Source: VietstockFinance

|

The direct cause stems not only from cost pressures in insurance operations but also from the decline in financial activities.

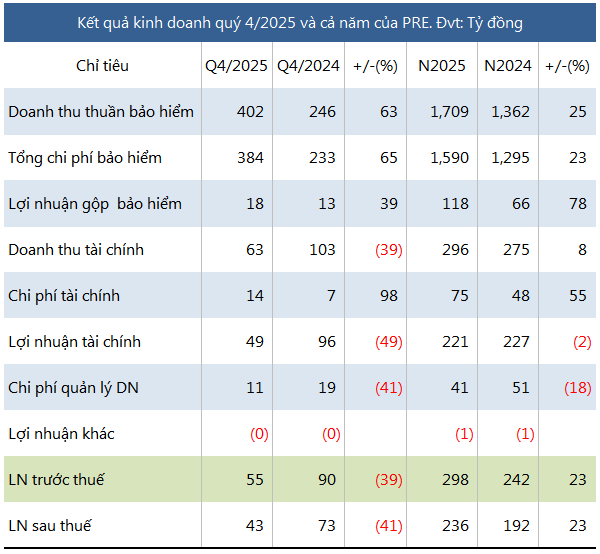

In Q4/2025, PRE’s reinsurance premium revenue reached nearly VND 791 billion, a 68% increase year-over-year, driving a 63% rise in net insurance business revenue to VND 402 billion. However, gross insurance profit grew only 39%, as total insurance operating costs surged 65% to VND 384 billion.

Gross margin narrowed amid weaker financial performance, with revenue dropping 39% and costs soaring 98%, resulting in Q4 financial profit halving compared to the same period last year. Despite significant administrative cost reductions, PRE’s net profit still fell over 40% to VND 43 billion.

For the full year 2025, PRE reported a 23% increase in net profit to VND 236 billion, primarily driven by the insurance segment, which saw a 78% profit rise, offsetting the slight decline in financial activities under cost pressures.

Notably, after years without borrowing, PRE incurred a short-term loan of VND 242 billion by year-end 2025. Leveraging financial debt amid volatile interest rates is likened to a “double-edged sword.” While the nearly VND 10 billion interest expense in 2025 is modest, it indicates PRE’s profit sensitivity to interest rate fluctuations, adding pressure to an already shrinking net margin in Q4.

In 2025, PRE targeted pre-tax profit of over VND 244 billion, matching 2024 levels. The company exceeded this goal by 22%.

By year-end, PRE’s total assets grew 11% to over VND 7.4 trillion, primarily in financial investments. Cash deposits rose 23% to VND 2.4 trillion, and bonds doubled to nearly VND 1.3 trillion.

Total liabilities increased 14% to nearly VND 5.8 trillion, mainly short-term technical reserves of VND 4.4 trillion, up 7%.

– 14:58 30/01/2026

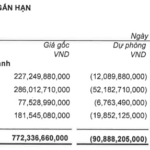

DigiWorld Invests Nearly VND 800 Billion in Stocks, Temporarily Records Over VND 90 Billion in Losses

For the first time, a distributor surpassing $1 billion in revenue has launched a stock portfolio valued in the hundreds of billions. However, the performance of this investment activity has significantly eroded profits.

MB Targets 18% Pre-Tax Profit Growth by 2025 as Credit Surpasses 1 Million Billion Dong

In 2025, Military Commercial Joint Stock Bank (MB, HOSE: MBB) reported pre-tax profits exceeding VND 34,268 billion, marking an 18% year-on-year increase. This impressive growth is attributed to the bank’s robust core operations and a significant rise in service revenue, as reflected in its consolidated financial statements.