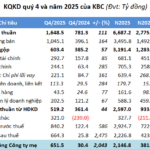

Nam Long Investment Corporation (Nam Long; HoSE: NLG) recently released its Q4/2025 consolidated financial report, revealing a significant decline in business performance. Revenue plummeted by 73% to VND 1,704 billion, while net profit after tax dropped by 62% year-on-year to VND 504.8 billion.

According to the company’s explanation, Q4/2025 revenue of VND 1,704 billion marked a VND 4,664 billion (73%) decrease compared to the same period last year. Housing and apartment sales dominated the quarter’s revenue, contributing 95%. The VND 882 billion (62%) decline in net profit was primarily due to reduced revenue from the Akari project handover in 2025.

For the full fiscal year 2025, Nam Long reported VND 5,645 billion in revenue, a 22% decrease from the previous year. Net profit after tax shrank by 32% to VND 1,387 billion.

Nam Long attributed the 2025 revenue drop of VND 1,551 billion (22%) to VND 5,645 billion, mainly from housing sales (96% of total revenue), to key projects like Southgate, Akari, and Can Tho. The VND 441 billion (32%) profit decline was largely due to reduced revenue compared to 2024.

As of December 31, 2025, Nam Long’s total assets decreased by 12.4% to VND 26,564 billion. Current assets fell by 30.1% to VND 19,246 billion.

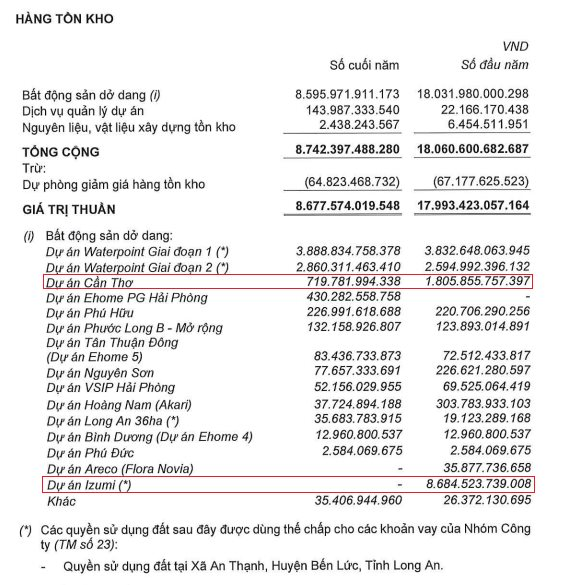

Notably, inventory decreased by 51.8% to VND 8,677 billion, a VND 9,315 billion reduction from the beginning of the year. Inventory at the Izumi project dropped to zero from VND 8,684 billion, while the Can Tho project’s inventory halved to VND 719.7 billion.

Nam Long’s inventory decreased by over VND 9,300 billion in 2025.

On the liabilities side, as of year-end 2025, Nam Long’s total debt was VND 11,740 billion, down 25.5%. Short-term debt decreased by 36.9% to VND 6,453 billion. Financial debt dropped by 20.7% to VND 5,521 billion, including VND 1,016 billion in short-term loans and VND 4,504 billion in long-term loans.

Nam Long’s bond debt stood at VND 3,625 billion (all long-term), with interest rates ranging from 8.98% to 11% per annum. All outstanding bonds are secured by land use rights or shares in subsidiaries owned by Nam Long.

NLG shares have been on a steep decline since mid-August 2025.

On the stock market, NLG shares closed at VND 28,450 on January 29, down 1.9% from the previous session, with over 2.1 million shares traded.

Since reaching a three-year high in mid-August 2025, NLG shares have experienced a sharp downturn. Nam Long’s market capitalization plummeted to VND 13,801 billion.

Nam Long (NLG) Included in 2026 Inspection Plan

The Government Inspectorate has announced its 2026 inspection plan, notably including major real estate companies across Vietnam, such as Nam Long, Him Lam, ResCo, Vinaconex, HUD, and Geleximco.

The inspection will focus on compliance with laws in investment, construction, housing development, real estate business, state capital and asset management, anti-waste measures, and joint ventures, capital contributions, and divestments.

Nam Long Investment Corporation (HoSE: NLG) will be inspected for its compliance with laws in investment, construction, housing, and real estate business across several projects. The 60-day inspection is scheduled for Q1/2026.

Phat Dat Targets 1.9 Trillion VND in Revenue from Project Transfers by 2026, Focusing on Ho Chi Minh City and Dong Nai

During the investor meeting livestream on January 29th, representatives from Phat Dat Real Estate Development Corporation (HOSE: PDR) announced a strategic shift. The company will now prioritize projects with complete legal frameworks, genuine residential demand, and the potential to generate cash flow in the short to medium term. This refocus also involves narrowing investment scope to key strategic locations.

BAF’s Q4 Pig Sales Surge 73% Amidst Challenging Livestock Industry Conditions

In 2025, BAF Vietnam Agriculture JSC (HOSE: BAF) aggressively expanded its livestock operations by launching 13 new farms, increasing feed mill capacity, and intensifying training efforts. Despite industry challenges, hog sales volume and revenue surged 140% and 155% year-over-year, respectively.