for the first time, reaching 1.170 trillion VND, a 41% increase, becoming the primary pillar supporting net profit.

This performance enabled MSH to slightly exceed its revenue target of 5.500 trillion VND and surpass its annual profit plan by 36%.

| MSH’s Business Results Over the Past Decade |

MSH‘s growth momentum was significantly bolstered in the final quarter, with the company reporting a net profit of nearly 203 billion VND, a 17% increase year-over-year and setting a new high compared to the previous quarter. This marks the second consecutive quarter that MSH has surpassed the 200 billion VND profit milestone in a single quarter.

Despite a slight 3% decline in Q4 revenue to below 1.400 trillion VND due to an increased proportion of export processing orders, profit results were maintained through contributions from financial activities and cost-cutting measures.

On the stock market, MSH shares started 2026 on a positive note. In the first month, the stock price rose by nearly 11% to 35,900 VND per share. Over the past year, MSH has gained over 15%, with average liquidity exceeding 386,000 shares per session.

| MSH Stock Price Movement Over the Past Year |

Adjustments in Cash Flow, Investments, and Debt

At the end of 2025, MSH held over 233 billion VND in bank deposits, a slight 5% decrease from the beginning of the year. Conversely, bond investments increased to 1.383 trillion VND, a 7% rise. Inventory reached over 555 billion VND, a 15% decrease, with finished products accounting for the largest share at over 42%.

On the capital side, the company’s total debt stood at 1.296 trillion VND, a 9% decrease from the start of the year. Major loans include over 400 billion VND in short-term loans from BIDV Nam Định branch, 440 billion VND in long-term loans from BIDV Nam Định branch, and nearly 208 billion VND in long-term loans from Vietcombank Nam Định branch.

Nearly 12,000 Employees, with Labor Costs Accounting for Over Half of Total Expenses

Alongside business expansion, MSH continued to grow its workforce. By the end of 2025, the company employed 11,750 staff, an increase of 367 employees compared to 2024.

In terms of cost structure, labor costs were the largest component, totaling 2.214 trillion VND, a 19% increase from the previous year and representing 57% of total production and operating expenses. On average, each employee at MSH earned approximately 15.7 million VND per month.

Change in CEO Position at the Start of the New Year

As 2026 began, MSH witnessed a notable change in senior leadership. On January 6th, the Board of Directors dismissed Mr. Bùi Việt Quang as CEO and appointed Mr. Franck Lignini, a French national, as the new CEO, following a year of outstanding business performance.

Mr. Bùi Việt Quang was reassigned to the position of Deputy CEO and concurrently appointed as Standing Vice Chairman of the Board of Directors.

– 13:15 31/01/2026

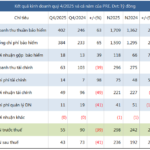

NCB Surpasses All 2025 Business Plans and Achieves Multiple Milestones at PACCL

By the end of 2025, National Commercial Bank (NCB) achieved remarkable business results, surpassing all targets and accelerating the completion of key milestones outlined in its restructuring plan (PACCL). This success underscores the bank’s strategic acumen and establishes a robust foundation for its upcoming growth phase.

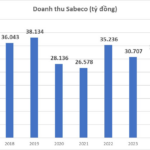

Sabeco’s 2025 Profit Stagnates, Revenue Drops as Vietnamese Cut Back on Drinking: What’s Behind the 17 Trillion VND Allocation?

Despite a nearly 19% decline in full-year 2025 revenue amid industry-wide challenges, Sabeco sustained profit growth momentum and maintained a substantial cash reserve.