|

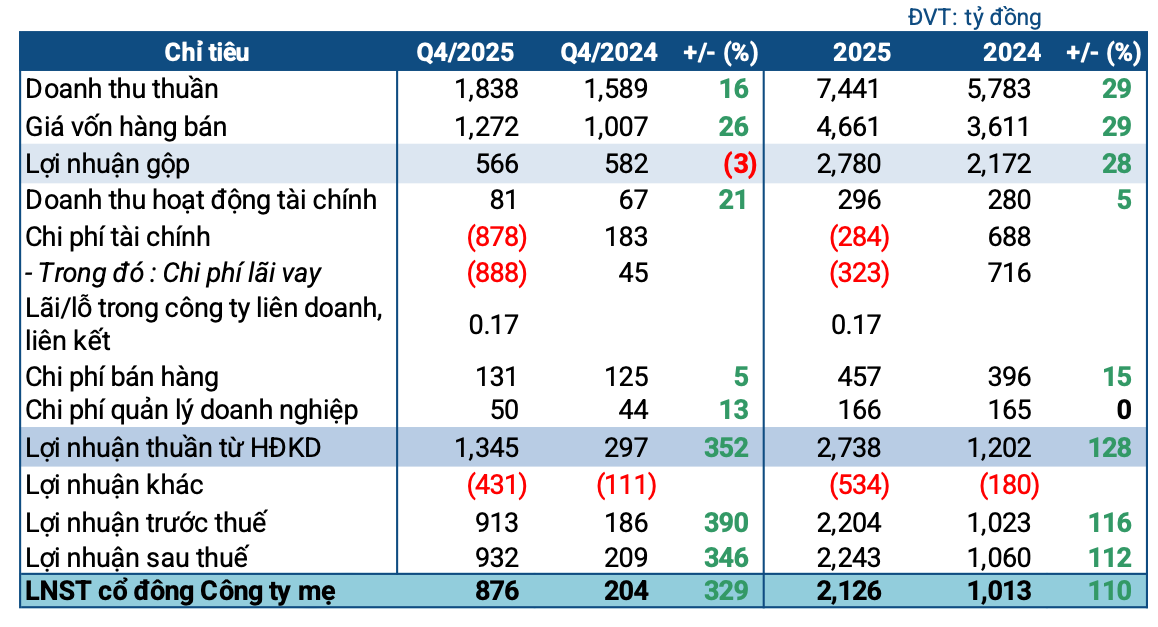

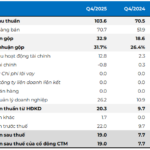

HAG’s Q4/2025 Business Targets

Source: VietstockFinance

|

In the final quarter of 2025, HAGL achieved over 1.8 trillion VND in net revenue, a 16% increase year-over-year, with the largest contribution coming from the fruit business segment (1.32 trillion VND). Conversely, the pig farming segment continued to shrink to 35 billion VND (compared to 158 billion VND in the same period last year). Cost of goods sold rose by 26%, resulting in a slight 3% decline in gross profit to 566 billion VND.

The most significant highlight of the quarter was the financial expenses, with the company recording a negative expense of 878 billion VND (compared to 183 billion VND in the same period last year) due to waived bond interest. Thanks to this amount, despite an additional loss of 431 billion VND (compared to 111 billion VND in the same period last year) from liquidating underperforming assets and restructuring agricultural land, Mr. Doan Nguyen Duc’s (Bầu Đức) company reported a net profit of 876 billion VND, 4.3 times higher than the same period last year.

HAGL Subsidiary Amends Terms of Trillion-VND Bond Issuance for Mulberry, Coffee Investment

For the full year 2025, HAGL generated 7,440 billion VND in net revenue, a 29% growth; net profit reached 2.1 trillion VND, 2.1 times higher than the previous year, marking the highest level ever. Compared to the 2025 Annual General Meeting’s plan, HAGL exceeded its revenue target by 35% and achieved more than double its profit goal.

| HAG’s Business Performance Over the Years |

By year-end, HAGL’s total assets reached nearly 27 trillion VND, a 21% increase from the beginning of the year. Cash and cash equivalents rose significantly to 680 billion VND, 4.5 times higher than the start of the year. Inventory increased by 8% to over 753 billion VND.

The majority of assets are in tangible fixed assets and construction in progress. Construction in progress surged by 71% to nearly 8.6 trillion VND, primarily invested in expanding fruit orchards (durian, bananas) and agricultural infrastructure.

On the capital side, equity increased by 52% to over 14 trillion VND, driven by retained earnings and a successful debt-to-equity swap. Short-term payables decreased by nearly half to over 2.1 trillion VND. However, the debt structure remains significant, with short-term loans rising by 8% to over 6.2 trillion VND and long-term loans increasing by 39% to nearly 1.7 trillion VND.

A notable achievement in 2025 was HAGL’s complete elimination of accumulated losses. After exiting accumulated losses in Q3 and the strong profit in Q4, the company’s undistributed after-tax profit turned positive to nearly 1.4 trillion VND (from a loss of 422 billion VND at the beginning of the year).

|

Provisions at Hoang Anh Gia Lai International JSC As of the end of 2025, HAGL still maintains provisions of nearly 713 billion VND at Hoang Anh Gia Lai International Investment JSC (formerly Hung Thang Loi Gia Lai LLC). Previously, in late November 2025, HAGL announced plans to IPO this company in Q2/2026. Bầu Đức emphasized that this is an “extremely good company,” currently contributing the most to HAG’s profits and sales with its prime land and fruit orchards (durian, bananas, coffee). He also highlighted the company’s growth potential. Preliminary information reveals that Hoang Anh Gia Lai International Investment has a charter capital of 1,685 billion VND, but equity of 3,700 billion VND; total assets exceed 11 trillion VND, with credit debt of 3,400 billion VND. The company owns over 7,000 hectares of cultivated land, including durian, coffee, and bananas (currently harvesting), all located in Laos. |

– 18:28 31/01/2026

PDR Falls Short of 2025 Goals Despite Tripling Net Profit from Previous Year

Despite a significant drop in net revenue, Phat Dat Real Estate Development Corporation (HOSE: PDR) recorded a remarkable net profit of nearly VND 314 billion in Q4/2025, a staggering 206-fold increase year-over-year, thanks to gains from the transfer of Bac Cuong Investment Corporation shares.

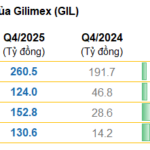

Q4 Profits Skyrocket 818%, Yet Gilimex’s Operating Cash Flow Remains Negative at Nearly 700 Billion

The final quarter’s remarkable surge enabled Binh Thanh Production, Business, and Import-Export Joint Stock Company (Gilimex, HOSE: GIL) to offset its nine-month loss exceeding hundreds of billions of dong. However, significant challenges persist in cash flow and inventory management.