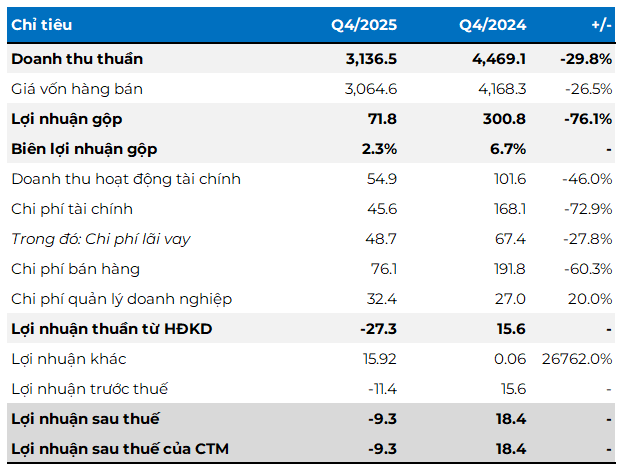

NKG recorded a widespread decline in the final quarter of 2025. The company reported revenue of VND 3.174 trillion, a nearly 30% drop compared to the same period last year, with profit margins shrinking from 6.7% to 2.3%.

Financial revenue, financial expenses, and selling expenses all plummeted by 45-70%. A bright spot was the nearly VND 16 billion in other profits.

After deducting expenses, the company incurred a net loss of over VND 9 billion in Q4/2025, compared to a profit of VND 18 billion in the same period last year.

Q4/2025 Business Results of NKG

Unit: Billion VND

Source: VietstockFinance

|

Domestic Revenue Surpasses Exports for the First Time

Looking back at 2025, NKG recorded net revenue of over VND 14.8 trillion and a net profit of VND 197 billion, down 28% and 56% year-over-year, respectively.

With these results, the company achieved only 64% of its revenue target and 55% of its pre-tax profit target.

A notable highlight is that domestic revenue surpassed export revenue for the first time in 2025. Domestic revenue reached VND 8.8 trillion, VND 1.5 trillion higher than the previous year. Meanwhile, export revenue halved to VND 6 trillion.

The lackluster performance occurred amid a weakening market and rising trade protectionism from several countries, particularly the U.S. Since April 2025, the U.S. has imposed preliminary anti-dumping duties of 40-88% on Vietnamese coated sheet products. This has significantly pressured export-dependent companies like Nam Kim Steel.

Data from the Vietnam Steel Association (VSA) shows that steel product exports stagnated from April 2025, following U.S. President Donald Trump’s announcement of retaliatory tariffs.

In the first 11 months of 2025, exports of most steel products declined, with coated sheet products seeing the sharpest drop of 48%, totaling 1.485 million tons.

For an export-reliant steel company like NKG, these results mark a significant shift amid a volatile global trade environment. The coated sheet giant is now accelerating its VND 4.5 trillion Phu My Roofing Steel Sheet Plant project, focusing on the domestic market and developing new products not yet manufactured locally, as stated by Chairman Ho Minh Quang.

The plant is designed with a galvanizing line capacity of 350,000 tons/year, along with two aluminum-zinc alloy coating lines with capacities of 300,000 tons/year and 150,000 tons/year. According to NKG leaders, the plant is expected to commence operations in Q1/2026.

– 09:47 31/01/2026

Q4 Explosion: Bầu Đức’s Company Reports Record Profits

Following its official exit from accumulated losses in Q3/2025, Hoang Anh Gia Lai Joint Stock Company (HAGL, HOSE: HAG) continued its profit surge in Q4, doubling the previous quarter’s results. A significant contributor to this achievement was the reversal of expenses following the exemption from bond interest payments.

Vietnam Airlines Achieves Record-Breaking Revenue of Over 121 Trillion VND in 2025

Consolidated after-tax profit surpassed 7.713 trillion VND, with the parent company’s after-tax profit reaching 5.509 trillion VND, doubling compared to the same period last year.

Latest Developments in Novaland’s Inventory

Novaland boasts a total asset value of VND 249.792 trillion, with inventory reaching VND 153.392 trillion. Notably, land funds and ongoing construction projects account for an impressive 94.2% of this inventory.