|

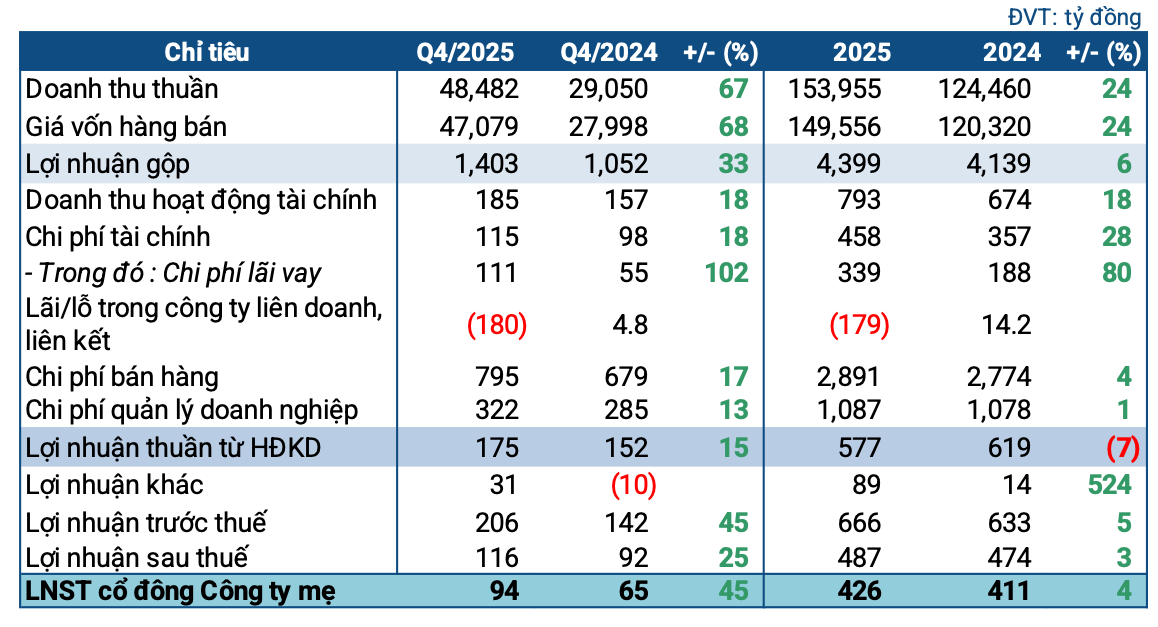

Q4 2025 Business Targets of OIL

Source: VietstockFinance

|

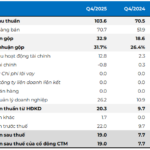

In Q4 2025, OIL‘s core business operations saw a significant improvement, with revenue surging by 67% to over 48.8 trillion VND. After deducting the cost of goods sold, gross profit increased by 33%, reaching 1.4 trillion VND. OIL attributed this success to proactive inventory management and a stable supply chain, despite declining domestic fuel prices.

A notable aspect of OIL‘s financial results was a loss of 180 billion VND from its joint ventures and associates. This loss stemmed from additional provisions for investments in PetroVietnam Biofuel and Petroleum Joint Stock Company (PVB), aimed at addressing the company’s stock warning status.

On October 2, 2018, the Prime Minister’s Office proposed the dissolution and bankruptcy of the Phu Tho Biofuel Plant, owned by PVB. By October 24, 2018, OIL had submitted a plan to its parent company, PetroVietnam (PVN), to initiate PVB‘s bankruptcy proceedings. As of the Q4 2025 financial report, OIL was still negotiating with PVB‘s shareholders regarding the bankruptcy process.

Despite this setback, OIL managed to absorb the provision, thanks to a 31 billion VND gain in other income (compared to a 10 billion VND loss in the same period last year). As a result, the company reported a net profit of 94 billion VND for Q4, a 45% increase year-over-year.

For the full year 2025, OIL‘s revenue reached 153 trillion VND, a 24% increase from the previous year. Net profit stood at 426 billion VND, a modest 4% growth, primarily due to the losses associated with PVB. Compared to the targets set by the Annual General Meeting, OIL exceeded its revenue goal by 58% but achieved only 78% of its after-tax profit target.

Beyond the financial results, OIL‘s 2025 financial statements highlight an ongoing issue with the equitization settlement. As of year-end 2025, competent authorities had not yet inspected and approved the equitization settlement at the time of PVOIL’s transition to a joint-stock company. Consequently, the 2025 financial statements do not include adjustments related to this settlement.

Notably, OIL is among the state-owned enterprises benefiting from a specialized resolution aimed at resolving bottlenecks in divestment, listing, and equitization. Since the beginning of 2026, OIL‘s stock price has surged by nearly 50%, reaching 16,300 VND per share as of January 31, 2026.

| OIL up 49% since the start of 2026 |

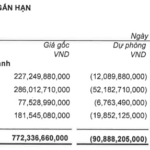

As of year-end 2025, OIL‘s total assets exceeded 45.5 trillion VND, a 9% increase from the beginning of the year, with the majority being current assets (nearly 38.9 trillion VND, up 10%). Cash and cash equivalents totaled nearly 19 trillion VND, a 27% increase, while inventory decreased significantly to 2.8 trillion VND (-21%).

Work-in-progress construction costs amounted to 224 billion VND, a 7% increase, primarily driven by the expansion of the Phu Tho oil depot and the modernization of fuel stations.

On the liabilities side, total debt increased by 11% to nearly 34 trillion VND, mostly short-term (33.6 trillion VND). Total loans reached approximately 10.9 trillion VND, a 44.5% increase. However, with substantial cash reserves, OIL faces no issues in meeting its debt obligations.

– 17:08 31/01/2026

Q4 Explosion: Bầu Đức’s Company Reports Record Profits

Following its official exit from accumulated losses in Q3/2025, Hoang Anh Gia Lai Joint Stock Company (HAGL, HOSE: HAG) continued its profit surge in Q4, doubling the previous quarter’s results. A significant contributor to this achievement was the reversal of expenses following the exemption from bond interest payments.

DigiWorld Invests Nearly VND 800 Billion in Stocks, Temporarily Records Over VND 90 Billion in Losses

For the first time, a distributor surpassing $1 billion in revenue has launched a stock portfolio valued in the hundreds of billions. However, the performance of this investment activity has significantly eroded profits.