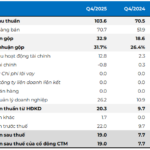

January 30, 2026 – Novaland Investment Group Corporation (Novaland, HoSE: NVL) announced its Q4 2025 business results, reporting consolidated net revenue of VND 1,567 billion from sales and services, with consolidated after-tax profit reaching VND 3,638 billion.

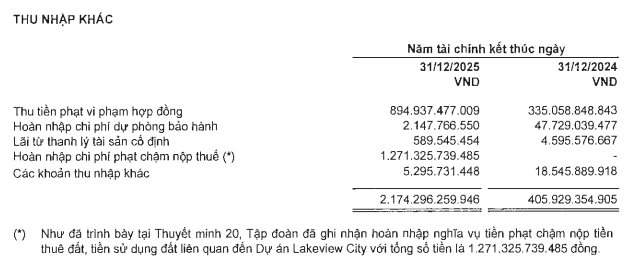

Compared to the same period last year, profit from sales and services increased by VND 641 billion, financial revenue rose by VND 1,106 billion, and financial expenses decreased by VND 693 billion. Other operating income also saw a significant increase of VND 935 billion.

For the full year 2025, Novaland’s consolidated net revenue from sales and services reached VND 6,965 billion. This includes VND 6,365 billion from property sales, recognized from handovers at projects such as NovaWorld Phan Thiet, NovaWorld Ho Tram, Aqua City, Sunrise Riverside, and Palm City, among others. Service revenue contributed VND 600 billion. The consolidated after-tax profit for the year stood at VND 1,819 billion, a turnaround from the previous year’s loss.

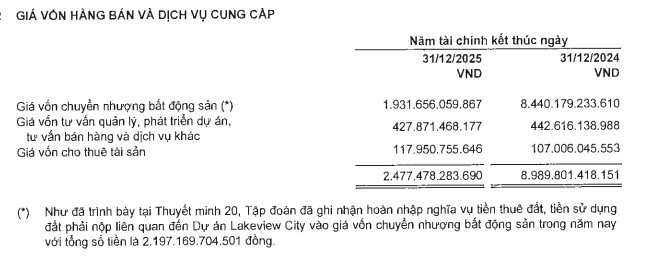

Notably, in Q4 2025, Novaland recorded a reversal and adjustment of provisions related to land rental and land use fees for the Lakeview City project.

As a result, the total provision in the Q4 2025 consolidated financial statements was reduced to VND 1,014 billion from the previous VND 4,369 billion. Lakeview City is one of the first projects in Ho Chi Minh City to benefit from the special mechanism under Resolution 170/2024/QH15.

Novaland recognized a reversal of VND 2,197 billion for land rental and land use fees related to Lakeview City, as well as a reversal of VND 1,271 billion for late payment penalties.

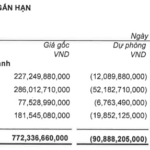

As of December 31, 2025, Novaland’s total assets reached VND 249,792 billion. Inventory was recorded at VND 153,392 billion, with land and projects under construction accounting for 94.2%, while the remainder includes completed properties and those awaiting handover to customers.

By the end of 2025, Novaland’s total debt stood at VND 67,191 billion, including VND 31,518 billion in short-term debt. Compared to the same period last year, short-term debt decreased slightly due to reduced bond liabilities, while long-term debt increased as new loan packages were disbursed to accelerate project development.

On January 30, NVL shares surged to VND 13,000 per share, with a market capitalization of VND 29,000 billion.

Novaland Stuns with a Whopping VND 3.6 Trillion Profit in Q4/2025, Sending Shares Surging to the Daily Limit

Novaland has reported the reimbursement of land rent and land use fees associated with the Lakeview City project, as detailed in the official statement.