PDR’s Investor Meeting Livestream Held on January 29th

|

Focusing on Ho Chi Minh City and Dong Nai, with no plans to expand to new provinces

According to Mr. Nguyen Van Dat, Chairman of the Board of Directors of PDR, the company has identified Ho Chi Minh City and Dong Nai as key focus areas for the upcoming phase. This decision is driven by the large population, high real housing demand, and the benefits from major infrastructure projects such as the Long Thanh Airport and the regional transportation network.

The company’s strategy is to avoid expanding into new provinces, instead focusing on executing existing projects in its portfolio across other locations. For new projects, PDR is actively seeking land in the Southeast region, which is expected to have better absorption capacity compared to the overall market.

Recently, PDR successfully bid for two land plots in Dong Nai to develop affordable apartment complexes targeting real-demand homebuyers rather than high-end or speculative products.

Mr. Dat mentioned that the company has largely resolved its outstanding BT projects in Ho Chi Minh City. Specifically, the Co Dai project has been adjusted, with PDR agreeing to halt development and await reimbursement for invested costs; the Orthopedic Hospital project has been converted into a Cancer Hospital with approximately 1,000 beds and a total investment of around VND 5,000 billion; and the ICD project continues as planned.

PDR’s leadership remains optimistic about participating in new BT projects in Ho Chi Minh City, given the city’s significant infrastructure investment needs.

Six Key Projects for 2025-2026

In terms of business operations, PDR is currently selling units in several projects, including: Han River (Da Nang), Bac Ha Thanh – Quy Nhon Iconic, Nguyen Thi Minh Khai (Binh Duong), Serenity Phuoc Hai, Poulo Condor (Con Dao), and the 239 Cach Mang Thang Tam project (Ho Chi Minh City).

The 239 Cach Mang Thang Tam project has completed legal procedures and is currently constructing the basement, with sales expected to begin in Q4/2025 or Q1/2026. The La Pura project remains under PDR’s management, with simultaneous construction of all blocks and an expected completion within 12-18 months.

At Quy Nhon Iconic, after a weather-related delay, construction has resumed, and the company aims to sell out the project by 2026 to generate cash flow. For Serenity Phuoc Hai, PDR is finalizing the 1/500 planning and applying for a construction permit.

PDR’s Chairman Nguyen Van Dat at the Livestream Event

|

A significant revenue source for 2026 will come from project transfers. According to the plan, PDR expects to receive approximately VND 1,900 billion from transferring most of the Thuan An 1 project to a foreign partner, with payment expected in the short term.

Additionally, the partner has committed to purchasing the Thuan An 2 project after completing payment for Thuan An 1, with an estimated value of over VND 2,000 billion. Thus, the total cash flow from these two transactions could exceed VND 4,000 billion.

The company’s leadership stated that the sale of these projects aims to restructure finances, reduce loan pressure, and create resources for new investment opportunities. If necessary, PDR may continue transferring or co-developing additional projects to ensure financial balance.

Projected 2026 Profit to Double Compared to Previous Year

PDR’s leadership anticipates that 2026 profits could at least double those of 2025, driven by contributions from project transfers and sales of ongoing projects.

Regarding dividend policy, PDR has not yet determined the specific payment method. The company will consider both cash and stock dividends, depending on cash flow conditions and shareholder interests at the time.

Beyond residential projects, PDR is also exploring investments in industrial real estate in select localities, prioritizing areas with strong land clearance support and stable cash flow potential. The company will proceed only when financial efficiency and legal feasibility are assured.

– 08:25 31/01/2026

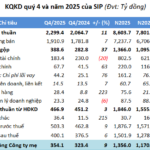

SIP Closes 2025 with Record-High Results, Lending Over 4.9 Trillion VND to Partners

Despite lacking explosive growth, SIP concluded 2025 with record-high business results, driven by steady increases in its utility and industrial park segments, both of which significantly surpassed initial targets.

Groundbreaking Ceremony for Nationally Accredited School Funded by Corporate Sponsorship in Thuận Giao Ward

On January 28, 2026, the groundbreaking ceremony for Binh Chuan 3 Primary School was held in Thuan Giao Ward, Ho Chi Minh City. This project is implemented through a public-private partnership, fully funded and executed by Phat Dat Real Estate Development Corporation (HOSE: PDR), with a total investment value of approximately 145 billion VND. The aim is to construct a modern primary school that meets national standards, gradually aligning with international benchmarks.

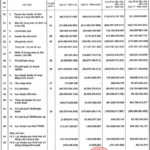

PDR Falls Short of 2025 Goals Despite Tripling Net Profit from Previous Year

Despite a significant drop in net revenue, Phat Dat Real Estate Development Corporation (HOSE: PDR) recorded a remarkable net profit of nearly VND 314 billion in Q4/2025, a staggering 206-fold increase year-over-year, thanks to gains from the transfer of Bac Cuong Investment Corporation shares.